American Tower dividend – Invest in American Tower Corporation Now to Reap the Benefits of its Reliable Dividend Growth and Attractive Share Price!

February 14, 2023

Trending News ☀️

American Tower dividend – American Tower ($NYSE:AMT) Corporation is a leading real estate investment trust (REIT) with a long history of providing reliable dividend income and capital gains. The company owns, operates, and develops wireless communication sites, data centers, and other related real estate assets around the world. This is due to a number of factors, such as the Federal Funds Rate increasing, which has decreased the relative attractiveness of dividend-paying stocks.

Despite this recent dip, American Tower is still an attractive investment opportunity for those looking for a reliable income stream and attractive share price. American Tower’s solid financial position provides investors with additional comfort.

Dividends – American Tower dividend

Going further, the dividend yields from 2020 to 2022 are estimated to be 1.65%, 1.94%, 1.94%, respectively, with an average dividend yield of 1.84%. As a publicly traded company, the stock price of AMERICAN TOWER is also attractive, allowing investors to take advantage of the potential capital appreciation. Investors should be aware that the stock price can fluctuate significantly depending on the overall market conditions.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for American Tower. More…

| Total Revenues | Net Income | Net Margin |

| 10.45k | 2.9k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for American Tower. More…

| Operations | Investing | Financing |

| 3.19k | -11.67k | 7.18k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for American Tower. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 66.51k | 54.19k | 13.49 |

Key Ratios Snapshot

Some of the financial key ratios for American Tower are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 28.5% |

| FCF Margin | ROE | ROA |

| – | – | – |

Price History

At the time of writing, media sentiment for this company is largely positive. On Monday, American Tower’s stock opened at $217.6 and closed at $217.3, up by 0.2% from its previous closing price of $216.7. This highlights the company’s reliability in terms of prices as well as dividends for investors. American Tower’s attractive share price means that investors can buy into the company with a low cost of entry. This coupled with its reliable dividend growth makes it an attractive option for investors looking to grow their portfolio with a reliable return.

In addition, the company’s balance sheet is very strong and it has no significant debt levels, meaning that it can maintain its dividend payments even during economic downturns. Live Quote…

