Meritage Homes Reports Record Q4 Earnings, Beats Expectations by $0.06 and $10M in Revenue.

February 2, 2023

Trending News 🌥️

Meritage Homes ($NYSE:MTH), a leading homebuilder in the United States, recently reported record fourth quarter earnings, beating analyst expectations. The company reported a GAAP earnings per share of $7.09, which was $0.06 above the consensus estimate of $7.03. Revenue for the quarter was also $10 million higher than the expected $1.98 billion, coming in at $1.99 billion. This impressive performance highlights the success that Meritage Homes has had in the past year, especially during a time of economic uncertainty. It has operations in eight states, including Arizona, California, Colorado, Florida, Georgia, Nevada, North Carolina and Texas. The company focuses on providing a variety of quality homes, ranging from single-family to multi-family residences, to its customers at an affordable price.

Meritage Homes also offers a comprehensive suite of financial services, such as mortgage and title services, to help its customers through the home buying process. Meritage Homes’ strong fourth quarter performance is a testament to the company’s focus on providing quality homes while also meeting customer needs. With the housing market continuing to recover, Meritage Homes is well-positioned to capitalize on future growth opportunities. Investors and analysts alike were encouraged by the company’s strong performance and are optimistic about its prospects for the future.

Market Price

Meritage Homes, a leading national homebuilder, reported record fourth quarter earnings on Wednesday that beat expectations by $0.06 and $10M in revenue. The news was met with enthusiasm from investors, as the company’s stock opened at $107.3 and closed at $109.5, up 1.7% from the prior closing price of $107.7. The strong earnings report is the latest in a string of positive news for Meritage Homes. The company’s success was largely driven by increased demand for new homes across the United States, as well as a focus on expanding its land portfolio to meet that demand. The company’s land acquisitions have helped to strengthen its presence in key markets across the country, including Texas, Arizona, California, and Florida. This is the highest number of net orders for any quarter in the company’s history.

The strong performance was attributed to higher consumer confidence due to improved economic conditions and lower mortgage interest rates. Looking ahead, Meritage Homes expects continued success in the coming quarters. The company plans to continue investing in land acquisitions to keep up with consumer demand and is also focusing on expansion into new markets. With strong financial performance and a focus on long-term growth, Meritage Homes is well-positioned for continued success in the years ahead. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Meritage Homes. More…

| Total Revenues | Net Income | Net Margin |

| 5.8k | 967.29 | 14.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Meritage Homes. More…

| Operations | Investing | Financing |

| -215.45 | -26.82 | 51.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Meritage Homes. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.31k | 1.9k | 93.32 |

Key Ratios Snapshot

Some of the financial key ratios for Meritage Homes are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.8% | 63.9% | 18.6% |

