Christine K Son, SVP of Dine Brands Global, Awarded $164K Worth of Stock Options for 2023.

March 18, 2023

Trending News ☀️

Christine K Son, Senior Vice President at Dine Brands Global ($NYSE:DIN), was recently rewarded with $164,000 worth of stock options from the firm. This award comes as a great recognition of her efforts and is a sign of the company’s appreciation for her leadership and performance. The stock options are expected to be vested in 2023, adding to the company’s long-term growth prospects. The decision follows a successful period for Dine Brands Global (DIN) which has recently seen its stock prices rise 1.90%. The higher stock prices also reflect the belief that the company is well-positioned for growth in the near future, in part due to Christine K Son’s leadership.

Dine Brands Global is an international company that owns and franchises American restaurant brands such as Applebee’s and IHOP. The award of $164,000 worth of stock options to Christine K Son is a clear indication of the company’s commitment to its employees and its belief in the potential of its current management team. Such recognition of talent and hard work will not only motivate Christine K Son but also other members of the team to continue driving growth and success at Dine Brands Global.

Price History

Despite the positive news, the stock opened at $65.7 and closed at $65.5, down 1.8% from the previous closing price of 66.7. This downward trend in the stock price reflects the current market conditions and the overall perception of Dine Brands Global’s performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for DIN. More…

| Total Revenues | Net Income | Net Margin |

| 909.4 | 78.94 | 9.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for DIN. More…

| Operations | Investing | Financing |

| 89.34 | -80.9 | -108.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for DIN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.88k | 2.18k | -19.3 |

Key Ratios Snapshot

Some of the financial key ratios for DIN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.0% | -5.5% | 19.3% |

