VAC Stock Fair Value – MARRIOTT VACATIONS WORLDWIDE: Championing Timeshare at a Reduced Stock Price

May 18, 2023

Trending News ☀️

Marriott Vacations Worldwide ($NYSE:VAC) (MVW) is a leading global hospitality company that operates timeshares and vacation ownership resorts around the world. Over the years, MVW has become a leader in the timeshare industry, offering customers high-quality vacation experiences and a wide range of destinations.

However, with recent market volatility, MVW’s stock price has dropped significantly, making it an even more attractive investment option for potential buyers. As a result of the lowered stock price, Marriott Vacations Worldwide is now a more accessible timeshare option for those looking to invest in a vacation property. With its wide selection of resorts, MVW provides excellent value for a lower cost than many other timeshare providers.

In addition, MVW offers more than just a vacation experience – they provide an array of services and amenities that make a timeshare investment worthwhile. The company also provides an array of benefits to its owners, such as discounted rates on hotel stays and discounts on food, drinks and activities. Moreover, Marriott Vacations Worldwide offers an array of financial options that make timeshare ownership more affordable. With their flexible payment plans, owners can make payments over time instead of making a large lump sum payment. Marriott Vacations Worldwide is still championing timeshare opportunities despite the reduced stock price. With its wide selection of resorts, excellent value, and flexible payment plans, MVW provides customers with an affordable and attractive timeshare investment option.

Share Price

On Wednesday, MARRIOTT VACATIONS WORLDWIDE saw a notable rise in their stock price, opening at $124.6 and closing at $127.1, up 2.6% from the previous day’s closing price of $123.9. This stock price bump is particularly noteworthy as it comes at a time in which other markets have been far less successful in their stock performances. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for VAC. More…

| Total Revenues | Net Income | Net Margin |

| 4.77k | 420 | 10.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for VAC. More…

| Operations | Investing | Financing |

| 343 | -11 | -408 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for VAC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.6k | 7.12k | 66.84 |

Key Ratios Snapshot

Some of the financial key ratios for VAC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.3% | 18.2% | 15.6% |