| FCF Margin | ROE | ROA |

| -4.2% | 23.1% | 14.8% |

Analysis

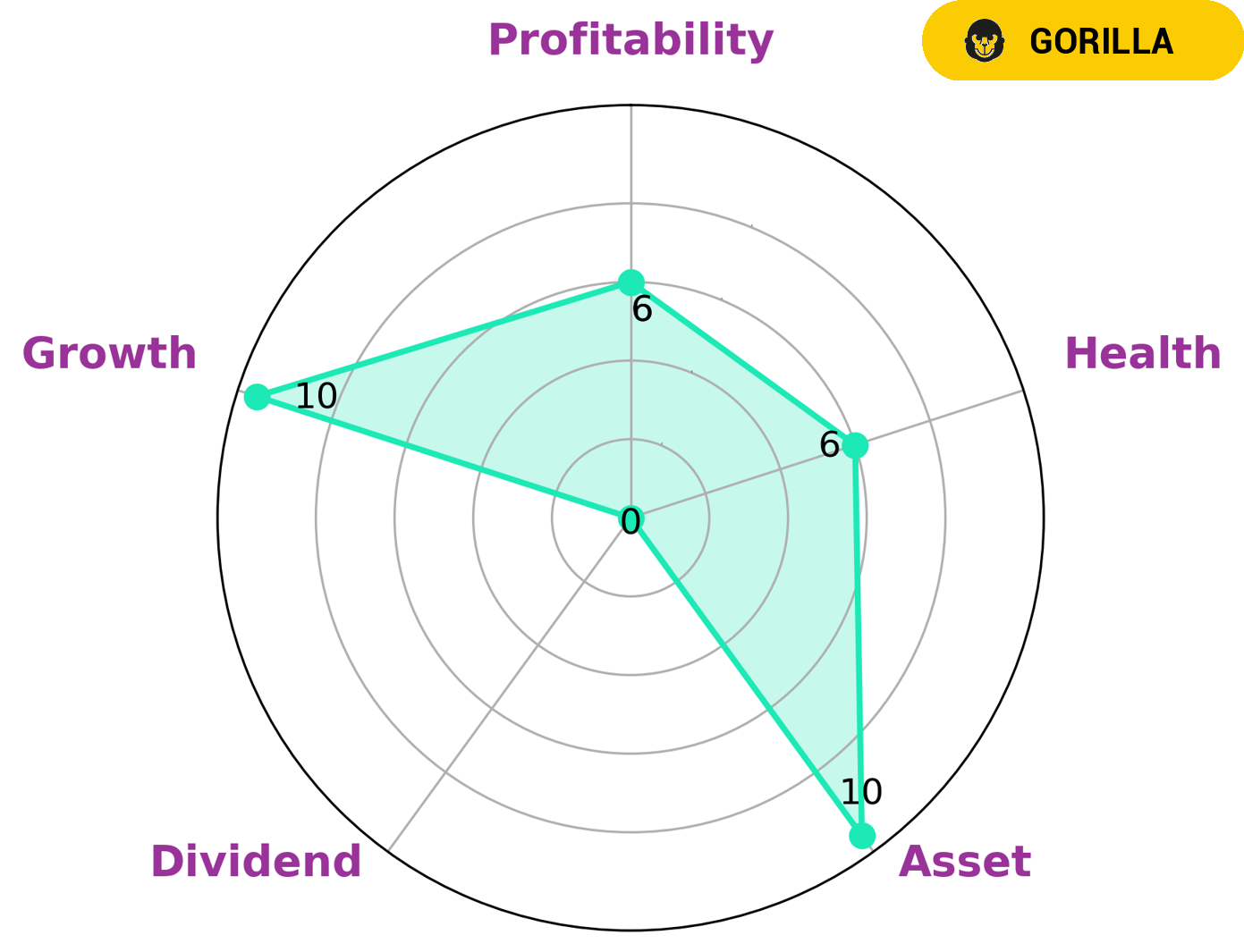

GoodWhale’s analysis of MERITAGE HOMES‘ fundamentals reveals an intermediate health score of 6/10, based on its cashflows and debt. This suggests MERITAGE HOMES is likely able to pay off debt and fund future operations. According to the Star Chart, MERITAGE HOMES is strong in asset and growth, medium in profitability and weak in dividend. MERITAGE HOMES is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors who may be interested in this type of company include value investors, growth investors, and dividend investors. Value investors look for companies with a good balance sheet and attractive price-to-book ratios. Growth investors are interested in companies that are growing rapidly, while dividend investors are looking for companies that pay regular dividends and generate consistent cash flows. MERITAGE HOMES may also attract investors who are interested in sustainable investments as it may be able to demonstrate a commitment to environmental, social and corporate governance (ESG) initiatives. These types of investors may be looking for companies with strong environmental, social and governance policies and practices that are integrated into their operations, products, and services. Overall, MERITAGE HOMES is well-positioned to attract a variety of investors due to its strong competitive advantage, stability, and ESG initiatives. More…

Peers

Beazer Homes USA Inc is a privately held company that is the tenth largest homebuilder in the United States. Skyline Champion Corp is a publicly traded company and the fifth largest builder in the United States. Taylor Morrison Home Corp is a publicly traded company and is the seventh largest homebuilder in the United States.

– Beazer Homes USA Inc ($NYSE:BZH)

Beazer Homes USA Inc is one of the largest homebuilders in the United States. The company has a market cap of 311.19M as of 2022 and a return on equity of 15.8%. Beazer Homes builds and sells single-family homes, townhomes, and condominiums in the United States. The company was founded in 1985 and is headquartered in Atlanta, Georgia.

– Skyline Champion Corp ($NYSE:SKY)

Skyline Champion Corporation is an American publicly traded company and one of the largest manufacturers of manufactured homes, modular homes, and park model RVs in North America. The company is headquartered in Elkhart, Indiana.

As of 2022, Skyline Champion Corporation has a market capitalization of 3.08 billion and a return on equity of 30.7%. The company’s primary business is the design, production, and sale of manufactured homes, modular homes, and park model RVs. Skyline Champion Corporation operates in three segments: Factory-Built Housing, Modular Buildings, and Park Models.

– Taylor Morrison Home Corp ($NYSE:TMHC)

Taylor Morrison Home Corporation is a homebuilder and land developer in the United States. The Company’s segments include Homebuilding and Financial Services. The Homebuilding segment builds and sells single-family detached and attached homes designed primarily for the entry-level and first move-up markets. This segment also provides mortgage banking and title services to homebuyers in its communities. The Financial Services segment provides mortgage banking and title services to third-party homebuyers in communities where it does not build homes, as well as to homebuyers of Taylor Morrison homes. The Company operates in Arizona, California, Colorado, Florida, Georgia, Illinois, North Carolina and Texas.

Summary

Meritage Homes reported record fourth quarter earnings, beating analyst expectations by $0.06 per share and $10 million in revenue. The strong earnings report showed strong demand for Meritage Homes’ products and services, with the company reporting a higher backlog of homes and improved prices. Meritage Homes’ stock price surged following the news, indicating that investors are confident in the company’s long-term prospects.

This report is a positive sign for investors, as Meritage Homes has a history of consistently meeting or exceeding expectations. With a strong balance sheet and a healthier housing market, Meritage Homes appears well-positioned for continued future growth.

Recent Posts