MGM Resorts International Keeps Eye on Sports Betting Opportunities During March Madness

April 1, 2023

Trending News 🌧️

MGM ($NYSE:MGM) Resorts International, a major hotel and casino company, is keeping a close eye on the sports betting market, especially during the intense NCAA basketball tournament known as March Madness. As this thrilling tournament produces unexpected results and bettors become increasingly excited, stocks related to sports betting are being closely monitored. MGM Resorts International is one such stock that is experiencing an increased level of interest. The company was founded by Kirk Kerkorian and is one of the world’s leading hospitality companies, owning and operating destination resorts in Las Vegas, Macau, and throughout the United States. MGM Resorts International has interests in a variety of businesses, including casinos, hotels, convention centers, spas, entertainment venues, golf courses and more. As one of the largest gaming companies in the world, it has been at the forefront of developing new technologies and services that improve the customer experience.

The potential financial opportunities for sports betting are vast and MGM Resorts International is well-positioned to capitalize on them. As the NCAA basketball tournament heats up and the sports betting market expands, MGM Resorts International is sure to keep a close eye on these developments. With its extensive experience in the gaming industry, the company is well-placed to take advantage of any opportunities that may arise from the March Madness frenzy.

Stock Price

As the NCAA college basketball tournament known as “March Madness” came to a close, MGM Resorts International kept an eye on the potential opportunities that could arise from sports betting. On Thursday, MGM RESORTS INTERNATIONAL stock opened at $43.7 and closed at $43.3, up by 0.6% from prior closing price of 43.1. Analysts believe that MGM has the potential to benefit from any changes in the legal status of sports betting in the U.S., as it has a presence in several key states. For now, the company is focusing on ensuring that its physical and digital sports betting operations are ready to take advantage of any changes in the legal landscape.

In addition, MGM’s extensive presence in Nevada gives it an edge in the sports betting market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MGM. More…

| Total Revenues | Net Income | Net Margin |

| 13.13k | 1.44k | -3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MGM. More…

| Operations | Investing | Financing |

| 1.76k | 2.12k | -3.02k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MGM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 45.69k | 40.32k | 12.75 |

Key Ratios Snapshot

Some of the financial key ratios for MGM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.6% | -24.9% | 11.4% |

