MKS Instruments Reports Q4 2023 Non-GAAP EPS of $2.00, Beating Expectations by $0.66.

February 28, 2023

Trending News 🌧️

MKS ($NASDAQ:MKSI) Instruments recently reported their Non-GAAP Earnings Per Share (EPS) for Q4 2023, which had an impressive result of $2.00. This result marks a strong quarter for the company, and is indicative of the strong momentum they have been building over the past few quarters. This result is particularly impressive considering the current economic conditions and the impact it has had on the financial performance of many companies across the world. This positive result from MKS Instruments shows that it is managing to maintain its strong performance despite the current challenges.

The strong result also bodes well for the future of MKS Instruments, as they are well-positioned to take advantage of any potential opportunities that arise in the future. This latest report is encouraging news for both investors and analysts alike, and it appears that MKS Instruments is set to have another successful year in 2023.

Share Price

MKS Instruments, Inc. recently reported their fourth quarter of 2023 Non-GAAP earnings per share (EPS) of $2.00, exceeding the expectations of Wall Street analysts by $0.66. On Monday, the company’s stock opened at $92.9 and closed at $92.2, up by 0.7% from its previous closing price of 91.5. MKS Instruments is a technology company focusing on advanced instruments, subsystems, and components that measure, control, power, monitor, and analyze critical parameters in advanced manufacturing processes. This fourth quarter marked the second consecutive quarter that MKS Instruments beat Wall Street expectations. The company has been consistently delivering strong performance and their stock price reflects the faith and confidence that their investors have in their ability to grow.

MKS Instruments has been steadily increasing their presence in the advanced manufacturing space through their high-precision instruments and components. They are looking to continue to expand their technologies and products that provide solutions for customers in a variety of industries and applications. With their recent successful quarters and outlook for future growth, MKS Instruments appears to be well on its way to continuing its success in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mks Instruments. More…

| Total Revenues | Net Income | Net Margin |

| 3.22k | 429.4 | 14.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mks Instruments. More…

| Operations | Investing | Financing |

| 539.5 | -4.35k | 4.1k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mks Instruments. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.37k | 7.22k | 62.39 |

Key Ratios Snapshot

Some of the financial key ratios for Mks Instruments are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.1% | 33.3% | 20.0% |

