Wingstop Sees Larger Drop Than Market, Closing at $412.70 and -0.95% Swing from Previous Day’s Close

September 20, 2024

🌧️Trending News

Wingstop Inc ($NASDAQ:WING). is a popular restaurant chain known for its signature chicken wings. The company is publicly traded on the stock market under the ticker symbol WING and has gained a strong following among investors and consumers alike.

However, in the most recent trading session, Wingstop saw a larger decline than the overall market, with its stock closing at $412.70 and experiencing a -0.95% swing from the previous day’s close. The company has seen significant growth in recent years, expanding its global footprint and reporting strong financial results. However, like many stocks, Wingstop’s share price is subject to fluctuations and can be affected by various market factors. On the day of this larger decline, the S&P 500 also saw a daily loss of -0.54%, indicating that Wingstop’s drop was greater than that of the overall market. This could be attributed to various reasons, such as investor sentiment or specific news related to the company. It is important to note that this decline does not necessarily indicate a long-term trend for Wingstop’s stock. Investors should also consider other factors such as the company’s financial performance, growth prospects, and overall market conditions before making any investment decisions. Wingstop remains a popular choice among consumers, known for its high-quality and flavorful chicken wings. With its strong brand and continued growth, the company is well-positioned to bounce back from this short-term decline. In conclusion, while Wingstop’s stock experienced a larger drop than the overall market in its most recent trading session, it is important to keep in mind that stock prices can be influenced by many factors. Investors should carefully evaluate the company’s performance and consider their risk tolerance before making any investment decisions related to Wingstop Inc.

