Comerica Bank Boosts Investment in Mesa Laboratories, by 11.5%

April 12, 2023

Trending News ☀️

Mesa Laboratories ($NASDAQ:MLAB), Inc. is a leading provider of accurate and reliable instrumentation and services for the measurement, monitoring and control of environmental conditions. As one of the largest privately held instrumentation companies in North America, Mesa Laboratories is well-known for its commitment to innovation, quality, and customer service. This marks the second consecutive quarter that Comerica has boosted its stake in the company. The move reflects Comerica’s confidence in Mesa Laboratories as a reliable and innovative leader in the instrumentation space.

The influx of capital from Comerica Bank should enable Mesa Laboratories to continue to invest in research and development and further expand its product offerings. It also provides additional security for the company in an increasingly volatile market and positions them to remain competitive amid the ever-changing landscape of the instrumentation industry. With the right investments and strategies in place, Mesa Laboratories is sure to remain a leader in the instrumentation space for years to come.

Stock Price

On Monday, MESA LABORATORIES stock opened at $174.4 and closed at $178.5, up by 1.7% from prior closing price of 175.5. The stock market reacted positively to this news, which showed that investors believed that the bank’s decision would be beneficial to the company’s future prospects. This increase in Comerica Bank’s investment also speaks volumes about their confidence in Mesa Laboratories and its potential to succeed in the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mesa Laboratories. More…

| Total Revenues | Net Income | Net Margin |

| 222.37 | -1.47 | -0.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mesa Laboratories. More…

| Operations | Investing | Financing |

| 24.77 | -9.25 | -38.98 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mesa Laboratories. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 662.98 | 275.78 | 72.48 |

Key Ratios Snapshot

Some of the financial key ratios for Mesa Laboratories are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 26.5% | -36.6% | 2.0% |

