Aigen Investment Management LP reduces stake in Wingstop by over 25% in third quarter

November 14, 2024

🌥️Trending News

Wingstop Inc ($NASDAQ:WING). is a popular fast-casual restaurant chain that specializes in chicken wings. Wingstop is known for its unique flavor options and its commitment to high-quality, fresh ingredients. In the investment world, Wingstop Inc. is also a well-known stock due to its consistent growth and strong financial performance. One of these investors was Aigen Investment Management LP, a hedge fund based in New York. So why did Aigen Investment Management LP decide to decrease their stake in Wingstop Inc.? It is important to note that Form 13F filings only provide a snapshot of an investor’s holdings at a specific point in time and do not necessarily reflect their current outlook on a company.

However, some analysts speculate that the decrease in Aigen’s stake could be due to concerns about Wingstop’s valuation. As the stock price continues to rise, some investors may see it as overvalued and decide to take profits.

Additionally, with many restaurants struggling during the pandemic and facing potential closures, there may be some hesitation about the long-term outlook for Wingstop Inc. Despite its strong performance during these challenging times, there is always uncertainty in the market. However, it is worth keeping an eye on as the restaurant industry continues to navigate through the pandemic and its long-term effects on consumer behavior.

Analysis

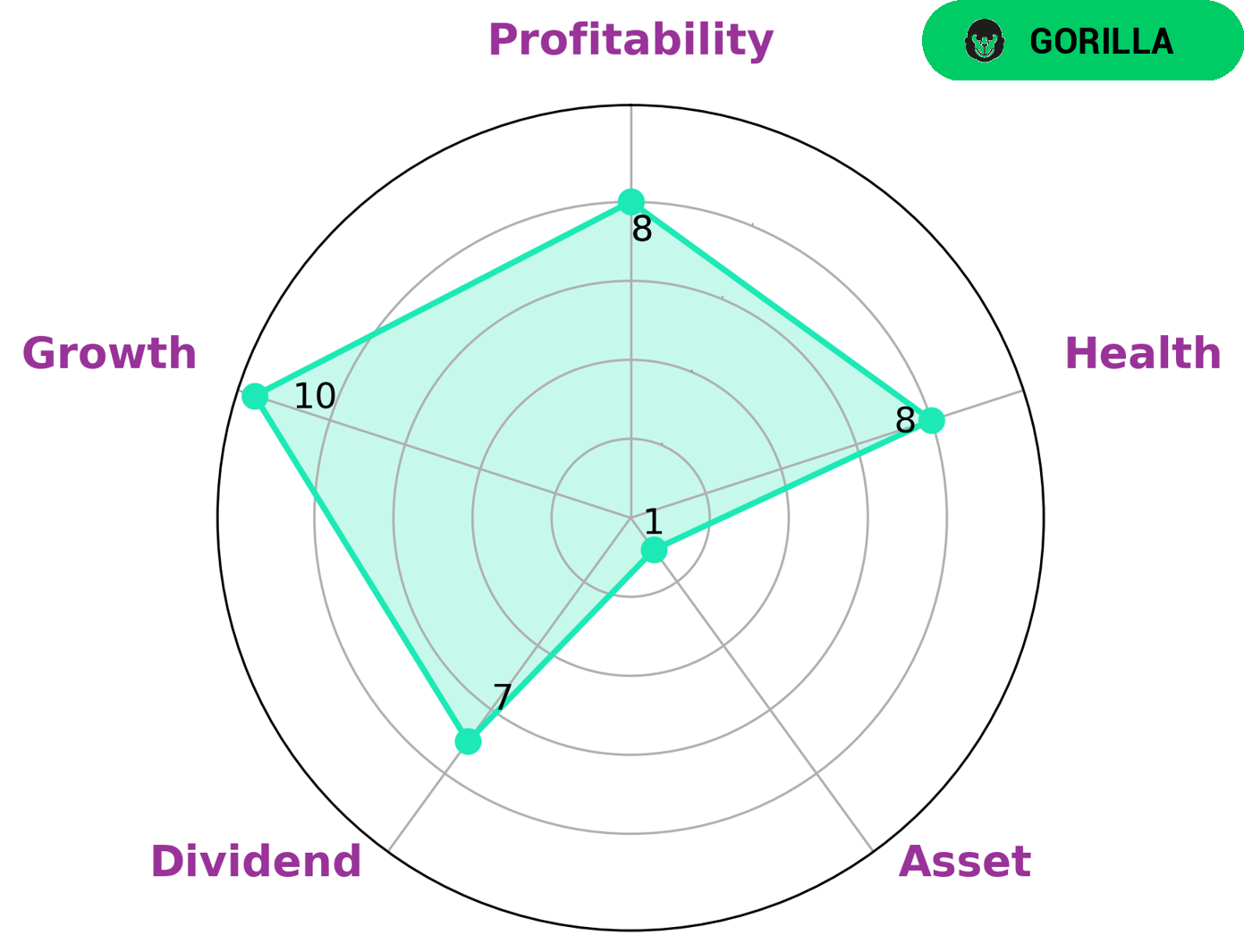

As a financial analyst at GoodWhale, I have conducted a thorough analysis of WINGSTOP INC‘s fundamentals. In terms of dividend, WINGSTOP INC has a solid track record of consistently paying dividends to its shareholders. This not only signals stability and reliability, but also potentially attracts income-seeking investors. Furthermore, WINGSTOP INC has shown strong growth potential. Its revenues and earnings have been steadily increasing over the past few years, indicating a strong and growing market demand for its products. Moreover, WINGSTOP INC’s profitability is also impressive. The company has consistently maintained a high profit margin, which is a strong indicator of its ability to generate profits from its operations. However, one area where WINGSTOP INC may be weaker is in its assets. While the company has a solid financial standing, it may not have as many physical assets or tangible resources compared to other companies. This could potentially limit its ability to expand or pivot in the future. Based on our analysis, we have classified WINGSTOP INC as a ‘gorilla’, which is a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. This means that WINGSTOP INC has a strong market position and is likely to continue its growth trajectory in the foreseeable future. Given these findings, we believe that investors who are looking for stable and growing companies with strong dividend payouts may be interested in WINGSTOP INC. Additionally, those