PulteGroup Stock Jumps 3.30% in Mixed Trading Session

April 20, 2023

Trending News 🌥️

PULTEGROUP ($NYSE:PHM): On Tuesday, shares of PulteGroup Inc. rose by 3.30% to $62.59, despite the S&P 500’s mixed trading session. PulteGroup Inc. is a homebuilding and financial services company, headquartered in Atlanta, Georgia. It is the parent company of Pulte Homes, Centex, Del Webb, DiVosta Homes, and John Wieland Homes and Neighborhoods. This increase in net income was attributed to strong demand in the housing market as well as robust pricing in the new home business.

Overall, investors have responded positively to the company’s financial performance, driving PulteGroup Inc.’s stock upwards by 3.30% in a mixed trading session on Tuesday. Looking ahead, investors will be closely watching the company’s financial updates to see if it can maintain its strong performance in upcoming quarters.

Stock Price

Wednesday saw PulteGroup Inc. stock jump 3.30% in a mixed trading session. The stock opened at $62.2 and closed at $62.4, representing an increase of 0.2% from its previous closing price of $62.6. The jump in stock price indicates investor confidence in the company’s prospects for the future, in spite of the recent market volatility. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pultegroup. PulteGroup_Stock_Jumps_3.30_in_Mixed_Trading_Session”>More…

| Total Revenues | Net Income | Net Margin |

| 16.23k | 2.6k | 16.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pultegroup. PulteGroup_Stock_Jumps_3.30_in_Mixed_Trading_Session”>More…

| Operations | Investing | Financing |

| 668.47 | -171.74 | -1.24k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pultegroup. PulteGroup_Stock_Jumps_3.30_in_Mixed_Trading_Session”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.8k | 5.88k | 39.51 |

Key Ratios Snapshot

Some of the financial key ratios for Pultegroup are shown below. PulteGroup_Stock_Jumps_3.30_in_Mixed_Trading_Session”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.7% | 37.0% | 21.2% |

