Q4 GAAP EPS of $133.44 Beats Expectations by $34.08

February 1, 2023

Trending News 🌥️

The company focuses on providing high-quality homes at a competitive price, and has operations throughout the United States. Recently, NVR ($NYSE:NVR) announced its fourth quarter results, which exceeded analyst expectations. Overall, NVR’s fourth quarter results exceeded analyst expectations and delivered strong growth across all segments of the business. The company’s strong performance is a testament to its long-term strategy of providing quality homes at a competitive price, and investors can expect continued growth for the foreseeable future.

Stock Price

On Tuesday, NVR reported its Q4 GAAP EPS of $133.44, which beat expectations by $34.08. The news coverage at the time of writing was mostly positive and the stock price reacted accordingly. At the opening bell, NVR stock opened at $5199.0 and closed at $5270.0, up by 5.0% from the last closing price of 5021.4. The strong financial performance of NVR was a welcome surprise to shareholders, as they had not expected such a strong performance in the fourth quarter. Investors were further encouraged by the fact that NVR was able to report such a solid beat in their earnings expectations. This positive sentiment was reflected in the stock price, which saw a healthy increase from the previous closing price.

This strong performance by NVR is further evidence of the company’s commitment to its shareholders. The company has consistently delivered strong results that have exceeded expectations and have been beneficial for shareholders. This has enabled them to remain competitive in the industry and maintain their position as a market leader. The strong financial performance of the company is a testament to their commitment to their investors, and shareholders can be confident that they will continue to deliver strong results in the future. nvr“>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nvr. nvr“>More…

| Total Revenues | Net Income | Net Margin |

| 10.06k | 1.61k | 16.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nvr. nvr“>More…

| Operations | Investing | Financing |

| 1.17k | -18.18 | -1.4k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nvr. nvr“>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.39k | 2.3k | 960.42 |

Key Ratios Snapshot

Some of the financial key ratios for Nvr are shown below. nvr“>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.7% | 27.7% | 21.4% |

