Cannae Holdings Reports Disappointing Q2 Earnings, Misses Estimates by $0.08 and $7.03M

May 10, 2023

Trending News 🌧️

Cannae Holdings ($NYSE:CNNE), a publicly traded holding company with a diverse portfolio of investments, has reported results for its second quarter that have failed to meet analyst expectations. The disappointing earnings come at an inconvenient time for Cannae Holdings, as the company had just recently been upgraded to ‘buy’ by analysts at Needham & Co. The stock had been on the rise since that upgrade, and the latest earnings report could jeopardize the company’s progress in the eyes of investors. In light of the earnings miss, Cannae Holdings will need to move quickly to gain back investor confidence and demonstrate its commitment to delivering results that meet or exceed analysts’ expectations. The company will also need to work to stabilize its core operations in order to halt any further losses in future quarters.

Earnings

The company reported total revenue of 155.7M USD, a 14.4% drop from the previous year, and net income of 27.5M USD, a 125.2% decrease from the previous year. This fell short of market expectations by $0.08 and $7.03M respectively. This is cause for concern as the company struggles to remain competitive in a rapidly changing market. Investors have been disappointed by the recent earnings report and it remains to be seen if CANNAE HOLDINGS can turn their fortunes around in the coming quarters.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cannae Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 662.1 | -428.1 | -64.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cannae Holdings. More…

| Operations | Investing | Financing |

| -205.1 | 521.2 | -154.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cannae Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.13k | 410.6 | 34.74 |

Key Ratios Snapshot

Some of the financial key ratios for Cannae Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -14.8% | – | -48.8% |

| FCF Margin | ROE | ROA |

| -33.1% | -7.4% | -6.5% |

Share Price

Cannae Holdings, a holding company listed on NASDAQ, recently reported its disappointing second quarter earnings. Investors were unimpressed with the results, leading to the stock’s slight dip in price. Cannae Holdings will have to work hard to restore investor confidence and keep up with market expectations in the future. Live Quote…