| FCF Margin | ROE | ROA |

| 3.4% | 25.2% | 14.5% |

Analysis

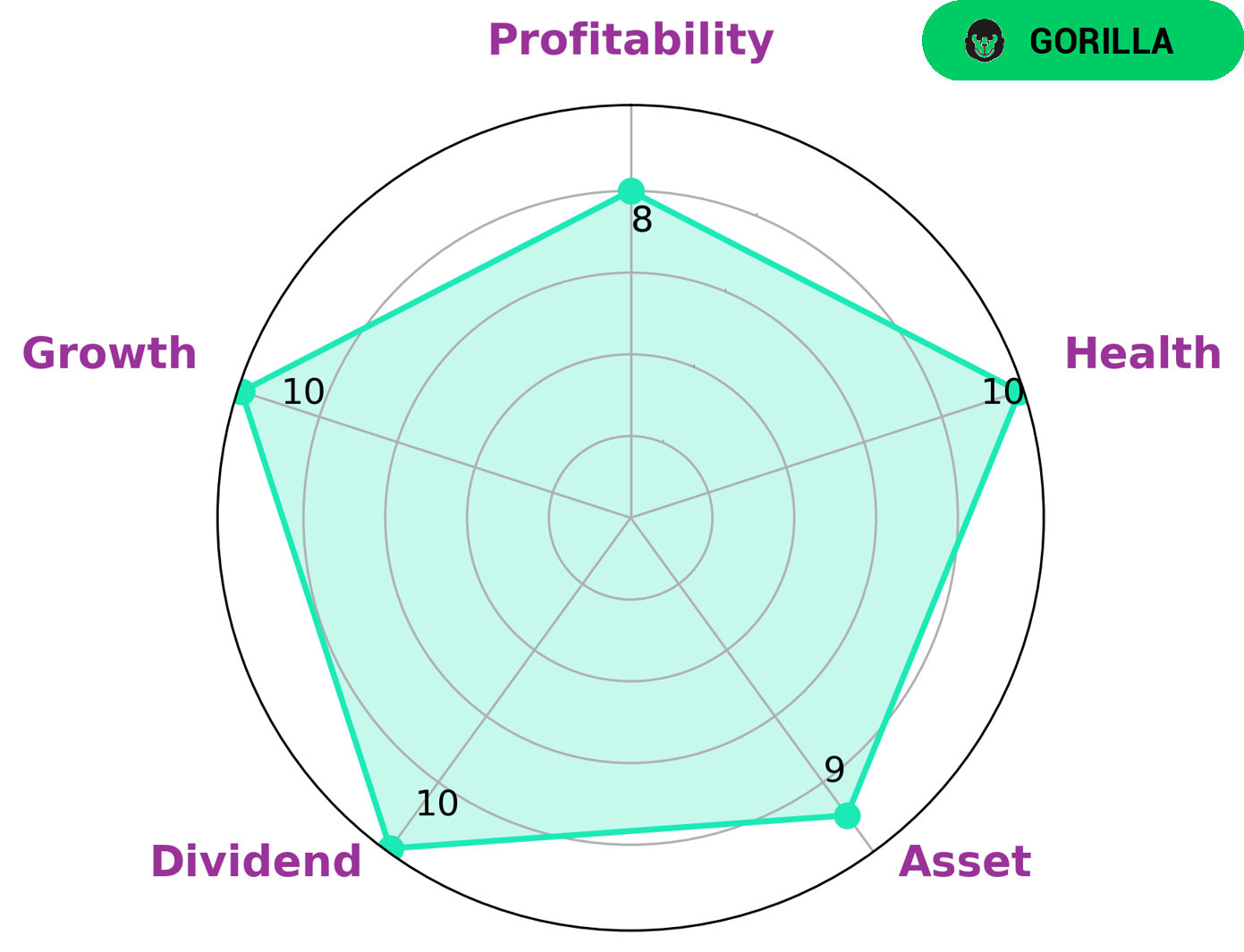

GoodWhale recently conducted an analysis of PULTEGROUP‘s wellbeing. Our findings, depicted by a Star Chart, revealed that PULTEGROUP is strong in asset, dividend, growth, and profitability. Upon further investigation, we concluded that PULTEGROUP is classified as a ‘gorilla’, meaning it has achieved stable and high revenue or earning growth due to its strong competitive advantage. Given this positive assessment, GoodWhale can confidently recommend PULTEGROUP as an investment option. With its high health score of 10/10 with regard to its cashflows and debt, PULTEGROUP is capable to sustain future operations even in times of crisis. Investors interested in a company with the potential for long-term, stable growth will find PULTEGROUP to be an attractive option. More…

Peers

PulteGroup Inc is one of the largest homebuilders in the United States. The company’s competitors include D.R. Horton Inc, Lennar Corp, and Beazer Homes USA Inc.

– D.R. Horton Inc ($NYSE:DHI)

D.R. Horton Inc is a homebuilding company that operates in 84 markets across 26 states in the United States. The company is engaged in the construction and sale of single-family detached homes, townhomes, and condominiums. It also provides mortgage financing and title services for homebuyers through its subsidiaries. As of March 31, 2021, the company had a market capitalization of $26.2 billion and a return on equity of 25.97%.

D.R. Horton was founded in 1978 and is headquartered in Fort Worth, Texas. The company operates through its Homebuilding and Financial Services segments. The Homebuilding segment acquires and develops land, and constructs and sells homes in 27 states across the United States. The Financial Services segment provides mortgage financing, title insurance, and closing services for homebuyers in its homebuilding markets.

– Lennar Corp ($NYSE:LEN)

Lennar Corp is a leading homebuilder in the United States. The company has a market capitalization of $22.33 billion as of 2022 and a return on equity of 18.78%. Lennar Corp is engaged in the business of homebuilding, land development, and related activities through its subsidiaries. The company builds and sells a variety of homes, including single-family detached homes, townhomes, and condominiums. It also provides a range of homebuilding-related financial services, such as mortgage financing, title insurance, and home warranty services.

– Beazer Homes USA Inc ($NYSE:BZH)

Beazer Homes USA Inc is a homebuilding company that operates in the United States. The company is engaged in the design, construction, and sale of single-family homes. As of 2022, Beazer Homes USA Inc had a market capitalization of $345.59 million and a return on equity of 15.8%. The company’s primary business is the construction and sale of single-family homes. Beazer Homes USA Inc also engages in the construction of multi-family homes and the development of land for homebuilding.

Summary

Investing in PulteGroup Inc. can be a wise decision as stock prices increased 3.30% to $62.59 on Tuesday. The overall market was mixed, with the S&P 500 slightly down, however PulteGroup managed to rise above the rest. Analysts suggest that investors should consider the potential benefits of investing in the company, including long-term capital appreciation and dividends.

It is also important to consider the company’s financials, management team, and competitive advantages before investing in PulteGroup. With careful research and analysis, investors can make informed decisions to maximize their returns.

Recent Posts