BlackRock Decreases Stock Holdings in Vontier Co. by $225.40 Million in 2023.

March 20, 2023

Trending News 🌥️

BlackRock Inc. recently announced that it has decreased its holdings of Vontier ($NYSE:VNT) Co. stock by $225.40 million in 2023. This represents a significant drop in the company’s holdings of Vontier Co. stock, and signals a shift in the company’s strategy. Vontier Co. is a publicly traded company, which provides a variety of products and services to customers around the world, including fuel dispensing systems, electronic components, and other hardware.

The company also has operations in various countries, as well as operations in the United States and Canada. It could suggest that the company is shifting its focus away from the Vontier Co. platform, or that it has decided to allocate its resources differently.

Stock Price

On Tuesday, VONTIER CORPORATION stock opened at $25.4 and closed at $25.8, up by 4.1% from previous closing price of 24.8. The move by BlackRock Inc. signals a decrease in confidence in Vontier Corporation, despite the stock’s rise due to other factors. It is an indication that BlackRock Inc. may be looking to reduce its exposure to the company and take a more cautious approach to its investment strategies in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Vontier Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 3.18k | 401.3 | 12.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Vontier Corporation. More…

| Operations | Investing | Financing |

| 321.2 | -329.9 | -347.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Vontier Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.34k | 3.76k | 3.7 |

Key Ratios Snapshot

Some of the financial key ratios for Vontier Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.7% | 0.9% | 18.7% |

