Alpha DNA Investment Management LLC Increases Stock Holdings in Skyline Champion Co. to $510,000 in 2023.

March 18, 2023

Trending News ☀️

Alpha DNA Investment Management LLC recently increased their stock holdings in Skyline Champion ($NYSE:SKY) Co. to a value of $510,000 in 2023. Skyline Champion Co. is a leading manufacturer and marketer of factory-built housing products in North America. Their products include manufactured homes, modular homes, and park model recreational vehicles. Skyline Champion Co. has been steadily increasing their sales in recent years and they are well positioned to continue their growth in the coming years. They have also been able to stay ahead of the competition by developing innovative products such as energy efficient modular homes and other green buildings.

With the increasing demand for green buildings, this investment by Alpha DNA Investment Management LLC could be seen as a sign of their belief that Skyline Champion Co. will continue to be a leader in the industry for many years to come. With the increasing demand for green buildings, their products and services are well placed to capitalize on this trend and remain competitive in the industry. As a result, this increased investment could be seen as an indication that Skyline Champion Co. is set to continue its growth in the coming years and beyond.

Market Price

News coverage on Skyline Champion Co. (SKY) has been overwhelmingly positive this month, and the stock is showing it. On Tuesday, SKY opened at $67.7 and closed at $66.9, up by 1.5% from its previous closing price of 65.9. This latest investment marks a major milestone for the company, propelling the stock even further.

Skyline Champion Co. has emerged onto the market at a time when the housing market is booming, replenishing investor confidence. This new investment from Alpha DNA Investment Management LLC further solidifies investors’ faith in the company’s potential and its ability to thrive in the current market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Skyline Champion. More…

| Total Revenues | Net Income | Net Margin |

| 2.75k | 430.85 | 15.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Skyline Champion. More…

| Operations | Investing | Financing |

| 424.12 | -53.81 | -34.81 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Skyline Champion. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.51k | 338.25 | 20.57 |

Key Ratios Snapshot

Some of the financial key ratios for Skyline Champion are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 25.4% | 81.3% | 20.9% |

