Raymond James Financial Services Advisors Reduces Investment in Las Vegas Sands Corp

May 27, 2023

Trending News 🌥️

Las Vegas Sands ($NYSE:LVS) Corp. (LVS) recently had its ownership reduced by Raymond James Financial Services Advisors Inc. LVS is a casino and resort company based in the Las Vegas Valley of Nevada. It has a diversified portfolio that includes developments in the United States, Singapore and Macau. Its casinos feature a high-energy gaming area with table games, slot machines, race and sports wagering, restaurants and bars, and lounges.

In addition, the company owns or operates hotels, resorts, and convention centers. It also provides online gambling, gaming machine manufacturing, and marketing services. The Las Vegas Sands Corporation is known for many iconic properties such as The Venetian and The Palazzo Las Vegas in Nevada, Marina Bay Sands in Singapore, and The Parisian Macao in Macau. It also owns Sands Bethlehem in Pennsylvania and Sands Cotai Central in Macau. Las Vegas Sands Corp has a long history of success and is one of the world’s largest gaming companies. Despite this recent reduction in ownership, it is still a major player in the global gaming industry.

Stock Price

While the increase was relatively small, it does suggest that investors still have some faith in the casino and resort company. This is in stark contrast to the major reduction in Raymond James’ investment, which indicates a lack of confidence in Las Vegas Sands Corp. and their future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for LVS. More…

| Total Revenues | Net Income | Net Margin |

| 5.29k | -551 | -10.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for LVS. More…

| Operations | Investing | Financing |

| -795 | 4.16k | 1.12k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for LVS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 22.04k | 18.38k | 5.08 |

Key Ratios Snapshot

Some of the financial key ratios for LVS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -23.6% | 13.8% | 0.9% |

