Nova LTD Selected by Leading Global Logic Manufacturer to Develop Next-Generation Integrated Circuit

December 31, 2022

Trending News 🌥️

Nova Ltd ($NASDAQ:NVMI) is a leading materials metrology company, providing innovative solutions to the semiconductor industry. The company is listed on the Nasdaq exchange and its stock has been performing well over the past year. Today, Nova Ltd is proud to announce that they have been selected by a leading global logic manufacturer to develop its next-generation integrated circuit. Nova ELIPSON enables accurate measurement of stress, strain and defectivity in advanced devices with high speed and precision.

This selection is a reflection of the hard work and dedication of our team in developing a world-class materials metrology portfolio. This achievement further establishes the company as a trusted partner for semiconductor manufacturers and reinforces Nova’s commitment to providing innovative solutions to the industry. With this project, Nova is set to further strengthen its leadership in the materials metrology sector and bring advanced technologies to the market.

Market Price

This news has been welcomed by investors who pushed the stock up by 0.5% on Tuesday’s opening at $82.2, closing it at $82.7, down from the prior closing price of 83.1. With Nova LTD’s expertise in integrated circuit design, they will be able to develop an advanced circuit that meets the unique needs of the manufacturer. This will enable them to create a product that offers improved performance, greater efficiency, and more reliable performance than current designs. The impact that this partnership could have on the industry is huge. It could also open up new opportunities for businesses and individuals to use integrated circuits in their projects and products.

The success of this partnership is also beneficial to Nova LTD as it will further cement their reputation as one of the leading providers of integrated circuit development services. This can only serve to attract more customers and business partners in the future, which could lead to further growth and success for the company. With their combined expertise, they have the potential to create a revolutionary integrated circuit that could revolutionize the way we use electronics and computing technology. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nova Ltd. More…

| Total Revenues | Net Income | Net Margin |

| 541.01 | 126.34 | 23.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nova Ltd. More…

| Operations | Investing | Financing |

| 90.21 | -24.89 | -14.81 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nova Ltd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 933.81 | 380.76 | 16.58 |

Key Ratios Snapshot

Some of the financial key ratios for Nova Ltd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 34.3% | 56.9% | 27.8% |

