Goldman Sachs Sees American Tower’s 26% Decline as Buying Opportunity, Boosts Rating to Buy

January 11, 2023

Trending News ☀️

American Tower ($NYSE:AMT) is a real estate investment trust (REIT) that owns, operates, and develops communications infrastructure assets such as cell towers, broadcast towers, and rooftop sites. This year, their stock has taken a hit due to rising interest rates, resulting in a 26% decline. On Tuesday, Goldman Sachs gave American Tower a Buy rating, expressing optimism and seeing the 26% decline as a buying opportunity. They believe that this is the perfect time to invest in the company due to the value it offers. This news sent AMT stock up 0.9% before the market opened. Goldman Sachs has also highlighted that American Tower’s tenants are largely immune to macroeconomic cycles, which means that the stock should continue to remain resilient despite the current downturn in the market. Furthermore, the company holds a significant amount of cash on hand which could be used to make strategic investments or provide returns to shareholders. American Tower has also been making strides in its international operations, particularly in India. This is further expected to increase the company’s revenue and profitability in the coming years.

Additionally, the company has recently entered into a joint venture with Helios Towers to buy tower assets in Africa. This move is expected to open up new markets for American Tower and further solidify its presence in the region. Overall, Goldman Sachs sees this as an ideal time to invest in American Tower given its value and potential for growth.

Share Price

At the time of the writing, news sentiment for American Tower was mostly positive. On Tuesday, the stock opened at $221.1 and closed at $222.0, up 1.2% from the prior closing price of $219.3. The upgrade by Goldman Sachs is based on the company’s strong fundamentals and positive outlook. American Tower has seen a steady increase in revenue and profits over the past few years and has managed to remain profitable despite the challenging economic environment. The company is also well-positioned to benefit from the growth in the mobile communications industry, which is expected to remain strong for years to come.

American Tower’s strong position in the market and its solid financials make it an attractive investment for those looking for a long-term buy-and-hold strategy. The company’s low debt levels and strong cash flow mean it can weather any short-term volatility in the market, making it a relatively safe bet for investors looking for a long-term return. Goldman Sachs believes that the stock’s current valuation makes it an excellent buying opportunity, and they are recommending investors to take advantage of the current market conditions and make a purchase. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for American Tower. More…

| Total Revenues | Net Income | Net Margin |

| 10.45k | 2.9k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for American Tower. More…

| Operations | Investing | Financing |

| 3.19k | -11.67k | 7.18k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for American Tower. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 66.51k | 54.19k | 13.49 |

Key Ratios Snapshot

Some of the financial key ratios for American Tower are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 28.5% |