| FCF Margin | ROE | ROA |

| 8.2% | 69.5% | 8.6% |

Analysis

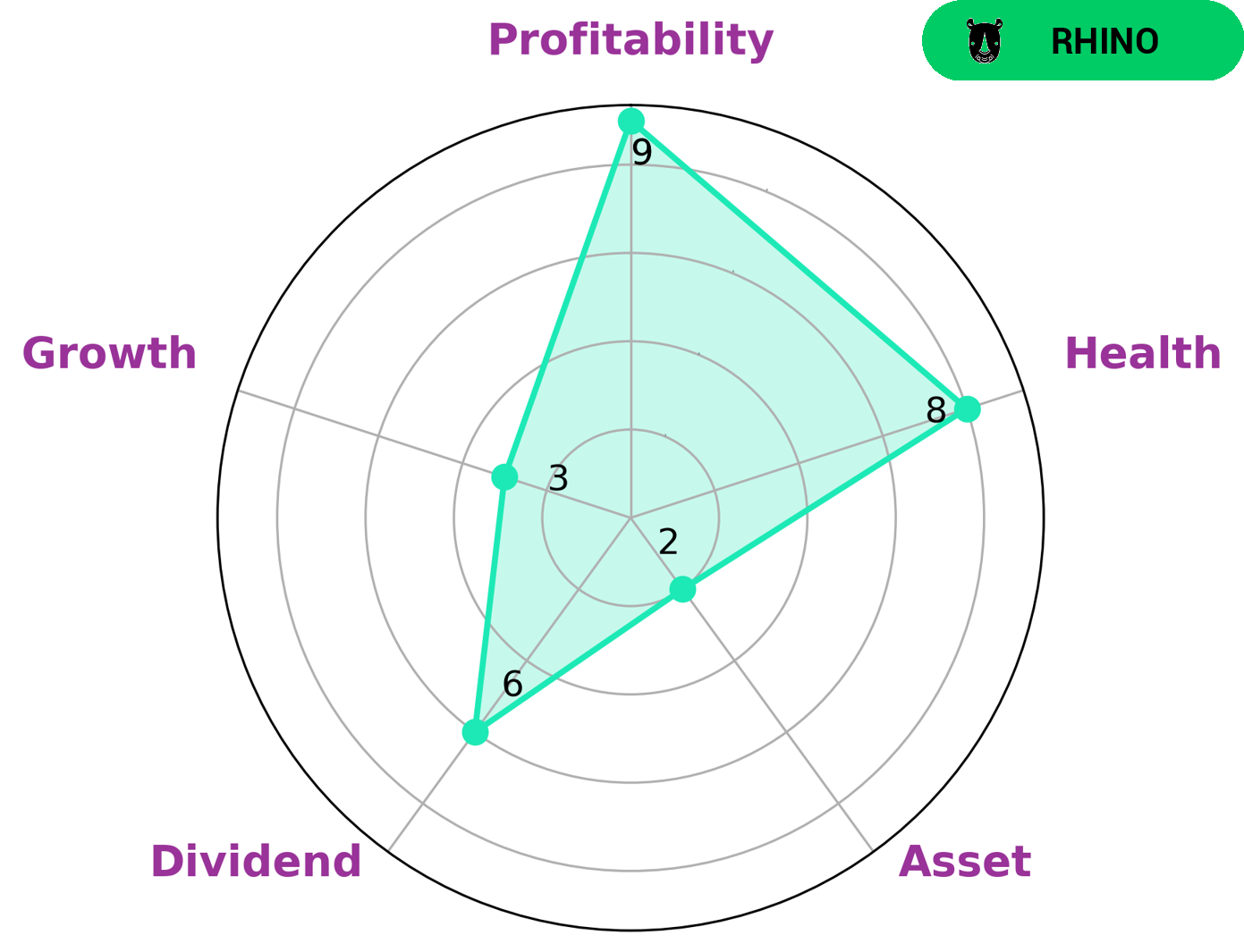

At GoodWhale, we conducted an analysis of VONTIER CORPORATION‘s fundamentals and determined that the company is strong in terms of profitability and medium in terms of dividend. However, it is weak in terms of asset growth. According to our Star Chart, VONTIER CORPORATION has a high health score of 8/10 with regard to its cashflows and debt, indicating that the company is capable of sustaining future operations in times of crisis. VONTIER CORPORATION is classified as a ‘rhino’, which means it has achieved moderate revenue or earnings growth. As such, investors who are looking for a steady income with moderate growth potential may be interested in investing in VONTIER CORPORATION. Furthermore, investors who prioritize company health and stability over growth may also be attracted to VONTIER CORPORATION due to its strong cashflows and debt management. More…

Peers

The company’s products are used in the manufacture of semiconductor chips, flat panel displays, solar cells, and other electronic devices. Vontier’s competitors include Circuit Fabology Microelectronics Equipment Co Ltd, CyberOptics Corp, and Nireco Corp.

– Circuit Fabology Microelectronics Equipment Co Ltd ($SHSE:688630)

As of 2022, Circuit Fabology Microelectronics Equipment Co Ltd has a market cap of 8.44B and a ROE of 8.6%. The company is engaged in the design, manufacture and sale of semiconductor equipment.

– CyberOptics Corp ($NASDAQ:CYBE)

CyberOptics Corporation is a global leader in high-precision sensing technology solutions that enable next-generation advanced factory automation and 3D metrology. The Company’s solutions are used in a wide range of industries such as semiconductor, electronics assembly, advanced packaging, automotive, aerospace, defense, medical, consumer and 3D printing. Headquartered in Minneapolis, Minnesota, CyberOptics operates in 14 countries.

– Nireco Corp ($TSE:6863)

Nireco Corporation is a Japanese company that manufactures and sells machinery and equipment for the semiconductor and electronics industries. It has a market cap of 6.94B as of 2022 and a return on equity of 3.27%. The company was founded in 1966 and is headquartered in Tokyo, Japan.

Summary

Vontier Corporation has been a subject of attention in recent months after the public disclosure that BlackRock Inc. had decreased its stake in the company by $225.40 million in 2023. Upon the news, investors were eager to comprehend the impact this might have on the stock price of Vontier, and the outcome was positive, with the stock price moving up the same day. Analysts are now closely following Vontier, with some deeming it as a potential investment opportunity due to its strong fundamentals.

The company operates in the transportation sector and is well-positioned to benefit from the rising demand for fuel and infrastructure upgrades. Investors should look out for further news about Vontier and take into consideration the impact it could have on the stock price before investing.

Recent Posts