| FCF Margin | ROE | ROA |

| 5.2% | 18.7% | 4.8% |

Analysis – VAC Stock Fair Value

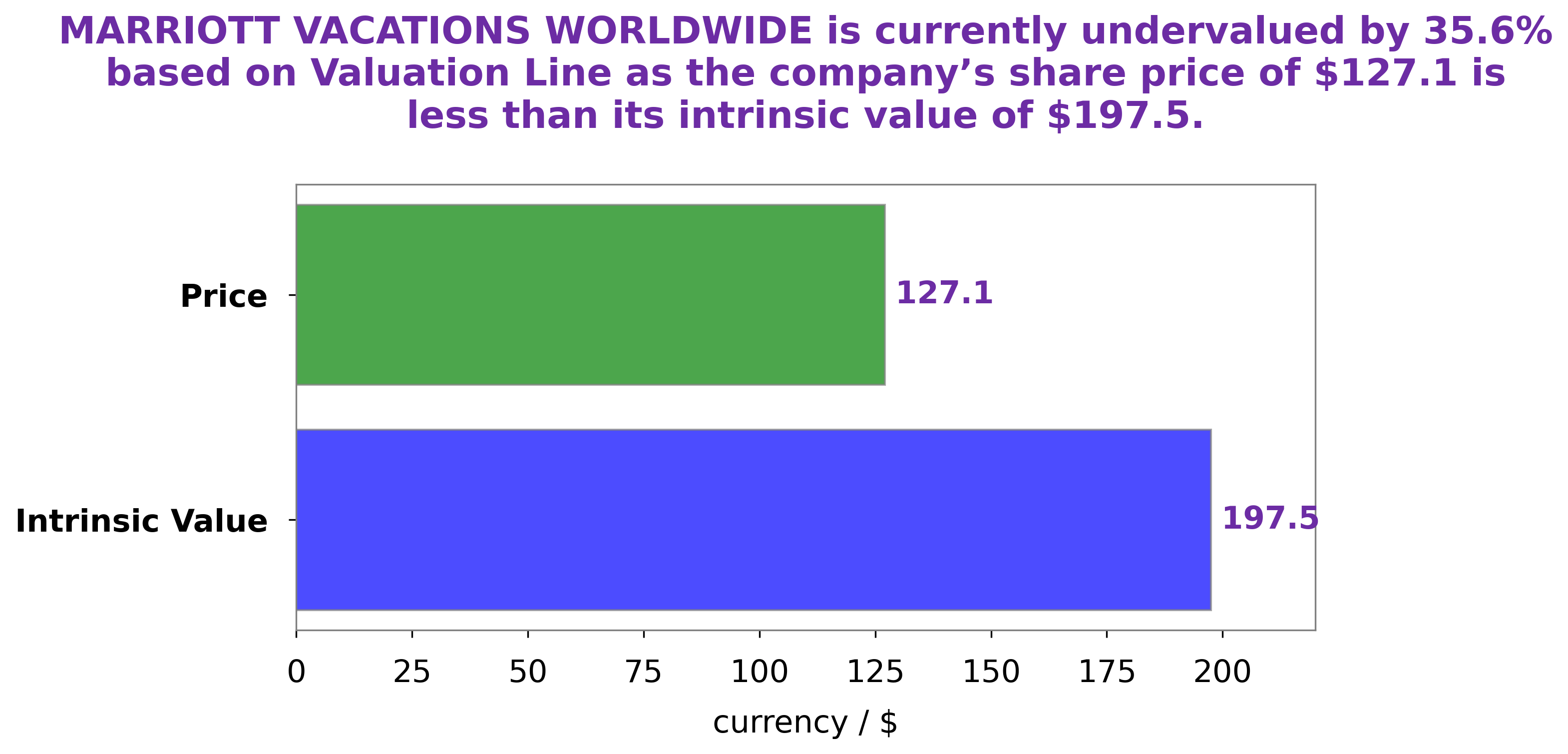

At GoodWhale, we have conducted an analysis of MARRIOTT VACATIONS WORLDWIDE’s wellbeing. Our proprietary Valuation Line has calculated the fair value of MARRIOTT VACATIONS WORLDWIDE share to be around $197.5. However, the stock is currently being traded at $127.1, undervalued by 35.6%. This represents an attractive opportunity for potential investors to acquire the stock at a discounted price. We recommend investors take advantage of this situation and purchase the stock at a discounted price, in order to benefit from its potential upside in the future. More…

Peers

In the vacation ownership and timeshare industry, Marriott Vacations Worldwide Corp is one of the largest and most well-known companies.

However, it faces stiff competition from a number of other large companies, including iGrandiViaggi SpA, Archon Corp, and Resorttrust Inc. While each of these companies has its own strengths and weaknesses, Marriott has been able to stay ahead of the competition by offering a wide variety of vacation ownership products and experiences that appeal to a broad range of customers.

– iGrandiViaggi SpA ($LTS:0R8E)

Hai Grandi Viaggi SpA is a company that provides travel services. It has a market capitalization of 36.65 million as of 2022 and a return on equity of 0.08%. The company offers a variety of travel-related services, including air travel, hotel accommodations, car rentals, and cruises.

– Archon Corp ($OTCPK:ARHN)

Archon Corporation is a holding company that operates through its subsidiaries. The Company, through its subsidiaries, is engaged in the business of real estate investment, development, management, construction, and brokerage.

– Resorttrust Inc ($TSE:4681)

Resorttrust Inc is a Japanese company that operates resorts and hotels. As of 2022, the company had a market capitalization of 248.83 billion yen and a return on equity of 11.02%. The company operates a total of 74 hotels and resorts, including 57 in Japan and 17 overseas. In addition to hotel and resort operations, the company also provides a range of services such as golf course management, real estate development, and food and beverage operations.

Summary

Marriott Vacations Worldwide is currently trading at a lower stock price than it has in recent months, making it an attractive option for investors. Analysts agree that Marriott Vacations has strong fundamentals and continues to be a leader in the timeshare industry. The company’s strong balance sheet and steady cash flow provide it with the means to acquire new properties and launch new products, enabling it to remain competitive.

The company is also investing in digital technology in order to better serve its customers and continually improve its services. With a strong focus on customer satisfaction, diversification of revenue streams, and a strategic approach to acquisitions, Marriott Vacations is well-positioned to continue delivering strong returns for investors in the long-term.

Recent Posts