Evolv Technology to Hold Analyst Day on May 25, 2023 to Highlight AI-Based Weapons Detection Security Screening Solutions.

March 22, 2023

Trending News ☀️

At this event, Evolv ($NASDAQ:EVLV) will be showcasing their groundbreaking AI-based weapons detection security screening solutions. Evolv has developed a patented gunshot detection system known as EVOLV Edge, which uses advanced algorithms to identify a potential threat in seconds.

Additionally, their EVOLV Express platform uses a combination of artificial intelligence and computer vision to recognize objects of concern in real time. With the technology that Evolv has developed, they have been able to create a secure environment for public spaces of all sizes. Their solutions are used in stadiums, airports, universities, and other public venues to detect weapons rapidly and accurately with minimal human intervention. By attending the Analyst Day, analysts will learn more about the groundbreaking technology that Evolv has developed. They will also get a chance to hear from the experts at Evolv and gain insight into how their solutions are transforming security for public venues. It’s sure to be an informative and exciting day, and analysts won’t want to miss it.

Market Price

The purpose of this day is to demonstrate the progress made and the potential applications of its AI-based detection solutions. On Monday, EVOLV TECHNOLOGIES stock opened at $2.6 and closed at $2.7, up 2.3% from the previous closing price of $2.6. This event will provide the company with the opportunity to present the latest developments in its AI-based technology, as well as potential applications in public safety and security.

In addition, analysts and investors will gain insight into the company’s long-term vision and strategic roadmap. Through this event, EVOLV TECHNOLOGIES looks forward to increasing investor confidence and strengthening its position as a leader in AI-based weapons detection solutions for security screening. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Evolv Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 55.2 | -86.18 | -175.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Evolv Technologies. More…

| Operations | Investing | Financing |

| -74.73 | -23.88 | 20.51 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Evolv Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 348.34 | 121.13 | 1.56 |

Key Ratios Snapshot

Some of the financial key ratios for Evolv Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 111.4% | – | -154.8% |