Analysis

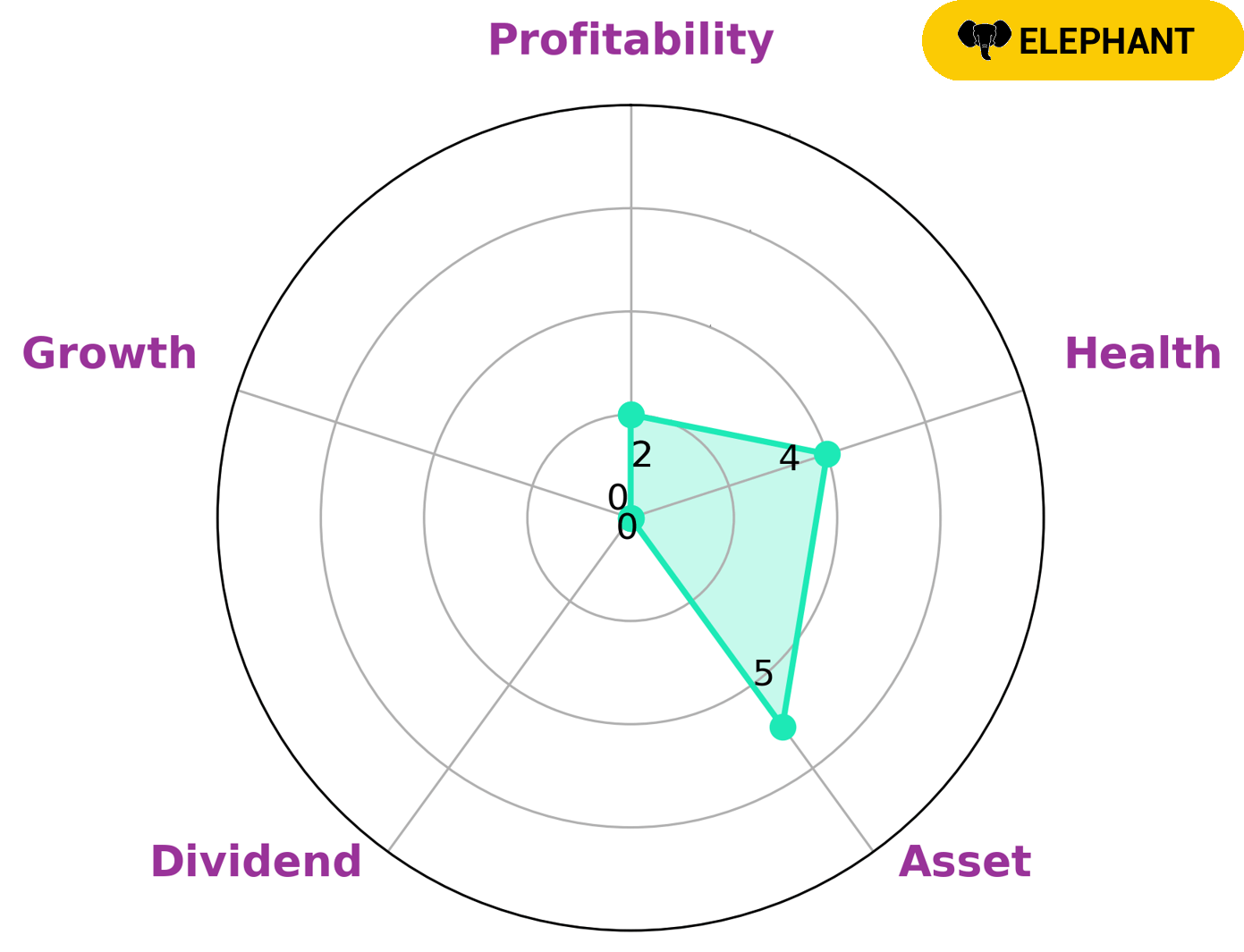

GoodWhale has conducted an analysis of CANNAE HOLDINGS‘s wellbeing and based on our Star Chart we’ve given it an intermediate health score of 4/10. We found that CANNAE HOLDINGS is strong in terms of cashflows and debt, meaning it is likely to pay off debt and fund future operations. But we also looked at revenue growth, profitability, and dividend payments; here the company scored medium in assets and weak in dividend, growth, and profitability. We classify CANNAE HOLDINGS as an ‘elephant’ – a type of company that is rich in assets after deducting off liabilities. This type of company may be attractive to investors looking for a safe bet that could yield a steady return. Investors who are more interested in potential growth may be less interested, given CANNAE HOLDINGS’s weak performance in these areas. More…

Peers

The company operates in three segments: restaurants, catering, and other food and beverage services. Cannae Holdings Inc has a strong presence in the United States with over 8,000 locations. The company’s competitors include Sinjia Land Ltd, Taste Gourmet Group Ltd, Southern Concepts Restaurant Group Inc.

– Sinjia Land Ltd ($SGX:5HH)

Sinjia Land Ltd is a real estate company that focuses on the development, acquisition, and management of commercial and residential properties in China. The company has a market capitalization of 4.56 million as of 2022 and a return on equity of -34.26%. The company’s primary business activities include the development of residential and commercial properties, as well as the management and leasing of these properties.

– Taste Gourmet Group Ltd ($SEHK:08371)

Taste Gourmet Group Ltd is a food and beverage company that manufactures, markets, and distributes gourmet food products. The company has a market capitalization of 423.89 million as of 2022 and a return on equity of 16.42%. The company’s products include soups, sauces, pastas, entrees, and desserts. The company also has a line of gourmet food products for pets.

– Southern Concepts Restaurant Group Inc ($OTCPK:RIBS)

Since its inception in 1981, Southern Concepts Restaurant Group has been providing high quality food and exceptional service to its customers. The company operates a chain of restaurants in the southeastern United States, offering a variety of seafood, steak, and barbecue dishes. Southern Concepts Restaurant Group has a market cap of 134.51k and a ROE of -322.77%. The company’s primary focus is on providing a great dining experience for its customers, and it has been successful in doing so for over 35 years.

Summary

Cannae Holdings has released its latest financial report for the quarter, and the results have been underwhelming. The company reported a GAAP EPS of -$0.05, missing analysts’ estimates by $0.08.

Additionally, revenue was reported as $154.3M, missing estimates by $7.03M. Investors should be wary of investing in Cannae Holdings if these weak financials continue, as they indicate a potential lack of sustainable growth in the future. Investors should also consider potential risk factors such as the competitive market and how Cannae Holdings may respond to changes in the economy. Overall, this quarter’s results demonstrate that Cannae Holdings may not be a reliable investment option.

Recent Posts