| FCF Margin | ROE | ROA |

| – | – | – |

VI Analysis

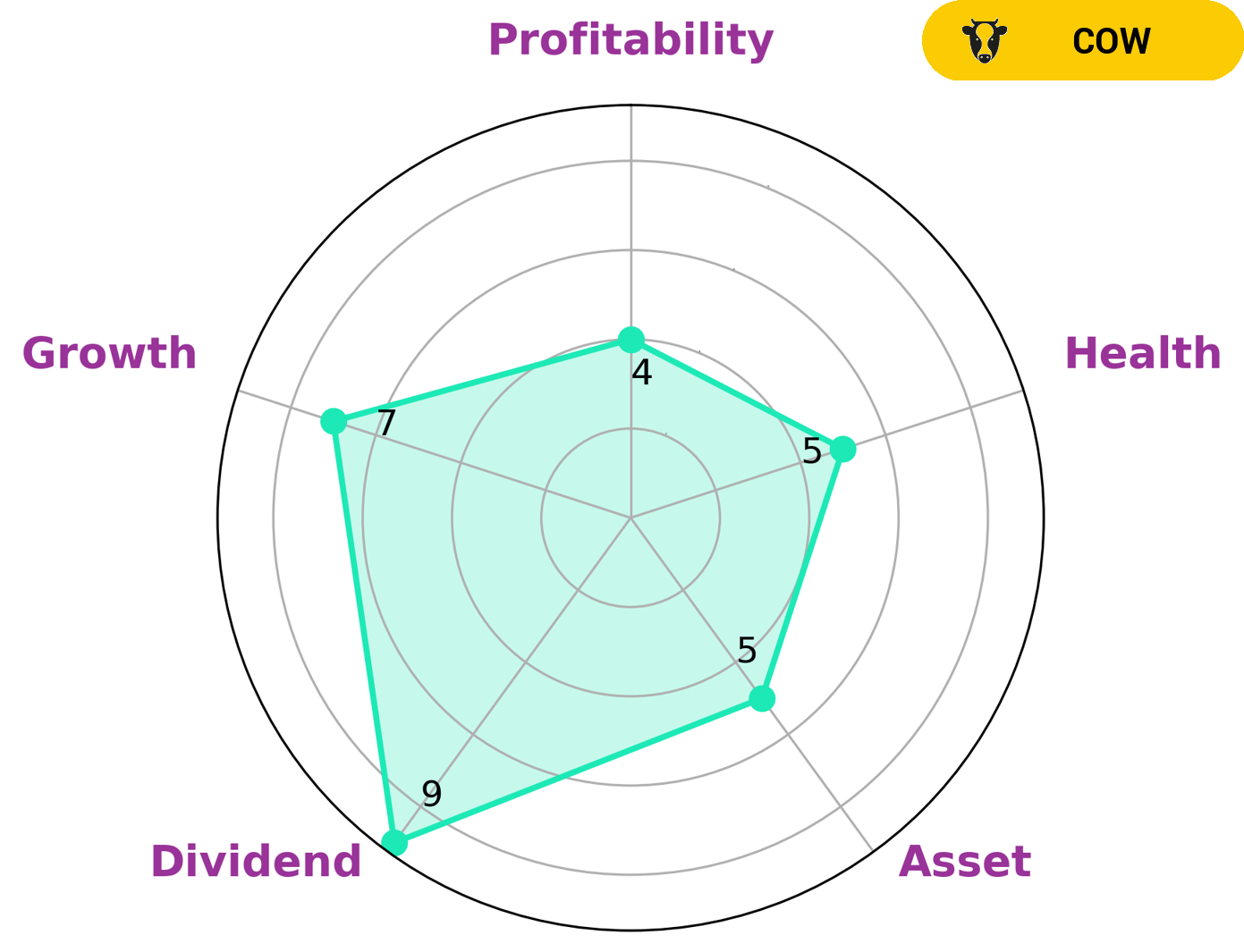

Investors who are looking for a consistent and sustainable dividend payout often look for companies classified as ‘cows’. American Tower is such a company, as seen on the VI Star Chart. With an intermediate health score of 5/10, American Tower has a strong track record of paying out dividends and has cashflows and debt that suggest it could withstand any crisis without the risk of bankruptcy. American Tower is also strong in dividend and growth, and medium in asset and profitability, making it an attractive option for investors who are looking for a company with long-term potential. It also has a consistent history of paying out dividends, which make it attractive to those investors who are looking for steady returns. American Tower’s fundamentals reflect its long-term potential. It has a strong balance sheet and cash flow, as well as low debt levels. This makes it an attractive option for investors looking for a company that can withstand any economic downturns. The company also has a strong history of paying dividends, which makes it attractive to those investors who are looking for a steady source of income. Overall, American Tower is an attractive option for investors who are looking for a company with long-term potential. It has strong fundamentals, low debt levels, and a consistent history of paying dividends. This makes it an ideal option for those investors who are looking for a company that can withstand any economic downturns and provide steady returns over time. More…

VI Peers

The company owns and operates more than 40,000 wireless communication sites across the country. American Tower Corp’s main competitors are SBA Communications Corp, CyrusOne Inc, and Equinix Inc.

– SBA Communications Corp ($NASDAQ:SBAC)

SBA Communications Corporation is a holding company that operates as a real estate investment trust (REIT), which is engaged in the ownership and leasing of wireless communications infrastructure, including antenna sites, towers, other structures, and supporting assets.

As of December 31, 2020, the Company owned or operated approximately 40,000 communication sites in the United States, Brazil, Canada, Chile, Colombia, Germany, Guatemala, India, Mexico, Peru, South Africa, and Spain.

– CyrusOne Inc ($NASDAQ:EQIX)

Equinix is a company that provides data center and interconnection services to a variety of customers. Its market cap as of 2022 is 47.86B. The company has a variety of products and services that it offers to its customers, which include data center services, interconnection services, and a variety of other services.

Summary

Investing analysts at Goldman Sachs have identified American Tower Corporation’s recent 26% drop in stock as an opportunity to buy. The firm has upgraded its rating on the stock to “Buy”, citing the company’s strong fundamentals. American Tower operates one of the largest and most geographically diverse portfolios of communications sites in the world, delivering wireless and broadcast services to customers.

The company has been able to successfully manage through the pandemic, and their strong balance sheet supports the stock’s current valuation. Goldman Sachs sees American Tower as a long-term winner and is taking advantage of this current buying opportunity.

Recent Posts