Xponance Cuts Stake in WillScot Mobile Mini Holdings Corp.

January 16, 2023

Trending News 🌧️

WILLSCOT ($NASDAQ:WSC): WillScot Mobile Mini Holdings Corp (WSC) is a publicly traded company that provides modular space solutions for commercial and residential customers. Its products include modular buildings, storage containers, and mobile offices. The sale of Xponance’s stake in WSC comes as no surprise, as the company has been reducing its exposure to the stock for some time. This latest sale further reduces the company’s exposure to WSC, though it still remains one of the largest shareholders in the company. The news of Xponance’s reduced stake in WSC has caused some concern among investors, as the company has been an important backer of the stock since it went public.

However, analysts believe that the reduction of Xponance’s exposure to WSC does not necessarily spell bad news for the company. Instead, they believe that the move may be a sign that Xponance is confident in WSC’s future prospects and is simply reducing its exposure to the stock in order to diversify its portfolio. Overall, Xponance’s reduced stake in WillScot Mobile Mini Holdings Corp. has caused some concern among investors. However, it appears that the company is simply reducing its exposure to the stock in order to diversify its portfolio. As such, it is likely that WSC will continue to perform well going forward and will remain a strong presence in the modular space industry.

Stock Price

The media sentiment surrounding the news has been mostly negative, although the stock opened at $45.1 and closed at $45.1, a 0.5% increase from its last closing price of 44.9. The exact details of the stake reduction have not yet been released, but analysts are speculating that Xponance has sold off a portion of its holdings in WillScot Mobile Mini. This decision comes in the wake of a turbulent few months for the company, as the pandemic has caused a major disruption to their operations. WillScot Mobile Mini has experienced a drop in revenue and profits in the past several months, and the share price has also been on a downward trajectory for several weeks prior to the announcement. Analysts are now concerned that this stake reduction could signal that Xponance is not optimistic about WillScot Mobile Mini’s future prospects.

At the same time, some investors remain hopeful that the company can turn things around and return to profitability. WillScot Mobile Mini has been focusing on cost-cutting initiatives in an effort to reduce expenses, and they are also exploring new opportunities for growth. Only time will tell how Xponance’s decision to reduce its stake in WillScot Mobile Mini will affect the company’s future prospects. For now, investors should continue to monitor the stock closely and be prepared to act quickly if any further developments occur. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for WSC. More…

| Total Revenues | Net Income | Net Margin |

| 2.15k | 274.32 | 12.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for WSC. More…

| Operations | Investing | Financing |

| 612.15 | -384.05 | -167.89 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for WSC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.81k | 4.13k | 8.21 |

Key Ratios Snapshot

Some of the financial key ratios for WSC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 27.0% | 70.3% | 22.7% |