Analysis

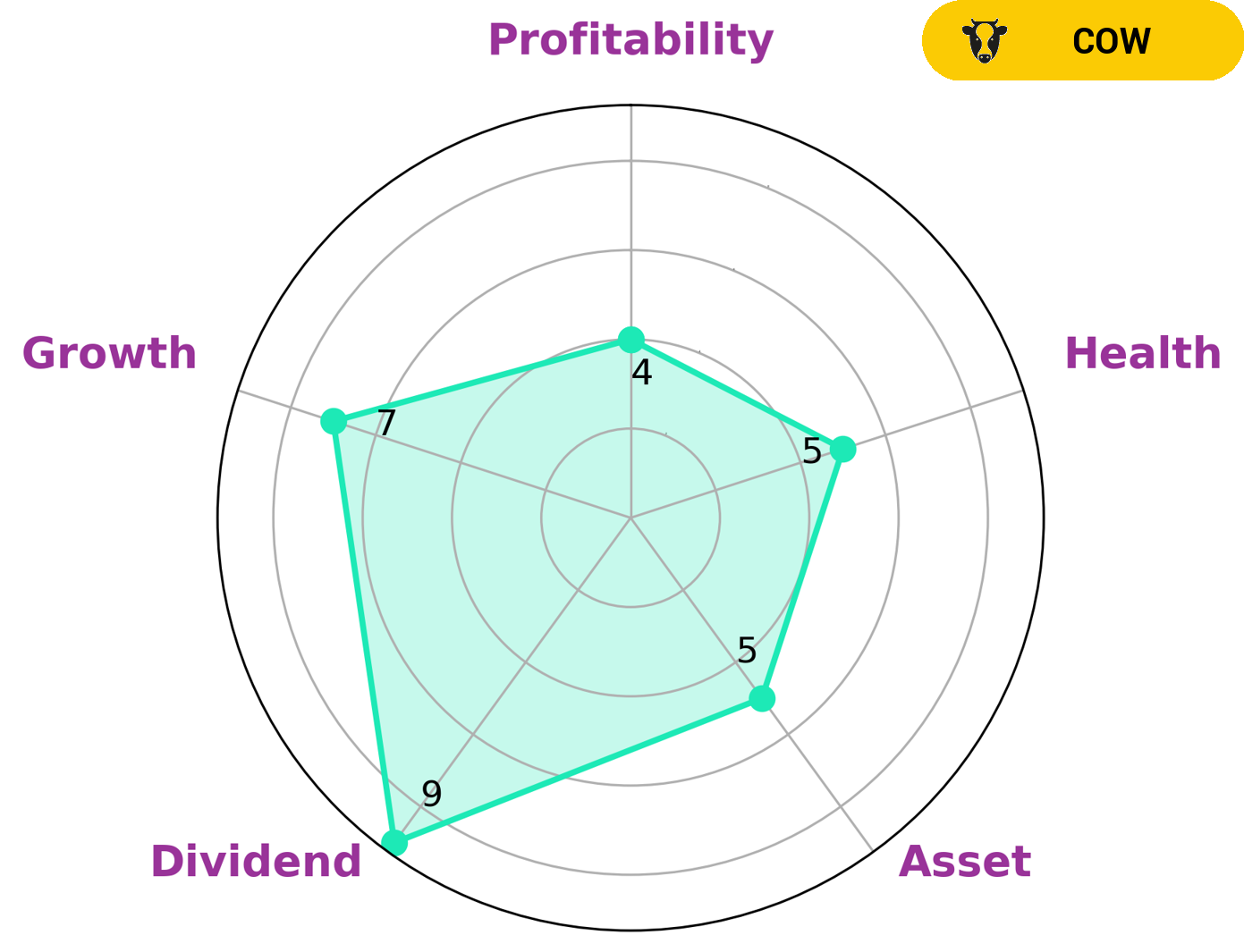

American Tower Corporation (AMT) is a real estate investment trust (REIT) that primarily operates cell towers and other communication sites. It has a good track record of paying out consistent and sustainable dividends, making it an attractive option for income and growth-oriented investors. The company’s financials have been analyzed by GoodWhale, which provides a star chart that shows an intermediate health score of 5/10 when considering cashflows and debt. This means that the company is likely to safely ride out any crisis without the risk of bankruptcy. The star chart also shows four distinct categories in which AMT excels: dividend, growth, asset, and profitability. Its strong financials make it an ideal choice for those seeking stability and long-term growth. More…

Peers

The company owns and operates more than 40,000 wireless communication sites across the country. American Tower Corp’s main competitors are SBA Communications Corp, CyrusOne Inc, and Equinix Inc.

– SBA Communications Corp ($NASDAQ:SBAC)

SBA Communications Corporation is a holding company that operates as a real estate investment trust (REIT), which is engaged in the ownership and leasing of wireless communications infrastructure, including antenna sites, towers, other structures, and supporting assets.

As of December 31, 2020, the Company owned or operated approximately 40,000 communication sites in the United States, Brazil, Canada, Chile, Colombia, Germany, Guatemala, India, Mexico, Peru, South Africa, and Spain.

– CyrusOne Inc ($NASDAQ:EQIX)

Equinix is a company that provides data center and interconnection services to a variety of customers. Its market cap as of 2022 is 47.86B. The company has a variety of products and services that it offers to its customers, which include data center services, interconnection services, and a variety of other services.

Summary

American Tower Corporation is a reputable company with a strong track record of reliable dividend growth and an attractive share price. Analysts cite its strong portfolio of wireless tower assets as well as its leadership in the wireless communications field as key factors for investor confidence. Analysts believe American Tower is well-positioned to benefit from the trends of increasing demand for mobile and internet services, making it a potentially lucrative long-term investment opportunity.

Recent Posts