| FCF Margin | ROE | ROA |

| -179.2% | -22.5% | -15.3% |

Analysis

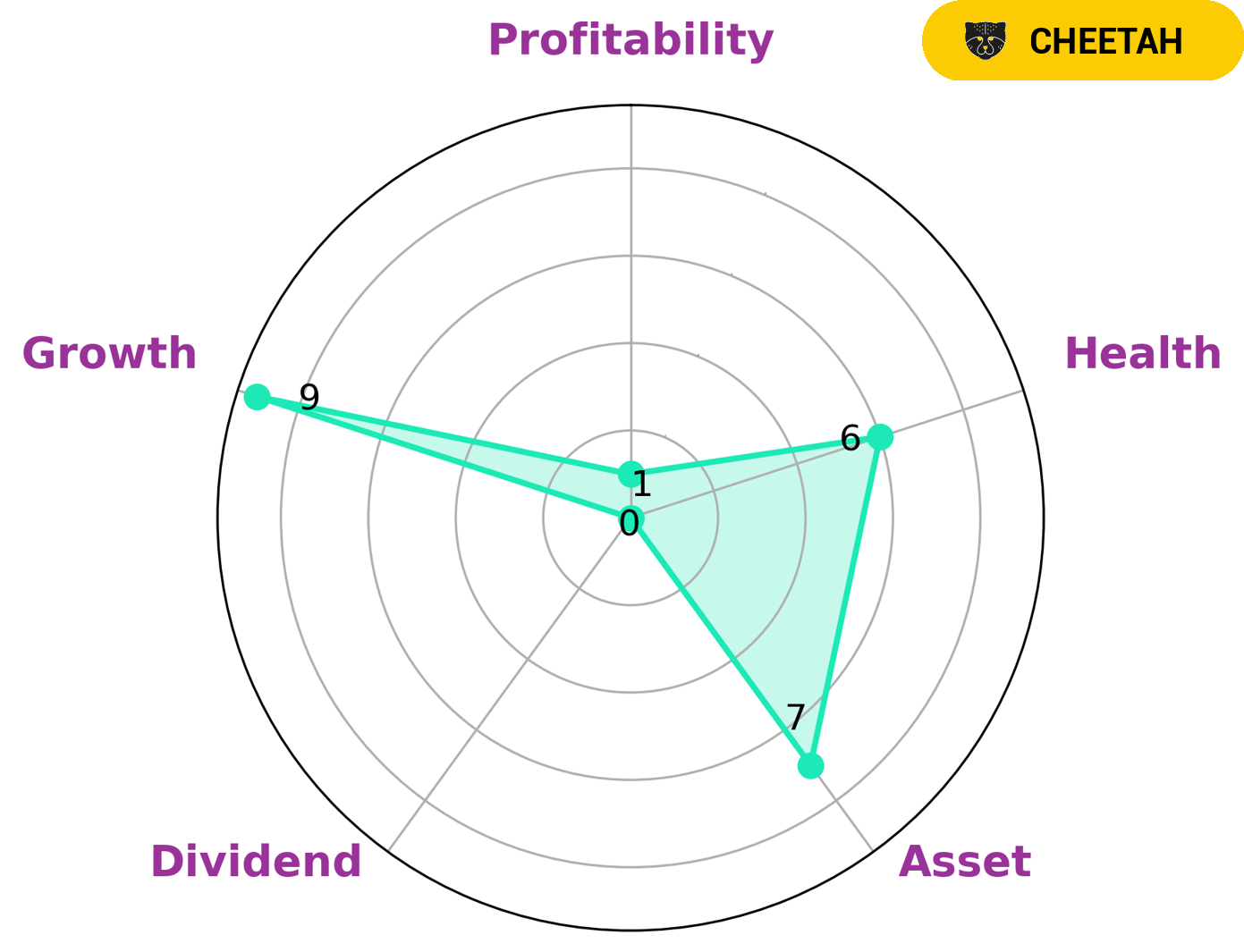

GoodWhale has conducted an analysis of EVOLV TECHNOLOGIES‘s wellbeing and found that the company has an intermediate health score of 6/10 on our Star Chart. This shows that EVOLV TECHNOLOGIES might be able to safely ride out any crisis without the risk of bankruptcy, as it has a good balance between its cashflows and debt. EVOLV TECHNOLOGIES is classified as a ‘cheetah’, meaning that the company has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company should attract investors who are looking for growth opportunities, but are willing to accept some risk. It is clear from our analysis that EVOLV TECHNOLOGIES is strong in terms of assets and growth, but weak in terms of dividend and profitability. The company is in a good position to capitalize on its strengths and improve profitability, which should attract more investors. More…

Peers

The competition between Evolv Technologies Holdings Inc and its competitors is fierce and ever-evolving. View Systems Inc, Mace Security International Inc, and Central Security Patrols Co Ltd all strive to outdo one another in an effort to provide the best security solutions for their customers. Each of these companies has their own unique approach to innovating and implementing their services, making the competition even more intense.

– View Systems Inc ($OTCPK:VSYM)

Mace Security International Inc is a leading provider of personal defense and security products. The company produces a range of products including pepper sprays, home security devices, door and window alarms, surveillance cameras, and stun guns. With a market cap of 8.44M as of 2022, Mace Security International Inc is a relatively small company in comparison to its competitors. Furthermore, its Return on Equity of -11.64% indicates that the company has not been able to efficiently use its assets to generate profits. While the company is still striving to improve its operations, investors should consider the risks associated with investing in such a small company.

– Mace Security International Inc ($OTCPK:MACE)

Central Security Patrols Co Ltd is a security and surveillance company with a market capitalization of 33.73 billion as of 2022. This company provides security services to businesses and individuals, including armed, unarmed, and guard services. With an impressive Return on Equity (ROE) of 9.28%, Central Security Patrols Co Ltd is one of the most profitable and successful security companies in the industry. The company’s market cap reflects its impressive financial performance and strong management team.

Summary

Evolv Technologies, a provider of AI-based weapons detection security screening solutions, will host an Analyst Day on May 25, 2023. The purpose of the event is to showcase its products and services to potential investors. Attendees will receive an overview of the company’s solutions and strategy, as well as presentations from Evolv’s management team.

Additionally, analysts and investors will have the opportunity to ask questions and gain further insight into the company’s technology and operations. Evolv Technologies is a leading player in the field of AI-based security, and the Analyst Day should be of major interest for investors looking for opportunities in this sector.

Recent Posts