| FCF Margin | ROE | ROA |

| 7.6% | 19.4% | 2.1% |

Analysis

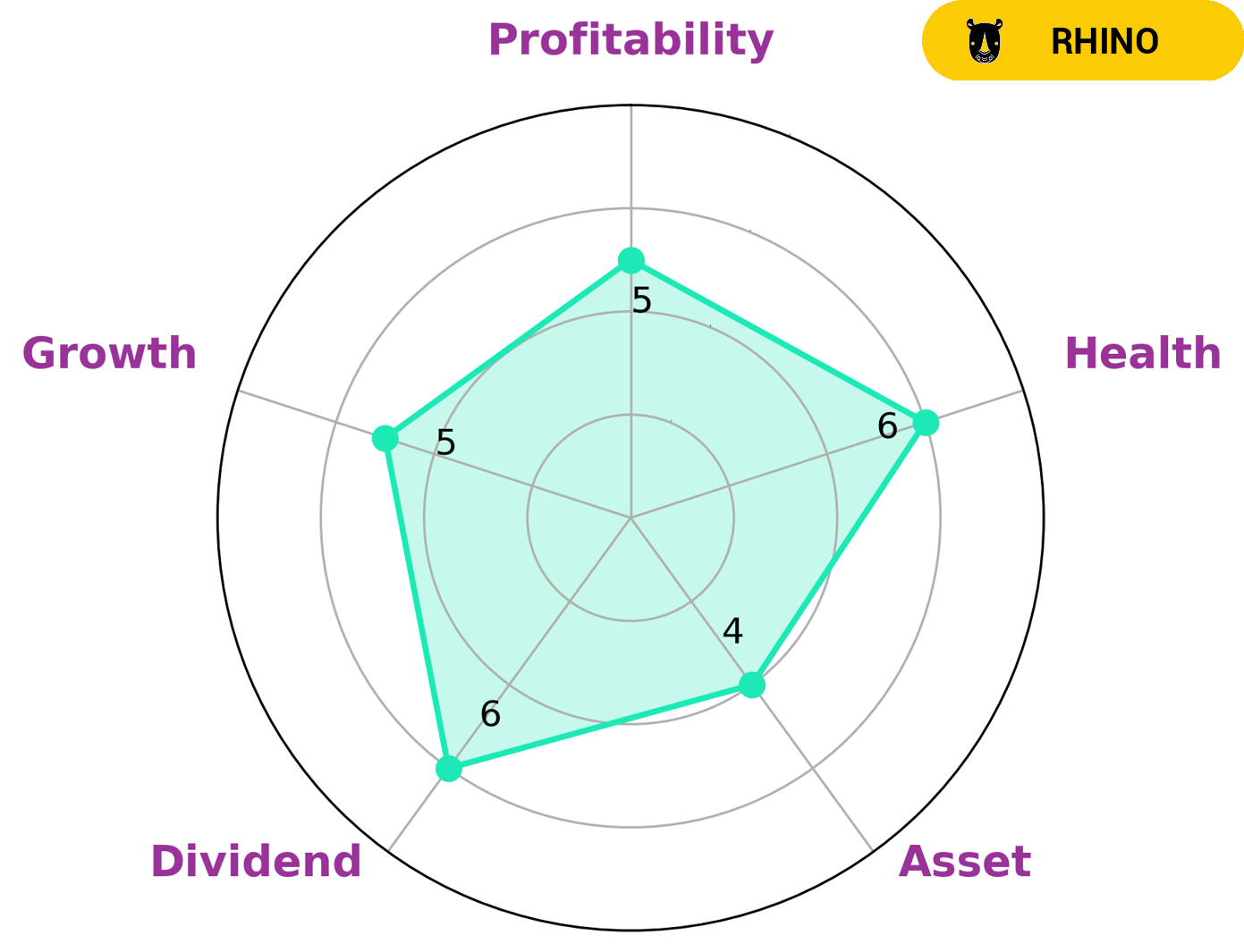

GoodWhale is proud to provide an analysis of MGM Resorts International’s financials. Based on our Star Chart, we classify MGM Resorts International as a ‘rhino’, meaning that it has achieved moderate earnings or revenue growth. Investors may be interested in MGM Resorts International due to its intermediate health score of 6/10 with regard to its cashflow and debt. This indicates that the company is likely to safely ride out any economic crisis without the risk of bankruptcy. Furthermore, MGM Resorts International is strong in liquidity, and medium in assets, dividends, growth and profitability. These factors could be attractive to investors looking for moderate, yet efficient and reliable returns. More…

Peers

MGM Resorts International is one of the world’s leading global hospitality companies, operating a portfolio of destination resort brands including Bellagio, MGM Grand, Mandalay Bay, The Mirage, and more. The company’s competitors include SkyCity Entertainment Group Ltd, Wyndham Hotels & Resorts Inc, and Cruzani Inc.

– SkyCity Entertainment Group Ltd ($NZSE:SKC)

SkyCity Entertainment Group Ltd is a casino and hospitality company based in New Zealand. The company has a market cap of 2B as of 2022 and a Return on Equity of 3.48%. SkyCity operates four casinos in New Zealand, two in Australia, and one in Chile. The company also has a number of hotels, restaurants, and bars.

– Wyndham Hotels & Resorts Inc ($NYSE:WH)

Wyndham Hotels & Resorts, Inc. is one of the largest hotel companies in the world, with over 9,000 hotels across more than 80 countries. The company offers a variety of hotel brands, including Wyndham, Ramada, Days Inn, Super 8, and Howard Johnson. Wyndham Hotels & Resorts is headquartered in Parsippany, New Jersey. The company’s market cap is 6.2B as of 2022 and its ROE is 30.65%.

Summary

MGM Resorts International is a company worth considering for investors due to its heavy involvement in the sports betting industry. After the NCAA basketball tournament saw upsets and major bracket-busting, MGM Resorts’ stocks have seen a boost. The company has a number of properties in Las Vegas and has made major investments in sports betting, including the expansion of its sports book at its MGM Grand hotel.

MGM Resorts has also been able to capitalize on other forms of entertainment, such as its new concert venue in Las Vegas, and its partnership with the UFC. With an increased focus on mobile gaming and its ability to offer unique experiences, MGM Resorts is well-positioned to benefit from the growing interest in sports betting and other forms of entertainment.

Recent Posts