Wendy’s Company Sees Systemwide Sales Growth Through Scaled Market Penetration

May 20, 2023

Trending News ☀️

The Wendy’s Company ($NASDAQ:WEN) is an internationally recognized quick-service restaurant chain that has experienced significant growth in systemwide sales due to their successful scaled market penetration. Wendy’s has a strong presence in the United States, Canada, the Middle East, Asia, and Europe. With a commitment to offering fresh, high-quality ingredients and innovative menu offerings, Wendy’s has become a top choice for consumers. Their scaled market penetration strategy involves targeting different types of customers in a variety of locations and investing in a range of products and services to meet their needs. As a result, Wendy’s has been able to expand its reach and gain access to new markets. Wendy’s has also implemented various technology-driven initiatives and strategies that have allowed them to tap into a larger customer base and drive increased sales.

This includes their mobile ordering systems, online ordering and delivery options, restaurant-specific websites, and loyalty programs. These measures have enabled Wendy’s to develop relationships with customers across multiple channels and engage them with offers and promotions. Overall, Wendy’s Company has been able to successfully leverage their scaled market penetration strategy to increase systemwide sales and reach new customers. By investing in innovative technology solutions, creating engaging promotional campaigns, and offering fresh menu items that appeal to a variety of tastes, they have been able to remain competitive in the quick-service restaurant industry.

Market Price

Wendy’s Company is seeing systemwide sales growth, with their stock recently opening at $23.9 and closing at $23.4 on Friday, representing a 0.4% decrease from the prior closing price of $23.5. Despite the small dip, the company is seeing promising results as they continue to focus on scaled market penetration. Wendy’s Company has seen an encouraging level of growth in the past year, as they strive to reach new markets and customers. The company has been successful in their efforts, as evidenced by their recent upward trend in sales. They have implemented a number of strategies to capitalize on new opportunities, such as refining their marketing campaigns and engaging with customers across different channels. The strategy has been working so far, as the company has seen an increase in sales and market share. Wendy’s Company is continuing to look for ways to further penetrate the market. The company is exploring potential partnerships and collaborations with other businesses to maximize their presence in various marketplaces.

Additionally, they are looking for ways to expand their product offering to better meet the needs of their customers. With their focus on scaled market penetration, Wendy’s Company is well-positioned to see further growth in the coming months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Wendy’s Company. More…

| Total Revenues | Net Income | Net Margin |

| 2.14k | 179.79 | 9.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Wendy’s Company. More…

| Operations | Investing | Financing |

| 291.9 | -76.79 | -296.41 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Wendy’s Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.41k | 4.99k | 1.98 |

Key Ratios Snapshot

Some of the financial key ratios for Wendy’s Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.8% | 11.2% | 17.6% |

