BOYD GAMING Smashes Expectations with Record-Breaking Q2 Earnings

April 26, 2023

Trending News 🌥️

This quarter, the company has reported record-breaking revenue and earnings. According to the financial report, Boyd Gaming ($NYSE:BYD)’s Non-GAAP earnings per share (EPS) of $1.71 exceeded expectations by $0.17, while revenue of $963.97 million surpassed predictions by $74.38 million. These impressive results have surpassed analysts’ predictions and have solidified BOYD GAMING’s position as a leader in the gaming industry.

Investors have responded positively to the news and the company’s share price has increased significantly since the announcement. With its robust performance this quarter, BOYD GAMING is well-positioned to continue its success in the upcoming quarters.

Share Price

The Las Vegas-based gaming and entertainment company opened the day at $67.0, only to close at $66.2, down 1.7% from its previous closing price of 67.4. This minor negative surge came despite BOYD GAMING’s otherwise positive news and suggested investors were expecting an even greater profit margin. These impressive figures are a testament to the company’s resilience in challenging times. Despite the ongoing pandemic, BOYD GAMING’s strategic decisions have allowed it to not only remain afloat but also to hit new heights in earnings growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Boyd Gaming. More…

| Total Revenues | Net Income | Net Margin |

| 3.56k | 639.38 | 19.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Boyd Gaming. More…

| Operations | Investing | Financing |

| 976.11 | -422.31 | -615.85 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Boyd Gaming. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.31k | 4.72k | 15.47 |

Key Ratios Snapshot

Some of the financial key ratios for Boyd Gaming are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.2% | 29.3% | 27.6% |