| FCF Margin | ROE | ROA |

| 13.7% | 31.9% | 23.8% |

Analysis

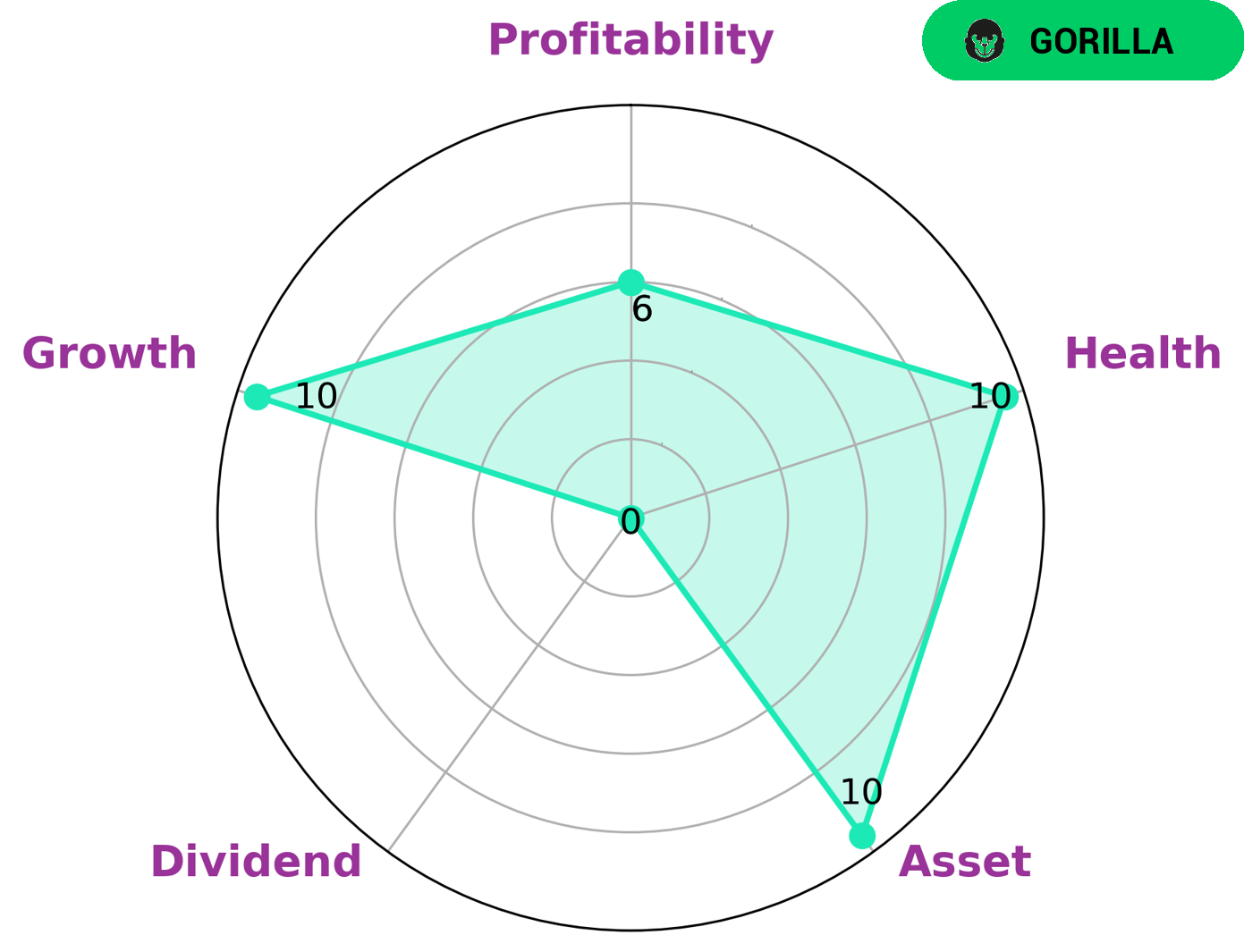

GoodWhale conducted an analysis of SKYLINE CHAMPION’s fundamentals, and based on the Star Chart, we saw that the company is classified as ‘gorilla’. This type of company typically achieves stable and high revenue or earning growth due to its strong competitive advantage. Given these positive attributes, SKYLINE CHAMPION may be an attractive investment opportunity for a variety of investors. For instance, those interested in stability may be drawn to the company’s high health score of 10/10 with regard to its cashflows and debt, which suggests the company is capable of sustaining future operations in times of crisis. Furthermore, SKYLINE CHAMPION is strong in asset and growth, medium in profitability and weak in dividend, making it well-suited for those who prioritize capital gains over income. In conclusion, investors interested in a strong, long-term investment opportunity that offers stability and growth may be particularly interested in SKYLINE CHAMPION. More…

Peers

Skyline Champion Corp is one of the leading homebuilders in the United States. The company’s main competitors are Meritage Homes Corp, Tri Pointe Homes Inc, and KB Home.

– Meritage Homes Corp ($NYSE:MTH)

Meritage Homes Corp is a homebuilder in the United States. As of 2022, the company has a market capitalization of 3.06 billion dollars and a return on equity of 23.05%. The company builds homes for a variety of different price points and markets, and has a focus on sustainability and energy efficiency.

– Tri Pointe Homes Inc ($NYSE:TPH)

Tri Pointe Homes Inc is a homebuilding company that focuses on the development of single-family homes. The company operates in various states in the United States, including Arizona, California, Colorado, Florida, Georgia, Illinois, Indiana, Maryland, Nevada, North Carolina, Ohio, Oklahoma, Oregon, South Carolina, Texas, and Virginia. As of 2022, the company has a market cap of 1.86B and a ROE of 16.87%.

– KB Home ($NYSE:KBH)

KB Home is a homebuilding company headquartered in Los Angeles, California. It is one of the largest homebuilders in the United States. The company builds and sells single-family detached and attached homes, townhomes, and condominiums in the United States. It operates in four segments: West Coast, Central, Southeast, and South Central. The company was founded in 1957 and is headquartered in Los Angeles, California.

Summary

Skyline Champion Corporation has seen significant investments this year, with Alpha DNA Investment Management LLC raising its stake in the company to $510,000. This is a positive sign for the company, as investors continue to believe in its potential. Analysts have noted the shift in the market and have cited the strength of Skyline’s position in the housing market and its ability to provide reliable manufactured homes and modular housing solutions to consumers.

Its diversified product offerings have also been praised, with its presence in both North America and Europe, as well as its strong financials. All in all, investors should consider Skyline Champion Corporation to be a safe long-term investment with potential for steady growth.

Recent Posts