| FCF Margin | ROE | ROA |

| 9.7% | 53.0% | 4.3% |

Analysis

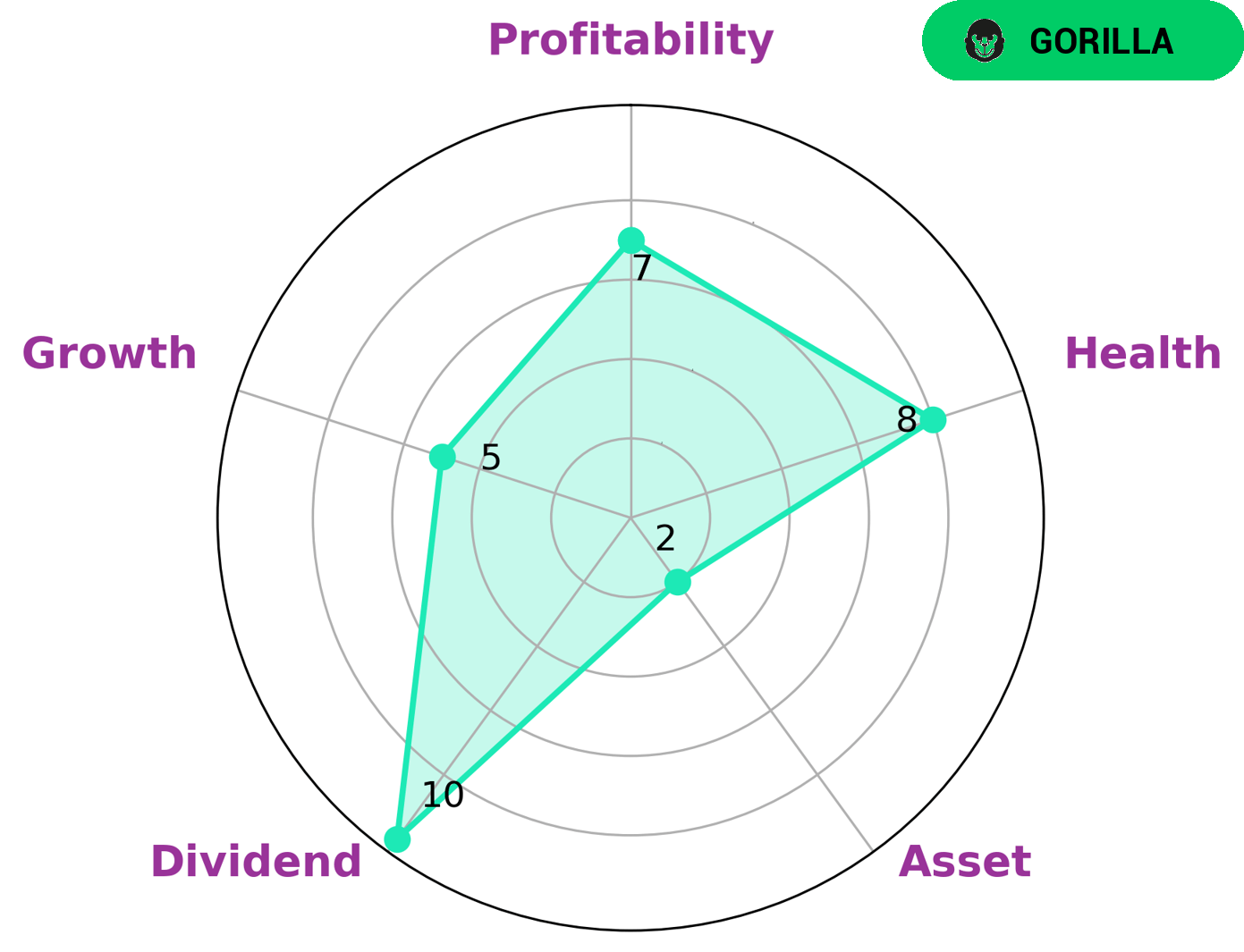

As GoodWhale conducted an analysis of WENDY’S COMPANY‘s financials, the Star Chart showed that WENDY’S COMPANY is strong in dividend and profitability and medium in growth and weak in asset. Investors who are interested in such a company may include those who seek a high dividend yield and those who have a value investing approach. Additionally, WENDY’S COMPANY had a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable to pay off debt and fund future operations. Therefore, investors who are looking for a financially sound company may also be interested in WENDY’S COMPANY. More…

Peers

In the quick-service restaurant industry, the Wendy’s Co. competes with McDonald’s Corp, Chipotle Mexican Grill Inc, and Yum Brands Inc. All of these companies are trying to attract customers with fresh, high-quality food at a reasonable price. Wendy’s Co. has an advantage over its competitors because it is a smaller company and can be more nimble in its response to customer trends.

– McDonald’s Corp ($NYSE:MCD)

McDonald’s Corp has a market cap of 187.28B as of 2022, a Return on Equity of -90.17%. McDonald’s Corporation is an American fast food company, founded in 1940 as a restaurant operated by Richard and Maurice McDonald, in San Bernardino, California, United States. They rechristened their business as a hamburger stand. The first McDonald’s franchise using the arches logo opened in Phoenix, Arizona in 1953. Businessman Ray Kroc joined the company as a franchise agent in 1955. He subsequently purchased the chain from the McDonald brothers and oversaw its worldwide growth.

– Chipotle Mexican Grill Inc ($NYSE:CMG)

Founded in 1993, Chipotle Mexican Grill is a chain of restaurants that primarily serves Mexican-style cuisine, including tacos and burritos. As of December 31, 2020, there were 2,724 Chipotle restaurants in the United States, Canada, the United Kingdom, France, and Germany. The company has a market cap of $43.03B as of 2022 and a return on equity of 27.52%.

– Yum Brands Inc ($NYSE:YUM)

Yum Brands Inc is a publicly traded American fast food company with more than 40,000 locations in over 140 countries. The company operates the brands KFC, Pizza Hut, and Taco Bell. Yum Brands is headquartered in Louisville, Kentucky.

Yum Brands Inc has a market cap of 31.59B as of 2022. The company has a Return on Equity of -15.87%. Yum Brands Inc is a publicly traded American fast food company with more than 40,000 locations in over 140 countries. The company operates the brands KFC, Pizza Hut, and Taco Bell. Yum Brands is headquartered in Louisville, Kentucky.

Summary

Wendy’s Company has experienced an increase in systemwide sales growth, driven by their scaled market penetration. Wendy’s has also seen an increase in shareholder value due to their focus on driving long-term shareholder returns. Wendy’s continues to strengthen its market position, and it looks like a strong investment opportunity for the long-term.

Recent Posts