| FCF Margin | ROE | ROA |

| 19.9% | 39.1% | 9.7% |

Analysis

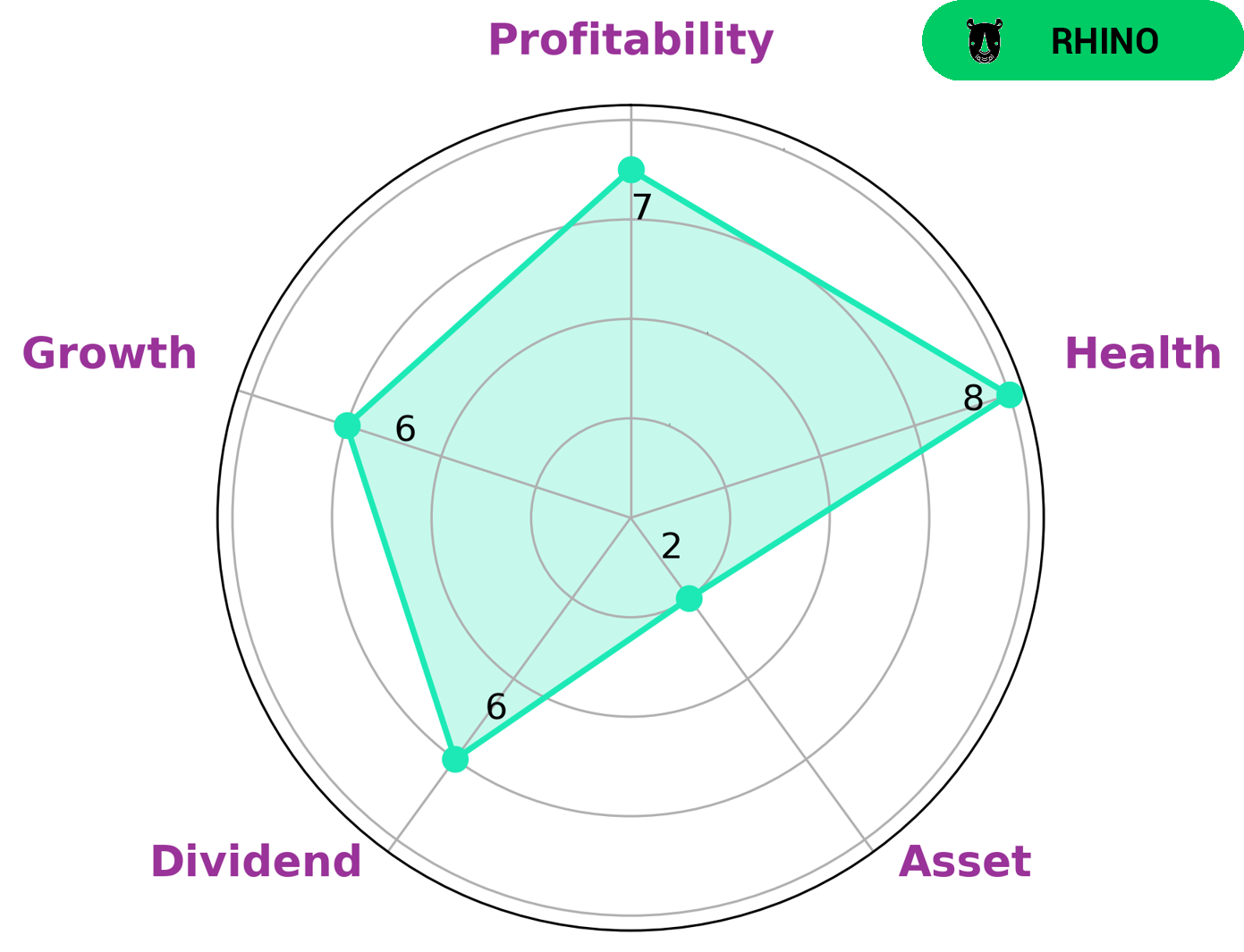

At GoodWhale, we conducted an analysis of BOYD GAMING’s wellbeing. The results were presented in our Star Chart, which showed that BOYD GAMING is strong in profitability and medium in dividend, growth and asset. Based on this, we classified BOYD GAMING as a ‘rhino’, meaning a company that has achieved moderate revenue or earnings growth. This type of company may be of interest to investors looking to diversify their portfolios with a safe investment option. Overall, we recommend BOYD GAMING as a safe and profitable investment option for investors. More…

Peers

Boyd Gaming Corporation is an American gaming and hospitality company based in Paradise, Nevada. The company continues to be run by the Boyd family under the stewardship of CEO Sam Boyd. Boyd Gaming operates 29 gaming properties in Nevada, Illinois, Indiana, Iowa, Kansas, Louisiana, Mississippi, Missouri, Ohio, and Pennsylvania.

– Penn National Gaming Inc ($NASDAQ:PENN)

As of 2022, Penn National Gaming Inc has a market cap of 5.21B and a ROE of 16.23%. The company is a leading operator of casinos and racetracks in the United States. Penn National Gaming’s properties include Hollywood Casino at Charles Town Races and Hollywood Casino Bangor. The company also owns and operates the Argosy Casino in Alton, Illinois.

– Caesars Entertainment Inc ($NASDAQ:CZR)

Caesars Entertainment Inc is a gaming company. It has a market cap of 9.46B as of 2022 and a Return on Equity of 21.84%. The company owns and operates casinos and resorts. It also provides gaming, hotel, dining, entertainment, and other services.

– Ballys Corp ($NYSE:BALY)

Bally’s Corporation is a gaming and hospitality company that owns and operates casinos, hotels, and spas across the United States. The company has a market cap of 1B as of 2022 and a return on equity of 3.13%. Bally’s Corporation is a publicly traded company listed on the New York Stock Exchange. The company was founded in 1969 and is headquartered in Reno, Nevada.

Summary

Investors reacted positively to Boyd Gaming‘s latest earnings report. The company reported Non-GAAP earnings per share of $1.71, which exceeded analysts’ expectations by $0.17. Revenue was also higher than expected, coming in at $963.97 million, a beat of $74.38 million. Investors are encouraged by the company’s strong performance and believe the stock is a good buy.

Analysts remain bullish on the stock, citing its potential for growth in the coming quarters. Investors should keep a close eye on Boyd Gaming, as it is well positioned to benefit from positive macroeconomic conditions.

Recent Posts