| FCF Margin | ROE | ROA |

| 9.2% | 0.7% | 0.4% |

Analysis

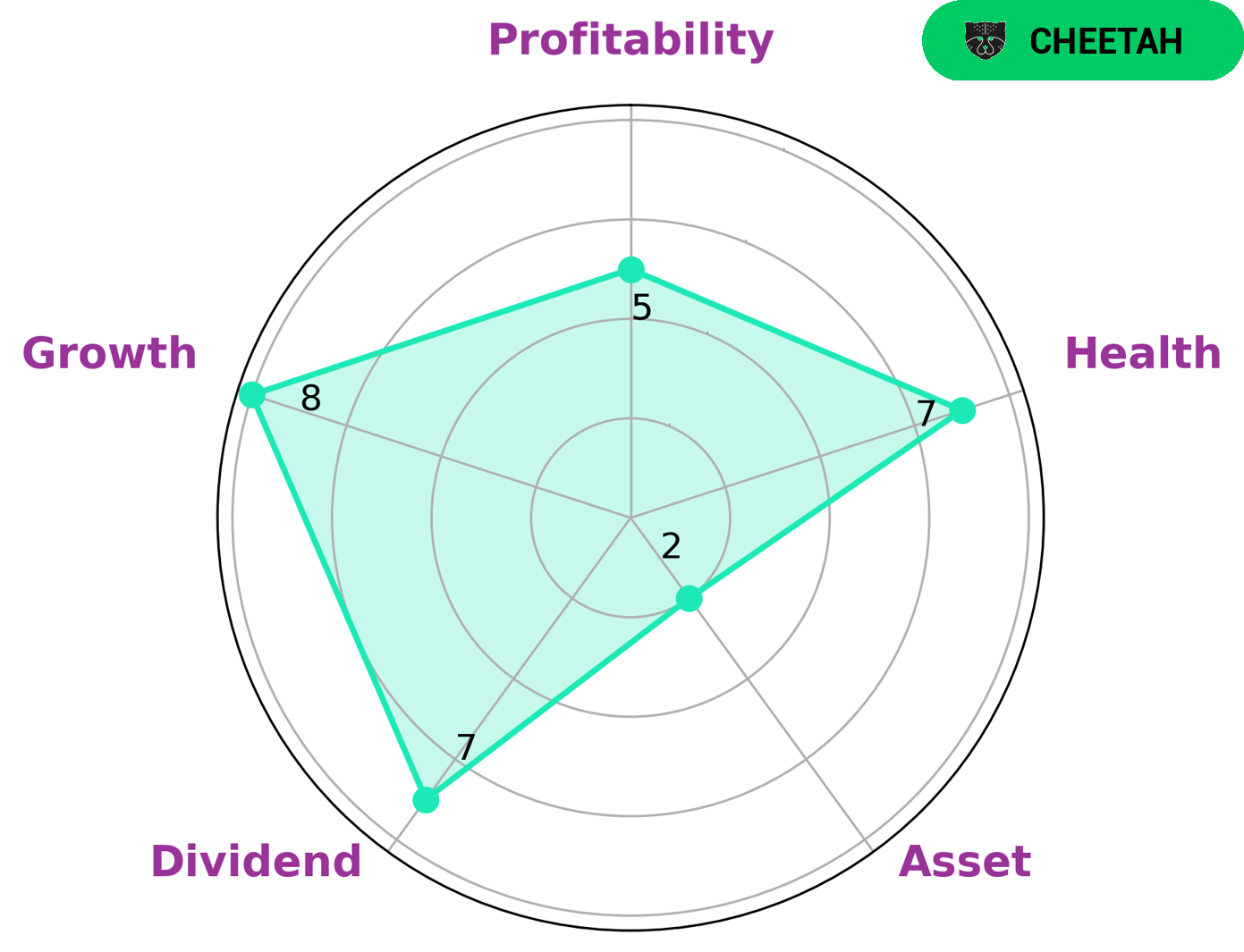

At GoodWhale, we conducted an analysis of MESA LABORATORIES‘ wellbeing. After examining their key financial attributes, our Star Chart showed that MESA LABORATORIES is strong in dividend, growth, and medium in profitability while being weak in asset. Based on these findings, we classify this company as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Such a company may be of interest to investors who are risk-seeking and prefer high return on investment, as well as those looking for short-term gains rather than long-term stability. Despite the inherent risks associated with investing in companies like MESA LABORATORIES, our Health Score of 7/10 indicates that they are still capable of sustaining future operations in times of crisis thanks to their satisfactory cashflows and debt. More…

Peers

The company’s products include blood gas analyzers, centrifuges, and incubators. Mesa Laboratories Inc’s competitors include CurAegis Technologies Inc, Biome Technologies PLC, PipeHawk PLC.

– CurAegis Technologies Inc ($LSE:BIOM)

Biome Technologies PLC is a British biotechnology company based in Southampton. The company’s core business is the development and commercialisation of sustainable technologies for the food, agriculture and energy industries. The company has a market cap of 1.86M and a ROE of -24.52%. The company’s products include anaerobic digestion systems, algal oils, enzymes and biopolymers. The company’s products are used in a variety of applications including food processing, animal feed, waste management and renewable energy.

– Biome Technologies PLC ($LSE:PIP)

PipeHawk PLC is a provider of pipe inspection and condition assessment services. The company has a market capitalization of 5.27 million as of 2022 and a return on equity of -3.7%. PipeHawk PLC provides services to a variety of industries including oil and gas, water and sewer, and power generation. The company’s services are used to inspect and assess the condition of pipelines and other infrastructure.

Summary

Mesa Laboratories, Inc. has recently seen a significant increase in investor interest. Investors are advised to research the company’s financials, management, competitive positioning, products, and services before investing. Analyzing the previous performance of the company, assessing the current market, and considering future growth prospects are all essential components of any successful investing strategy. Ultimately, investors must weigh the risks and rewards of investing in Mesa Laboratories before making any decisions.

Recent Posts