Creative Planning cuts stake in Custom Truck One Source by 40.4% in third quarter

November 16, 2024

☀️Trending News

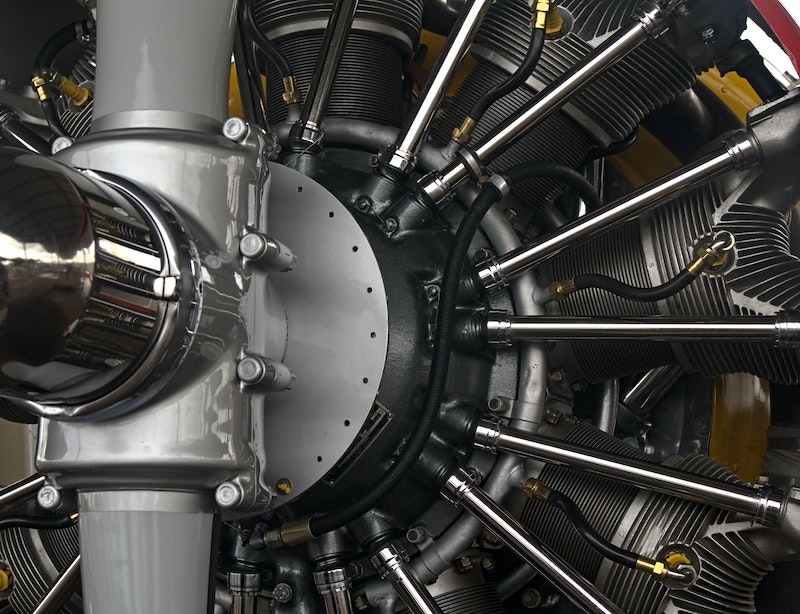

Custom Truck One ($NYSE:CTOS) Source is a leading provider of specialized trucks and heavy equipment to the construction, utility, and energy industries. The company offers a wide range of custom-built trucks, cranes, and other equipment, as well as repair and maintenance services.

However, recent filings by investment management company Creative Planning reveal a significant decrease in their stake in Custom Truck One Source during the third quarter of this year. This marks a significant change in Creative Planning’s investment in Custom Truck One Source, and raises questions about their reasoning behind this decision. It is worth noting that Creative Planning is not the only investment management firm to decrease its stake in the company during this period. Other notable firms such as T. Rowe Price and The Vanguard Group also reported reduced holdings in Custom Truck One Source in their latest filings. One possible explanation for this trend could be the recent volatility in the stock market and concerns about economic uncertainty. As a provider of specialized equipment to industries that are heavily dependent on economic conditions, Custom Truck One Source may be seen as a risky investment in the current market climate.

Additionally, the company’s financials have not been as strong as some of its competitors, which could also contribute to decreased confidence from investors. On the other hand, there could be other factors at play that have led to Creative Planning’s reduced stake in Custom Truck One Source. It is important to note that 13F filings only provide a snapshot of a firm’s holdings at a specific point in time, and may not reflect their current or future investment strategies. In any case, this news may have an impact on the company’s stock performance in the near future. Investors and analysts will be closely monitoring Custom Truck One Source’s next earnings report for any indications of the reasons behind this decrease in investment from major firms.

Analysis

After conducting an in-depth analysis of CUSTOM TRUCK ONE SOURCE, it is clear that the company is performing well in terms of growth and medium in profitability and asset. However, the company is weak in terms of dividend, which may be a cause for concern for some investors. Based on our Star Chart assessment, we have classified CUSTOM TRUCK ONE SOURCE as a ‘cheetah’ type of company. This means that the company has achieved high revenue or earnings growth, but is considered less stable due to its lower profitability. This information is important for investors to consider as it provides insight into the potential risks associated with investing in CUSTOM TRUCK ONE SOURCE. Investors who are looking for high-growth opportunities may be interested in CUSTOM TRUCK ONE SOURCE. The company has shown strong performance in terms of growth, which can be appealing to investors seeking to maximize their returns. However, it is important to note that the company’s lower profitability may make it a riskier investment compared to other companies with higher profitability. It is also important for investors to be aware of CUSTOM TRUCK ONE SOURCE’s health score, which is currently at 3/10. This score takes into account the company’s cash flows and debt and suggests that it may struggle to sustain its operations in times of crisis. This information can be valuable in helping investors make informed decisions about their investments in CUSTOM TRUCK ONE SOURCE. In conclusion, while CUSTOM TRUCK ONE SOURCE may present attractive growth opportunities, it is important for investors to carefully assess the risks associated with investing in the company. Keeping in mind its lower profitability and health score, investors should carefully consider their investment strategies before making any decisions regarding CUSTOM TRUCK ONE SOURCE. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CTOS. More…

| Total Revenues | Net Income | Net Margin |

| 1.87k | 50.71 | 3.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CTOS. More…

| Operations | Investing | Financing |

| -30.88 | -176.6 | 202.88 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CTOS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.37k | 2.45k | 3.81 |

Key Ratios Snapshot

Some of the financial key ratios for CTOS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 83.3% | 97.9% | 10.2% |

| FCF Margin | ROE | ROA |

| -21.2% | 12.9% | 3.5% |

Peers

The company has a strong competitive position in the market, with a wide range of products and services. Custom Truck One Source Inc is a publicly traded company on the New York Stock Exchange under the ticker symbol CUST.

– H&E Equipment Services Inc ($NASDAQ:HEES)

H&E Equipment Services is a leading provider of equipment services and solutions for a wide range of industries, including construction, mining, oil and gas, government, and power generation. The company has a market cap of 1.49B as of 2022 and a return on equity of 35.46%. H&E Equipment Services provides a wide range of services, including equipment rental, sales, and maintenance, to its customers. The company has a strong focus on customer service and provides a wide range of support services to its customers.

– Babylon Pump & Power Ltd ($ASX:BPP)

Babylon Pump & Power Ltd is a market leader in providing pump and power solutions. The company has a strong focus on customer service and providing high quality products. The company has a market capitalization of 12.29M as of 2022 and a return on equity of -43.24%. The company’s products are used in a wide range of industries, including mining, construction, agriculture, and manufacturing.

– Triton International Ltd ($NYSE:TRTN)

Triton International Ltd is a leading provider of containers and related services. The company has a market cap of 3.83B as of 2022 and a return on equity of 15.89%. Triton International Ltd is a publicly traded company listed on the New York Stock Exchange. The company was founded in 2006 and is headquartered in Hamilton, Bermuda. Triton International Ltd is a leading provider of intermodal transportation equipment and services with a focus on container leasing and sales, depot services, container trucking, and related logistics services.

Summary

Creative Planning, a financial planning and investment management company, has recently decreased its stake in Custom Truck One Source, a provider of specialized trucks and heavy equipment, by 40.4%. This decrease was reported in the third quarter of this year. It is not known why Creative Planning reduced its holdings, but it could signal a lack of confidence in the company’s performance or potential.

This could be a potential red flag for other investors who may also decide to reduce their investments in Custom Truck One Source. Overall, this news highlights the importance of regularly analyzing and monitoring investments to make informed decisions.

Recent Posts