| FCF Margin | ROE | ROA |

| -29.8% | 0.8% | 0.1% |

Analysis

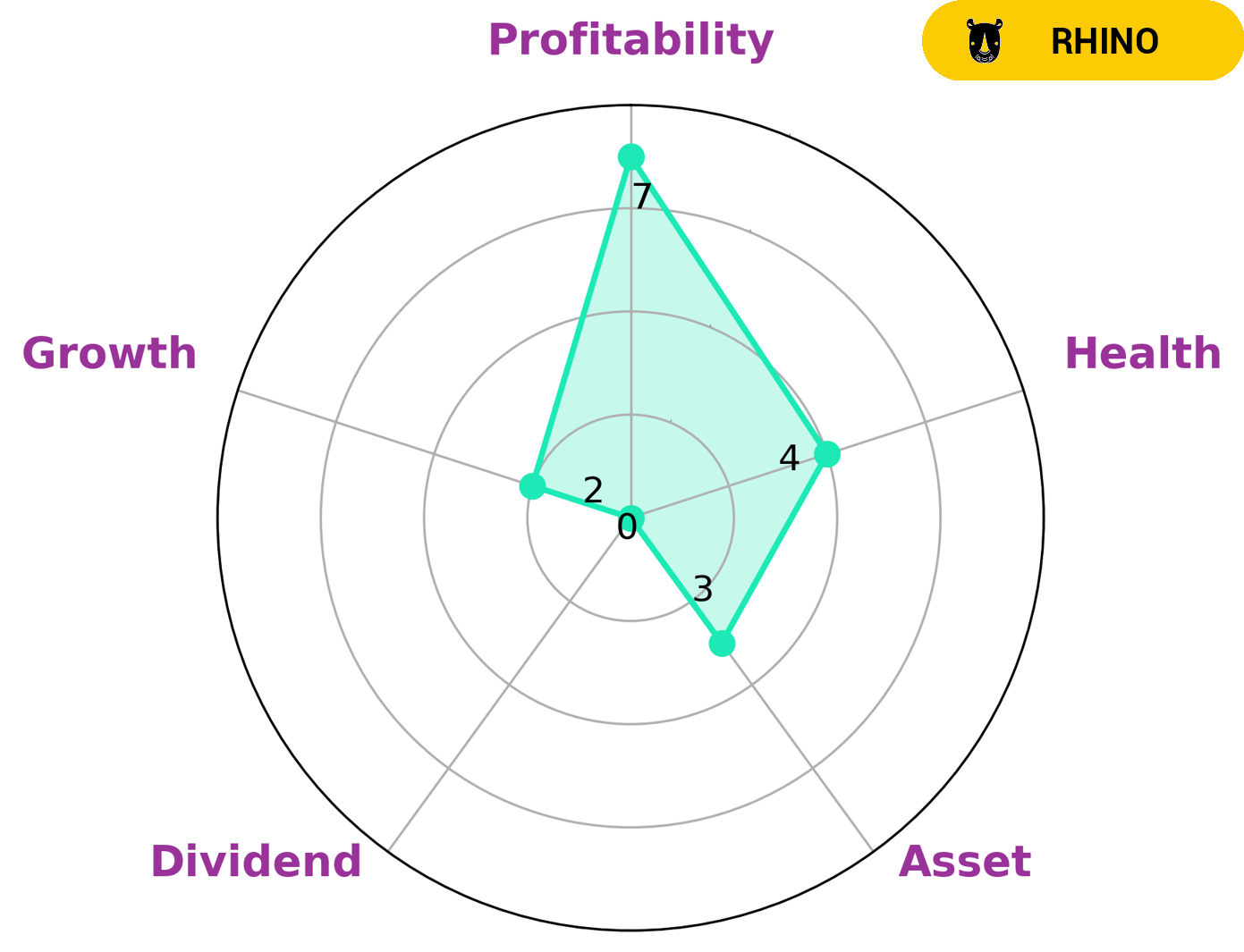

At GoodWhale, we performed an analysis of the financials of LAS VEGAS SANDS. According to our Star Chart, LAS VEGAS SANDS has an intermediate health score of 4/10. This suggests that while the company could pay off its debt and fund future operations, its cashflows and debt structure are far from ideal. We classified LAS VEGAS SANDS as a ‘rhino’ company, one with moderate revenue or earnings growth. Investors who are interested in this type of company may be looking for steady returns with an emphasis on profitability. While LAS VEGAS SANDS is strong in profitability, it is weak in asset, dividend, and growth-related metrics. More…

Peers

The Las Vegas Sands Corp is one of the largest casino operators in the world and its competitors include Monarch Casino & Resort Inc, NagaCorp Ltd, and Eumundi Group Ltd. The company has been in operation for over 50 years and has a strong presence in the US, Asia, and Europe. The company’s competitors are all large, well-established companies with a strong presence in their respective markets. Las Vegas Sands Corp has a strong brand and a loyal customer base. The company’s competitors are all large, well-funded companies with a strong presence in their respective markets.

– Monarch Casino & Resort Inc ($NASDAQ:MCRI)

Monarch Casino & Resort Inc is a holding company that, through its subsidiaries, owns and operates the Atlantis Casino Resort Spa, a hotel and casino located in Reno, Nevada, and the Monarch Black Hawk Casino Resort in Black Hawk, Colorado. The company has a market cap of 1.16B and a ROE of 17.26%. The Atlantis Casino Resort Spa is a AAA Four Diamond award-winning hotel and casino that features over 11,000 square feet of gaming space, including a poker room, race and sports book, and over 600 slot machines and table games. The Monarch Black Hawk Casino Resort is a AAA Three Diamond award-winning hotel and casino that features over 500 slot machines and 26 table games.

– NagaCorp Ltd ($SEHK:03918)

NagaCorp Ltd is a casino operator based in Cambodia. The company has a market cap of 17.7B as of 2022 and a return on equity of 0.7%. NagaCorp operates the NagaWorld casino resort in Phnom Penh, Cambodia. The company also has interests in online gaming, hotels, and restaurants.

– Eumundi Group Ltd ($ASX:EBG)

Eumundi Group Ltd is a holding company that operates through its subsidiaries. The company operates in two segments: businesses and real estate. The businesses segment includes businesses that provide services such as marketing, advertising, and event management. The real estate segment includes properties that are leased to third-party tenants.

Eumundi Group Ltd has a market cap of 47.33M as of 2022. The company has a return on equity of 11.53%.

The company operates in two segments: businesses and real estate. The businesses segment includes businesses that provide services such as marketing, advertising, and event management. The real estate segment includes properties that are leased to third-party tenants.

Summary

Las Vegas Sands Corp is a US-based casino and resort operating company that operates several properties in the US and Asia. Recently, Raymond James Financial Services Advisors Inc. decreased its stake in the company. This could be an indication that analysts believe the stock may be overvalued. Analysts suggest that investors should consider the industry’s current state before investing in Las Vegas Sands Corp, as well as its outlook for the future.

Additionally, prospective investors should consider the company’s fundamentals such as revenue growth, operating margins, dividend payout, and debt levels. They should also pay attention to the company’s competitive landscape and the impact of recent events, such as the pandemic. Taking all of these factors into consideration could help investors make an informed decision on whether to invest in Las Vegas Sands Corp.

Recent Posts