| FCF Margin | ROE | ROA |

| 5.9% | -36.4% | 5.8% |

Analysis

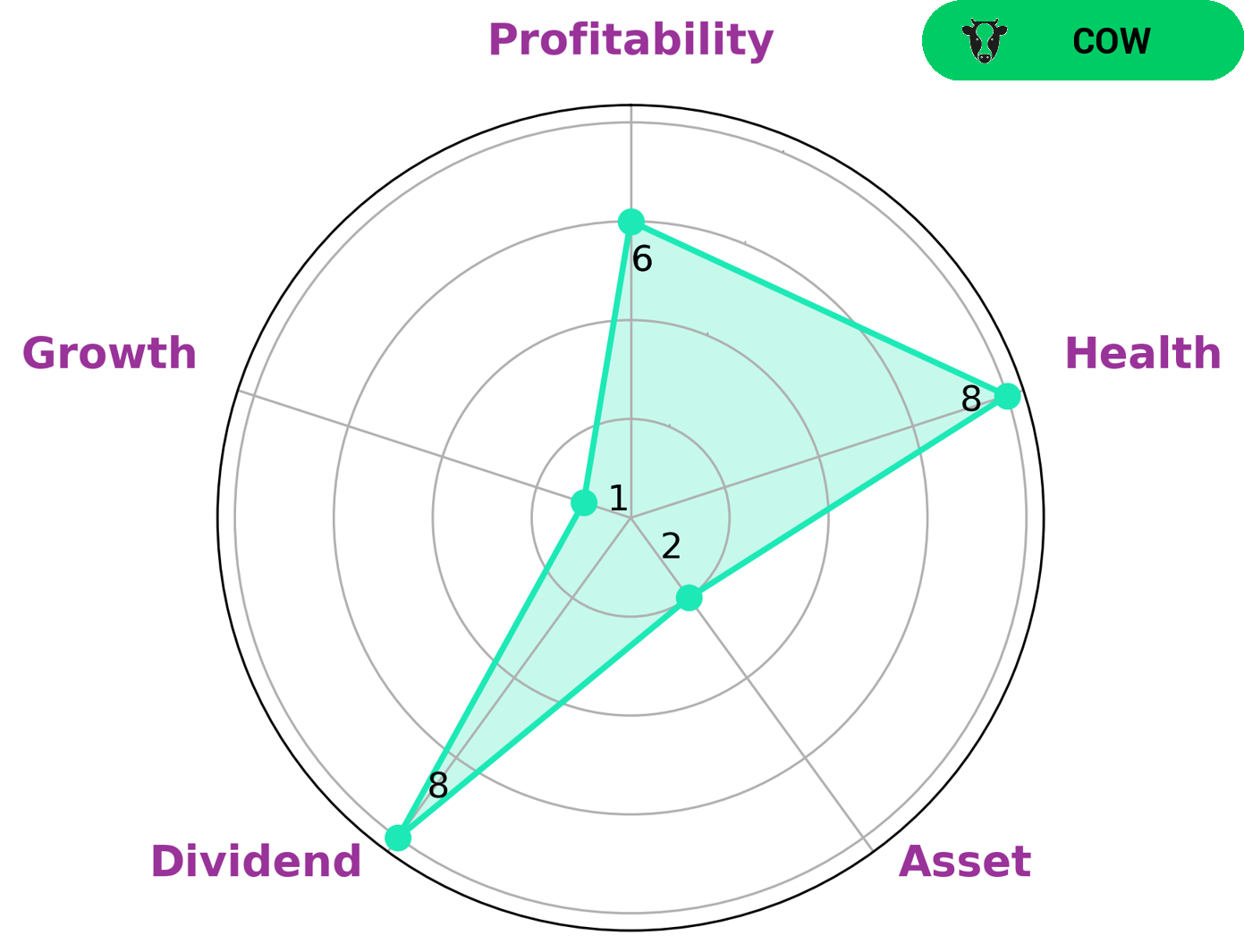

As a part of GoodWhale’s comprehensive analysis of DINE BRANDS GLOBAL, we looked at the company’s fundamentals to arrive at an informed opinion. Our Star Chart analysis reveals that DINE BRANDS GLOBAL is strong in dividend, and medium in profitability and asset growth. With this in mind, we classify DINE BRANDS GLOBAL as a “cow” type of company, one that has a track record of paying out consistent and sustainable dividends. We believe this makes DINE BRANDS GLOBAL an appealing investment for those looking for steady returns. Furthermore, GoodWhale’s health score of 8/10 indicates that the company is in good shape to pay off its debt and adequately fund future operations from its cashflows. All in all, DINE BRANDS GLOBAL is an attractive option for dividend investors. More…

Peers

Dine Brands Global Inc. is one of the largest full-service restaurant companies in the world. The company operates or franchises more than 3,700 restaurants in over 100 countries. Dine Brands Global is the parent company of two of the world’s most iconic restaurant brands, Applebee’s and IHOP. Dine Brands Global competes with other full-service restaurant companies, including Recipe Unlimited Corp, Pavillon Holdings Ltd, and Jlogo Holdings Ltd.

– Recipe Unlimited Corp ($TSX:RECP)

Pavillon Holdings Ltd is a holding company that operates in the food and beverage industry. The company has a market cap of 63.14M as of 2022 and a Return on Equity of -104.65%. The company operates in the food and beverage industry and is engaged in the production and distribution of food and beverage products. The company’s products include alcoholic and non-alcoholic beverages, food, and other consumer goods.

– Pavillon Holdings Ltd ($SGX:596)

Jlogo Holdings Ltd is a company that provides services relating to the design, manufacturing, and distribution of logos. The company has a market capitalization of 445M as of 2022 and a return on equity of -32.17%. The company’s primary business is the provision of services to businesses in the design, production, and distribution of their logos. The company also provides services to businesses in the area of marketing and advertising. The company has a wide range of clients, including small businesses, large businesses, and international businesses.

Summary

Dine Brands Global, the parent company of Applebee’s and IHOP, has recently awarded their Senior Vice President Christine K. Son with $164,000 worth of stock options for the year 2023. This news has been welcomed positively by the investment community, with many analysts seeing it as a sign of confidence from the company. Dine Brands’ stock has been steadily increasing in recent months and the award of these stock options could be seen as an indication that the company believes that this upward trend will continue. Investors are encouraged to watch Dine Brands’ performance over the next few years and to weigh the potential risks and rewards of investing in the company.

Recent Posts