| FCF Margin | ROE | ROA |

| 9.0% | 17.6% | 5.2% |

VI Analysis

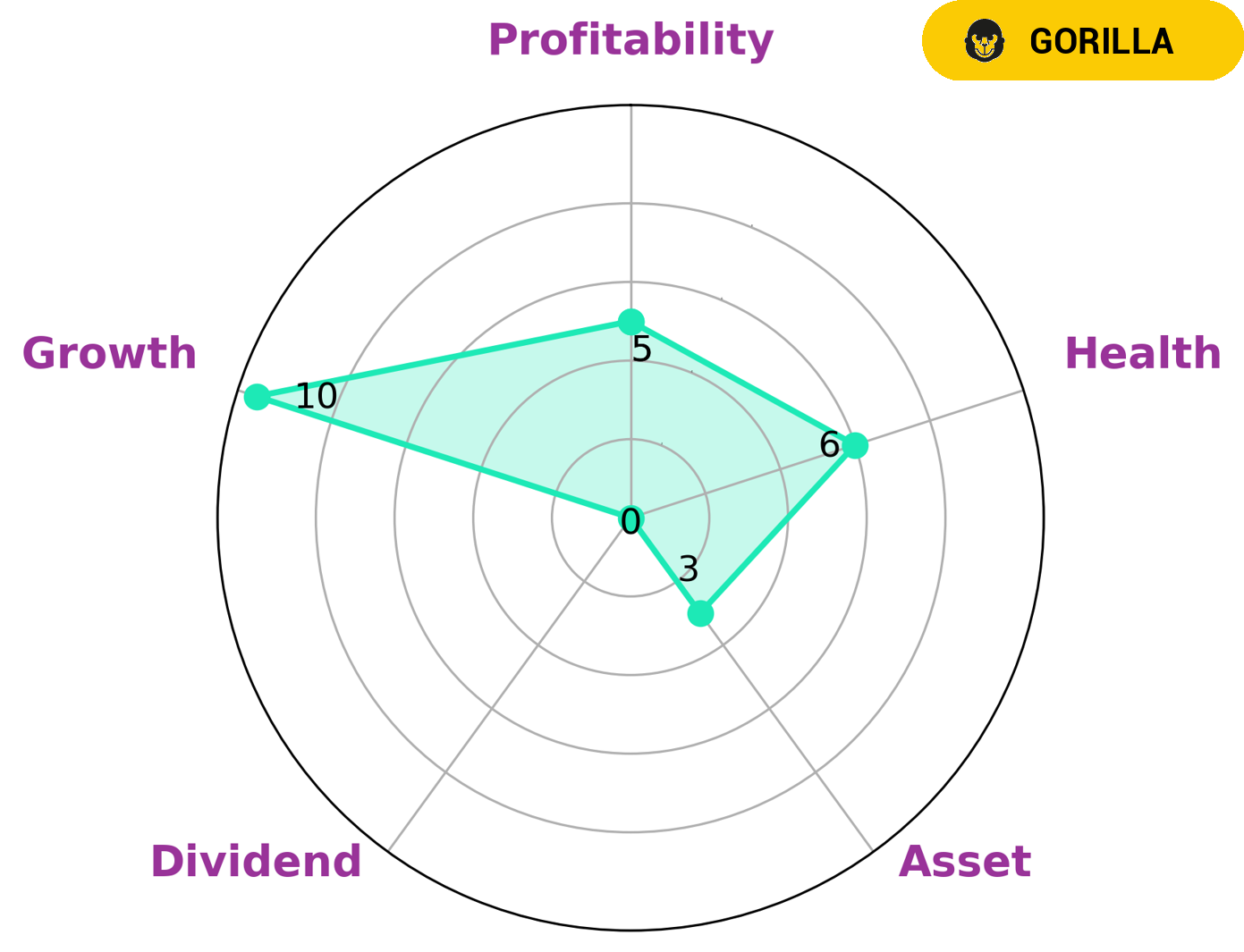

WILLSCOT MOBILE MINI is a strong growth company, based on VI’s Star Chart. Its asset and dividend performance are weaker than its growth and profitability, but it is nevertheless classified as a ‘gorilla’ – a company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. Investors interested in this type of company may be drawn to its intermediate health score of 6/10, which suggests that it is likely to pay off debt and fund future operations. As the company’s fundamentals reflect its long term potential, investors may be interested in investing in the company for the long haul. With its strong competitive advantage, the company is likely to continue to experience revenue and earnings growth in the future. Additionally, its intermediate health score suggests that it can pay off debt and fund operations. Profitability is likely to be affected by competition and economic conditions, while asset performance may be affected by the company’s ability to manage its assets and investments. Finally, WILLSCOT MOBILE MINI’s dividend performance is weak. Dividends are generally paid out to shareholders when a company has excess cash, and so investors may not expect to receive a large return on investment through dividends with this company. Overall, WILLSCOT MOBILE MINI is a strong growth company with an intermediate health score. Its growth, profitability, asset and dividend performances may attract different types of investors who are looking for long term investments. More…

VI Peers

The competition between WillScot Mobile Mini Holdings Corp and its competitors, The Brink’s Co, Touax, and Groupe CRIT SA, has become increasingly fierce in recent years. These companies are all vying for a greater share of the mobile storage and modular building solutions market, with each of them bringing their own strengths and strategies to the table. With the stakes so high, it is an exciting time to see who will come out on top.

– The Brink’s Co ($NYSE:BCO)

The Brink’s Co is a global leader in security-related services and cash handling. With a market cap of 2.71 billion as of 2022 and a Return on Equity of 103.48%, the company is well-positioned to continue its success in the industry. The Brink’s Co provides secure transportation, cash management services, and security-related services to customers in over 100 countries around the world. Their services are designed to help customers protect their assets from theft and fraud. In addition, their services also help customers increase efficiency, reduce costs, and improve customer satisfaction. With its market cap and ROE, the Brink’s Co is well-prepared to continue its success in the industry.

– Touax ($LTS:0IXN)

Touax is a leading global provider of modular buildings and containers. With a market cap of 60.12M as of 2022, Touax is a well-respected player in the industry and its Return on Equity (ROE) of 20.2% demonstrates its strong financial performance. The company is known for its excellent customer service, great value for money and reliable products. The company’s focus on creating innovative solutions has enabled it to maintain its competitive edge in the market. With a strong presence in Europe and North America, Touax is well-positioned to continue to grow and expand its operations in the future.

– Groupe CRIT SA ($LTS:0DZJ)

Groupe CRIT SA is a French-based group of companies that specialize in temporary staffing. As of 2022, Groupe CRIT SA has a market cap of 665.91M, making it one of the largest staffing companies in France. The company also has a Return on Equity (ROE) of 9.1%, indicating that it has been able to effectively generate profits and return value to shareholders. Groupe CRIT SA focuses primarily on temporary staffing solutions, with a particular focus on the industrial, medical, and administrative sectors. The company has offices in France, Spain, Italy, Switzerland, Germany, the United Kingdom, and Belgium. Groupe CRIT SA is well-positioned for continued success in the staffing industry.

Summary

Investors have taken a cautious stance on WillScot Mobile Mini Holdings Corp. (WSC) after Xponance Inc. recently sold off a portion of its stake in the company. Analysts have suggested that the move reflects a lack of confidence in WSC’s current performance and future prospects. Despite this, some analysts are still bullish on WSC due to its potential for growth and its market niche.

Investing in WSC is a high-risk venture, as the stock has been volatile and the company’s financial statements are not yet public. As such, investors should proceed with caution and conduct their own due diligence before investing in WSC.

Recent Posts