| FCF Margin | ROE | ROA |

| 12.6% | 11.1% | 3.5% |

Analysis

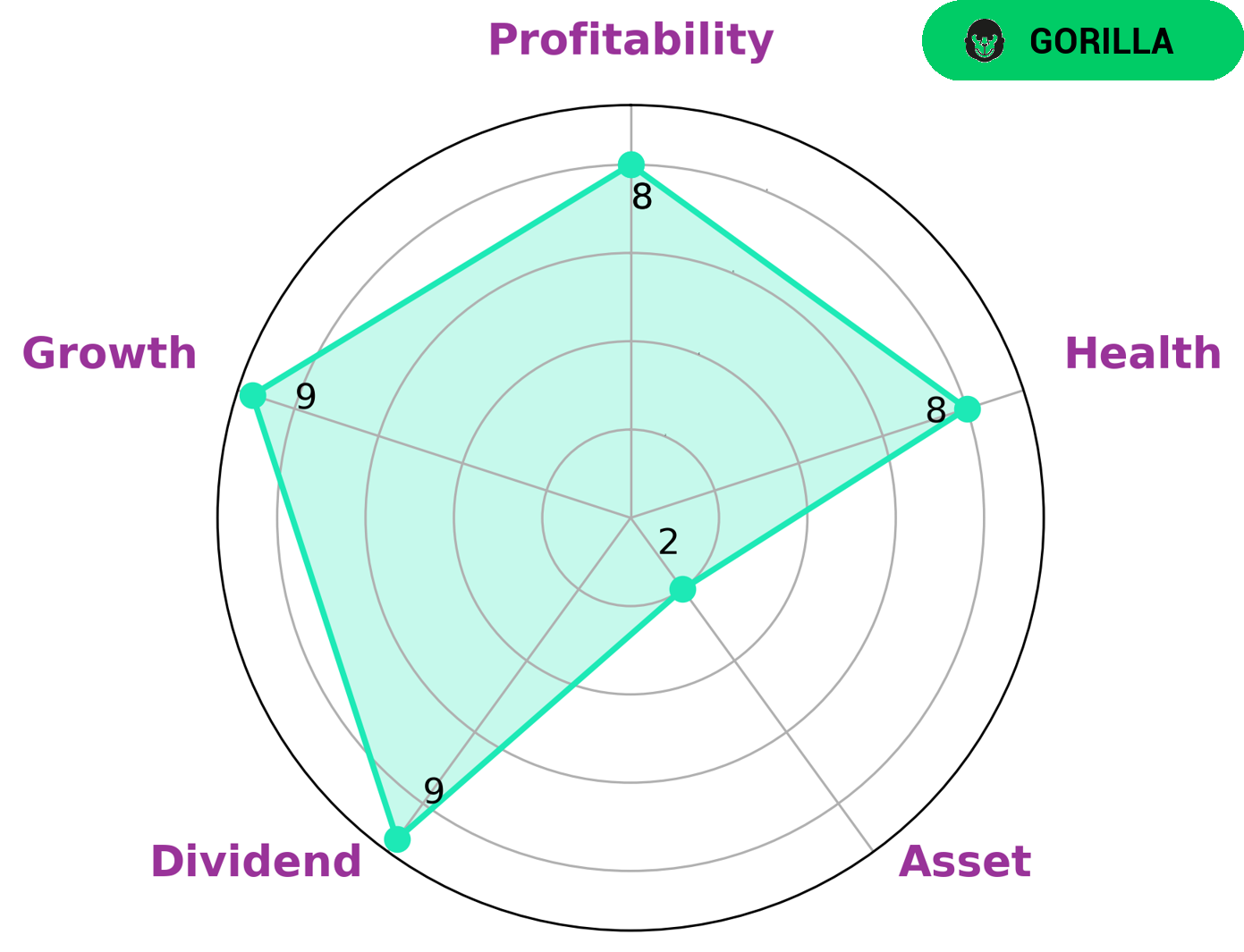

GoodWhale has conducted an analysis of MKS INSTRUMENTS‘ wellbeing and the results are interesting. Based on this data, we can classify MKS INSTRUMENTS as a ‘gorilla’, a company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors who are looking to invest in companies with long-term stability and potential for growth may be interested in MKS INSTRUMENTS. We also have evidence of their good financial health: our health score for MKS INSTRUMENTS is 8/10, which means that they have good cashflows and debt and are capable to safely ride out any crisis without the risk of bankruptcy. More…

Peers

The company’s products are used in semiconductor, flat panel display, industrial, and scientific research applications. MKS Instruments is a publicly traded company with annual revenues of over $1 billion, and is headquartered in Andover, MA. MKS Instruments’ primary competitors are Coherent, Inc., Teledyne Technologies, Inc., and Horiba, Ltd. These companies are all much larger than MKS Instruments, with Coherent and Teledyne each having over $2 billion in annual revenue, and Horiba having over $3 billion. All three of these companies are much more diversified than MKS Instruments, with each having a significant presence in a variety of industries beyond just the semiconductor and flat panel display industries.

– Coherent Inc ($NYSE:TDY)

Teledyne Technologies Inc is a provider of advanced electronics and communication products. Its products are used in a variety of industries including aerospace, defense, medical, and industrial. The company has a market cap of 16.43B as of 2022 and a return on equity of 6.93%. Teledyne Technologies is a diversified company with a strong history of innovation and growth.

– Teledyne Technologies Inc ($TSE:6856)

As of 2022, Horiba Ltd has a market capitalization of 246.85 billion and a return on equity of 9.91%. The company is a leading provider of scientific instruments and analytical and measurement solutions. Its products are used in a variety of fields, including automotive, environmental, life science, semiconductor, and chemical.

Summary

This solid performance highlights the company’s ability to leverage its product portfolio and capitalize on growth opportunities in the semiconductor and healthcare markets. MKS Instruments also saw improved gross margin and operating margin, reflecting effective cost control initiatives. Going forward, MKS Instruments is well positioned to capitalize on increased demand for essential products in its end-markets, as well as further operational improvements. This could lead to stronger financial results in the future. Overall, investors should consider MKS Instruments a good stock to invest in given its strong performance and long-term growth prospects.

Recent Posts