Analysis

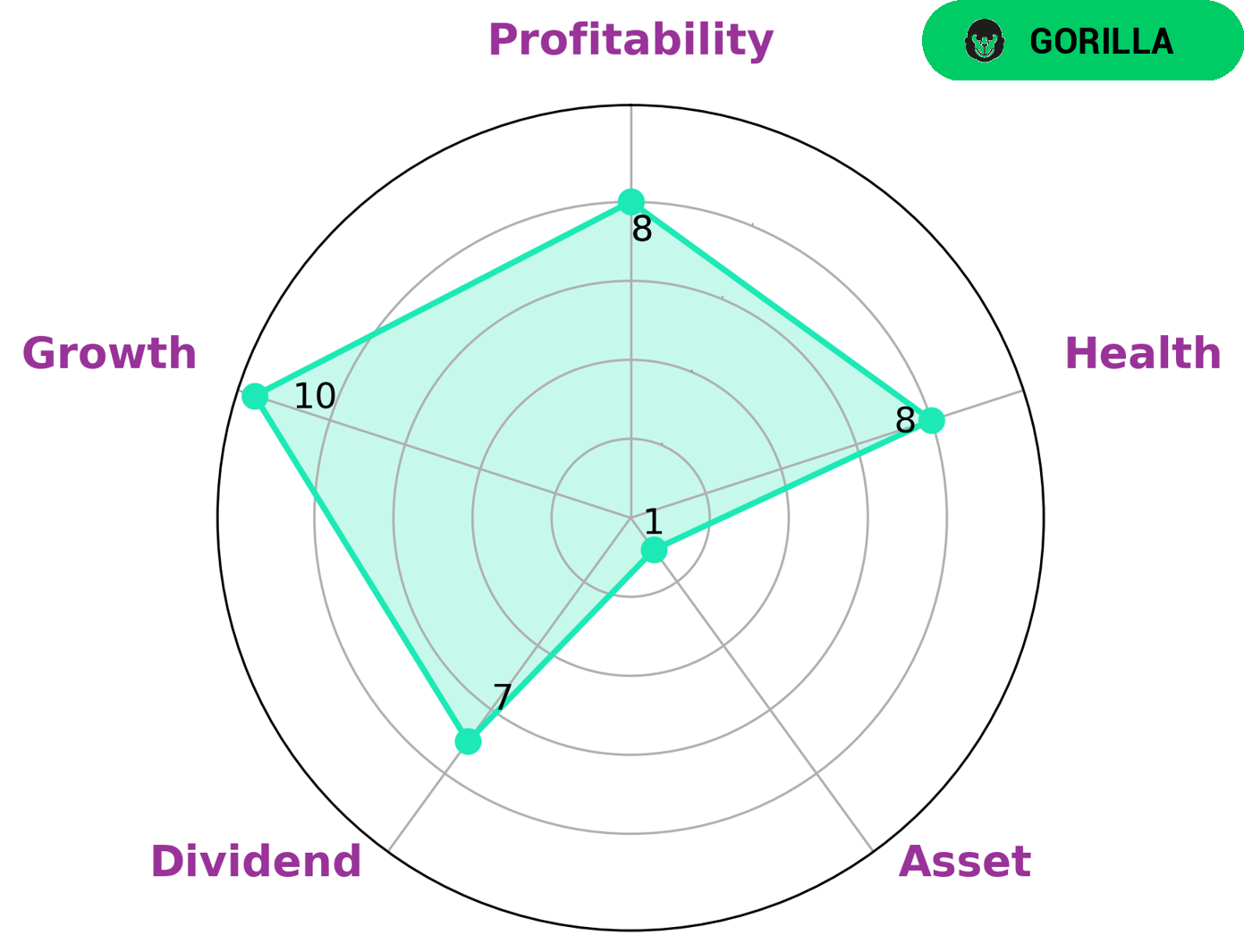

As GoodWhale, I have conducted a thorough analysis of WINGSTOP INC‘s fundamentals and have come to some key conclusions. Firstly, based on the Star Chart, it is evident that WINGSTOP INC has strong fundamentals in areas such as dividend, growth, and profitability. On the other hand, its weakness lies in the asset department. This means that while WINGSTOP INC may not have a strong asset base, it excels in other areas that are crucial for a company’s success. Based on our analysis, we have classified WINGSTOP INC as a ‘gorilla’ company. This type of company is known for achieving stable and high revenue or earning growth, thanks to its strong competitive advantage. In the case of WINGSTOP INC, this advantage could be attributed to factors such as its brand reputation, unique offerings, or market dominance. As a result, WINGSTOP INC is likely to continue its success and growth in the long run. Now, let’s consider what type of investors may be interested in WINGSTOP INC. Based on its strong fundamentals and competitive advantage, WINGSTOP INC would be an attractive option for investors looking for stable and consistent returns. Additionally, those who believe in the company’s potential for further growth may also be interested in investing in WINGSTOP INC. Lastly, I would like to highlight WINGSTOP INC’s high health score of 8/10. This score takes into account the company’s cashflows and debt levels, indicating that WINGSTOP INC is well-equipped to handle any financial crisis without the risk of bankruptcy. As an investor, this can provide a sense of security and confidence in WINGSTOP INC’s ability to weather any storms and continue on its path of success. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Wingstop Inc. More…

| Total Revenues | Net Income | Net Margin |

| 460.06 | 70.17 | 15.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Wingstop Inc. More…

| Operations | Investing | Financing |

| 121.6 | -52.15 | -155.49 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Wingstop Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 377.82 | 835.19 | -15.59 |

Key Ratios Snapshot

Some of the financial key ratios for Wingstop Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.7% | 27.6% | 24.5% |

| FCF Margin | ROE | ROA |

| 17.6% | -15.1% | 18.6% |

Peers

The competition in the quick-service restaurant industry is heating up. Wingstop Inc, a leading player in the chicken wing segment, is facing increased competition from Wowprime Corp, Various Eateries PLC, and Hostmore PLC. These companies are all vying for a share of the quick-service restaurant market and are each employing different strategies to gain an edge over their competitors. Wingstop Inc is well-positioned to compete against these rivals and maintain its position as a leading player in the industry.

– Wowprime Corp ($TWSE:2727)

Wiprime Corp, a 9.14B market cap company as of 2022, is a holding company with a -1.91% ROE. The company invests in a range of businesses including healthcare, education, and technology.

– Various Eateries PLC ($LSE:VARE)

Eateries PLC has a market cap of 34.27M as of 2022. The company has a Return on Equity of -5.88%. Eateries PLC is a restaurant company that operates in the United Kingdom.

– Hostmore PLC ($LSE:MORE)

Hostmore PLC is a U.K.-based holding company engaged in the operation of hotels. As of 2022, the company had a market capitalization of 22.07 million pounds and a return on equity of 2.42%. The company operates a portfolio of hotels in the United Kingdom, Spain, and Portugal.

Summary

Wingstop’s recent trading session saw a -0.95% decrease in stock price, lower than the S&P 500 index. This indicates a bigger fall for Wingstop compared to the overall market. Investors should take note of this movement and consider the factors that may have influenced it.

Further analysis of the company’s financials, market trends, and industry performance can provide valuable insights for investors looking to make informed decisions. It is important to closely monitor Wingstop’s performance and keep track of any updates or developments that could impact its stock price.

Recent Posts