who are looking for companies with a competitive advantage and potential for long-term success may also find WINGSTOP INC to be an attractive investment opportunity. Overall, with a high health score of 8/10 considering its cashflows and debt, WINGSTOP INC appears to be well-equipped to sustain its operations even during times of crisis. Its strong fundamentals and competitive advantage make it a promising investment option for a variety of investors. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Wingstop Inc. More…

| Total Revenues | Net Income | Net Margin |

| 460.06 | 70.17 | 15.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Wingstop Inc. More…

| Operations | Investing | Financing |

| 121.6 | -52.15 | -155.49 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Wingstop Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 377.82 | 835.19 | -15.59 |

Key Ratios Snapshot

Some of the financial key ratios for Wingstop Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.7% | 27.6% | 24.5% |

| FCF Margin | ROE | ROA |

| 17.6% | -15.1% | 18.6% |

Peers

The competition in the quick-service restaurant industry is heating up. Wingstop Inc, a leading player in the chicken wing segment, is facing increased competition from Wowprime Corp, Various Eateries PLC, and Hostmore PLC. These companies are all vying for a share of the quick-service restaurant market and are each employing different strategies to gain an edge over their competitors. Wingstop Inc is well-positioned to compete against these rivals and maintain its position as a leading player in the industry.

– Wowprime Corp ($TWSE:2727)

Wiprime Corp, a 9.14B market cap company as of 2022, is a holding company with a -1.91% ROE. The company invests in a range of businesses including healthcare, education, and technology.

– Various Eateries PLC ($LSE:VARE)

Eateries PLC has a market cap of 34.27M as of 2022. The company has a Return on Equity of -5.88%. Eateries PLC is a restaurant company that operates in the United Kingdom.

– Hostmore PLC ($LSE:MORE)

Hostmore PLC is a U.K.-based holding company engaged in the operation of hotels. As of 2022, the company had a market capitalization of 22.07 million pounds and a return on equity of 2.42%. The company operates a portfolio of hotels in the United Kingdom, Spain, and Portugal.

Summary

Aigen Investment Management LP has reduced its stake in Wingstop Inc. by 25.6% in the third quarter, according to the company’s recent report. This suggests that the investment management firm may have lost confidence in the company’s performance or future prospects. This decrease in ownership could also indicate a shift in Aigen’s investment strategy or portfolio allocation. Investors should take note of this change and conduct further analysis on Wingstop Inc. before making any investment decisions.

Additionally, this could also impact the overall market sentiment towards Wingstop Inc. and potentially lead to changes in its stock price.

Recent Posts