| FCF Margin | ROE | ROA |

| 13.9% | 19.8% | 10.1% |

VI Analysis

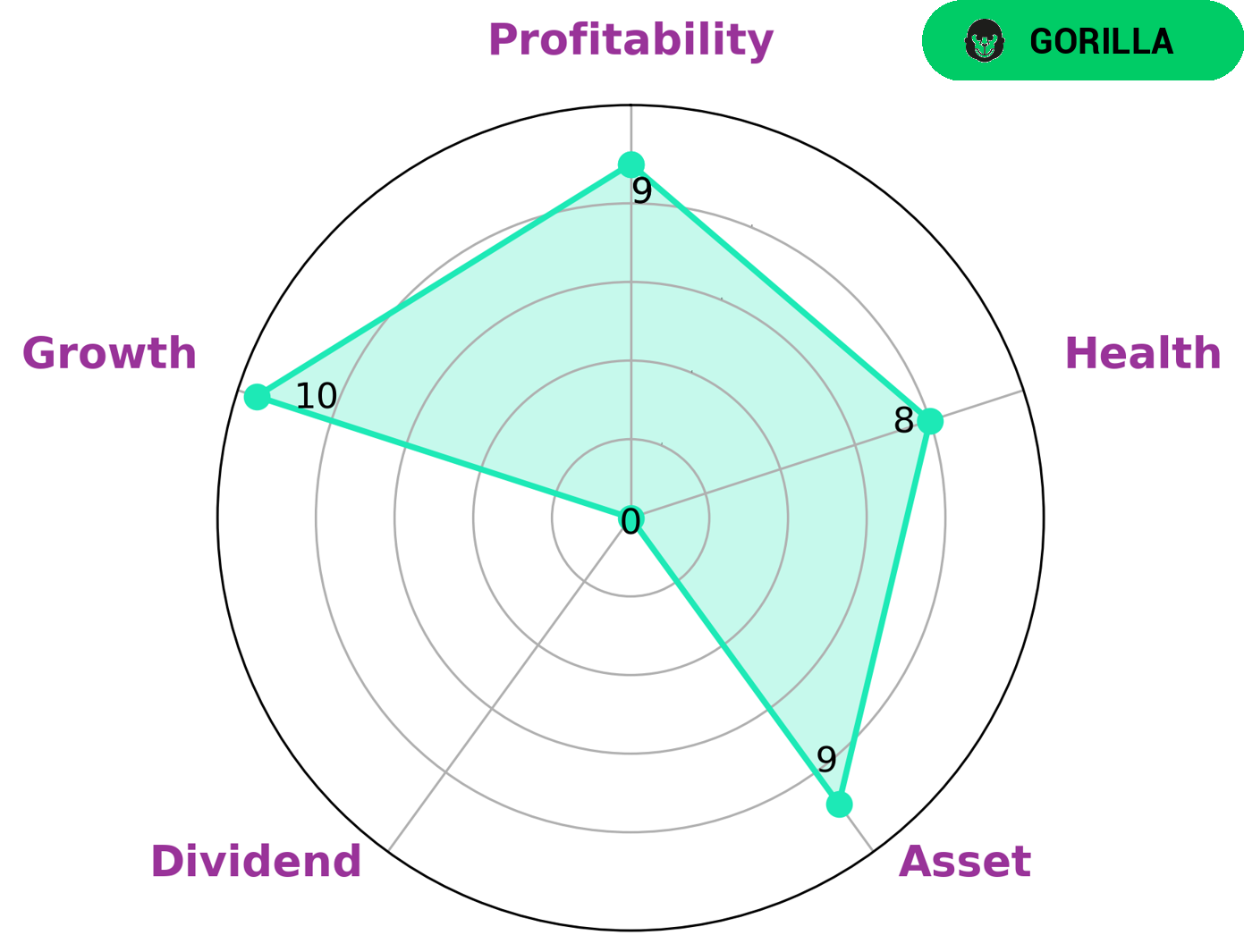

NOVA LTD is a company with strong fundamentals that reflect its long term potential. As seen on the VI Star Chart, NOVA LTD is classified as a ‘gorilla’, meaning that it is a company with stable and high revenue or earning growth, due to its strong competitive advantage. Investors who are interested in such a company may look for companies with strong assets and growth, but are more focused on the potential of the company rather than its dividends. NOVA LTD is strong in terms of asset and growth, which is reflected by its high health score of 8/10. This score shows that the company is capable of paying off debt and funding future operations. It also indicates that the company has a strong balance sheet and is financially sound. The company’s profitability is also a positive factor, as it provides evidence that the company can generate returns for investors. This is important for investors who are looking for companies that can generate returns and maintain a strong balance sheet over the long term. Overall, NOVA LTD is a strong company with strong fundamentals and long term potential. Its strong assets, growth, and profitability show that it is well positioned to provide returns to investors and maintain a healthy balance sheet. For these reasons, investors who are looking for companies with long term potential should consider NOVA LTD. More…

VI Peers

There is fierce competition between Nova Ltd and its competitors KLA Corp, Camtek Ltd, Advantest Corp. All four companies are striving to be the leading semiconductor equipment company in the world. Nova Ltd has the most experience and the best technology, but its competitors are catching up.

– KLA Corp ($NASDAQ:KLAC)

KLA Corp is a leading provider of process control and yield management solutions for the semiconductor and other nanoelectronics industries. The company has a market cap of 44.28B as of 2022 and a Return on Equity of 142.34%. KLA’s products and services are used by customers in the semiconductor, data storage, LED, solar, display and other industries. KLA has more than 4,500 employees in over 30 countries.

– Camtek Ltd ($NASDAQ:CAMT)

Camtek Ltd is a company that provides equipment and services for the semiconductor and circuit board industries. The company has a market cap of 952.49M as of 2022 and a return on equity of 15.32%. Camtek Ltd provides a wide range of services including design, manufacturing, and assembly of semiconductor devices and circuit boards. The company’s products are used in a variety of applications including automotive, communications, computing, consumer, industrial, and medical.

– Advantest Corp ($TSE:6857)

Advantest Corporation is a leading manufacturer of semiconductor testing equipment. The company has a market capitalization of $1.45 trillion and a return on equity of 27.97%. Advantest is a leading provider of test and measurement solutions for the semiconductor industry. The company’s products are used in a wide range of applications, including the testing of digital, analog and mixed-signal devices.

Summary

Investing in NOVA LTD is an attractive option for those looking to diversify their portfolios. The company has recently been selected by a leading global logic manufacturer to develop a next-generation integrated circuit, indicating that they have the technological prowess and reliable customer base to have a successful future. NOVA LTD also has a long history of innovation, developing leading-edge technologies that have been used in various sectors, from telecommunications to semiconductors. Furthermore, they have excellent financial stability, with consistent returns and a strong balance sheet. In addition to their impressive track record, NOVA LTD offers great value for investors.

The company trades at a reasonable price, allowing investors to receive a sizable return on their investment with minimal risk. The company has also been increasing its profitability and market share steadily over the last several years, indicating that it is well-positioned to continue to grow in the future. Overall, investing in NOVA LTD is a great option for those looking for a reliable and profitable investment. With their impressive track record, strong financial stability, and attractive value proposition, NOVA LTD is an attractive company for those looking to diversify their portfolios.

Recent Posts