| FCF Margin | ROE | ROA |

| 11.4% | 44.3% | 24.9% |

VI Analysis

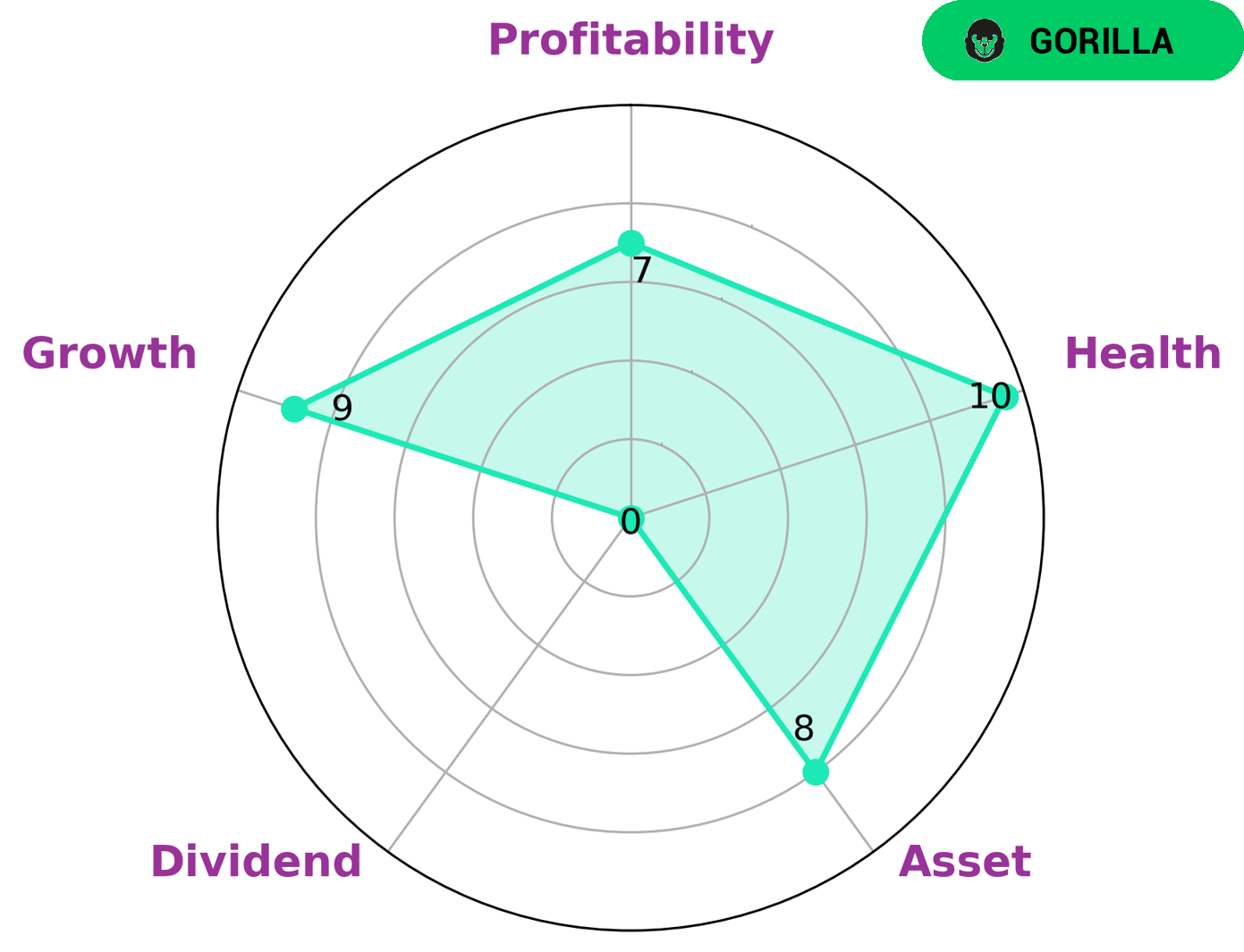

Value Investors App (VI) simplifies the analysis of a company’s fundamentals, which are key indicators of its long term potential. According to the VI Star Chart, NVR is strong in assets, growth, and profitability and weak in dividend. The app also gives NVR a high health score of 10/10 based on its cashflows and debt, indicating that it is capable of withstanding any crisis without facing the risk of bankruptcy. NVR is classified as a ‘gorilla’ company, meaning that it has achieved stable and high revenue or earnings growth due to its strong competitive advantage. Investors who are looking for a safe and profitable long-term investment may be particularly interested in such companies. Furthermore, investors who are looking for companies with strong fundamentals and attractive growth prospects may also be interested in NVR. Overall, VI gives investors an easy way to assess the fundamentals of a company and identify potential investments that would be suitable for their financial goals. By analyzing NVR’s fundamentals, investors can make an informed decision about whether or not it is worth investing in. nvr“>More…

VI Peers

In the homebuilding industry, NVR Inc compete against D.R. Horton Inc, Lennar Corp, and Toll Brothers Inc. All four companies are publicly traded and operate in the United States. NVR Inc is the largest company by revenue, followed by D.R. Horton Inc, Lennar Corp, and Toll Brothers Inc.

– D.R. Horton Inc ($NYSE:DHI)

D.R. Horton Inc is one of the largest homebuilding companies in the United States. The company builds and sells single-family homes, townhomes, and condominiums in a variety of price ranges and locations. Horton has operations in 26 states and 84 markets across the country. The company’s homes are marketed under a number of different brand names, including D.R. Horton, Express Homes, Emerald Homes, and Freedom Homes.

D.R. Horton’s market cap is 25.14B as of 2022. The company has a return on equity of 25.97%. D.R. Horton is one of the largest homebuilding companies in the United States and builds and sells single-family homes, townhomes, and condominiums in a variety of price ranges and locations.

– Lennar Corp ($NYSE:LEN)

Lennar Corporation is a home construction and real estate company founded in 1954. The company operates in 22 states and specializes in the construction of single-family homes, multifamily homes, and community amenities. As of 2022, the company has a market cap of 21.83B and a return on equity of 18.78%.

– Toll Brothers Inc ($NYSE:TOL)

Toll Brothers Inc is a homebuilding company that was founded in 1967. The company is headquartered in Horsham, Pennsylvania, and it operates in over 50 markets across the United States. The company builds single-family detached homes, townhouses, condominiums, and apartments. As of 2022, the company has a market cap of 4.88B and a return on equity of 15.37%. The company has been profitable for every year since 2002, and its revenue has increased every year since 2004. The company’s stock price has increased by over 1000% since 2009.

Summary

NVR Inc. is an attractive investment for those looking for potential returns. The company recently reported a Q4 GAAP Earnings Per Share (EPS) of $133.44, beating expectations by $34.08. This news was met with positive coverage from the media and a corresponding stock price increase on the same day.

NVR offers a wide range of products and services in the homebuilding and mortgage banking industries and is well-known for high quality and value. With a strong financial performance, diverse portfolio, and international presence, NVR is an appealing option for investors looking to diversify their portfolio and capitalize on potential gains.

Recent Posts