Sumitomo Mitsui Trust Holdings Invests $1.49 Million in Acadia Realty Trust

April 26, 2023

Trending News ☀️

Sumitomo Mitsui Trust Holdings Inc. has recently invested $1.49 million in Acadia Realty Trust ($NYSE:AKR), as reported by Defense World. Acadia Realty Trust is a publicly traded real estate investment trust (REIT) that specializes in the acquisition, development and management of retail properties throughout the United States. They currently have a portfolio that consists of shopping centers, lifestyle centers, power centers, and urban retail properties. Acadia Realty Trust has a strong focus on creating exceptional shopping experiences for customers by investing in properties that offer desirable amenities and attractive locations. They strive to create value for shareholders by achieving attractive returns on capital employed and delivering consistent results. The company also takes pride in their commitment to sustainability and has implemented green initiatives to reduce their carbon footprint.

In addition, they have established a diversity and inclusion program to promote a strong and inclusive culture within the organization. With this new investment, Acadia Realty Trust will have the capital to continue expanding its portfolio of retail properties and further diversifying its business.

Share Price

This investment pushed the stock up at the open and it opened at $13.3. However, by the close of the trading session, it had dropped by 2.3% to close at $13.1 from its prior closing price of $13.4. Even with the price drop, investors remain optimistic about the stock, with many expecting ACADIA REALTY TRUST to be a good long-term buy. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AKR. More…

| Total Revenues | Net Income | Net Margin |

| 326.29 | -35.45 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AKR. More…

| Operations | Investing | Financing |

| 133.21 | -124.17 | -4.38 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AKR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.3k | 2.05k | 17.79 |

Key Ratios Snapshot

Some of the financial key ratios for AKR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 13.6% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

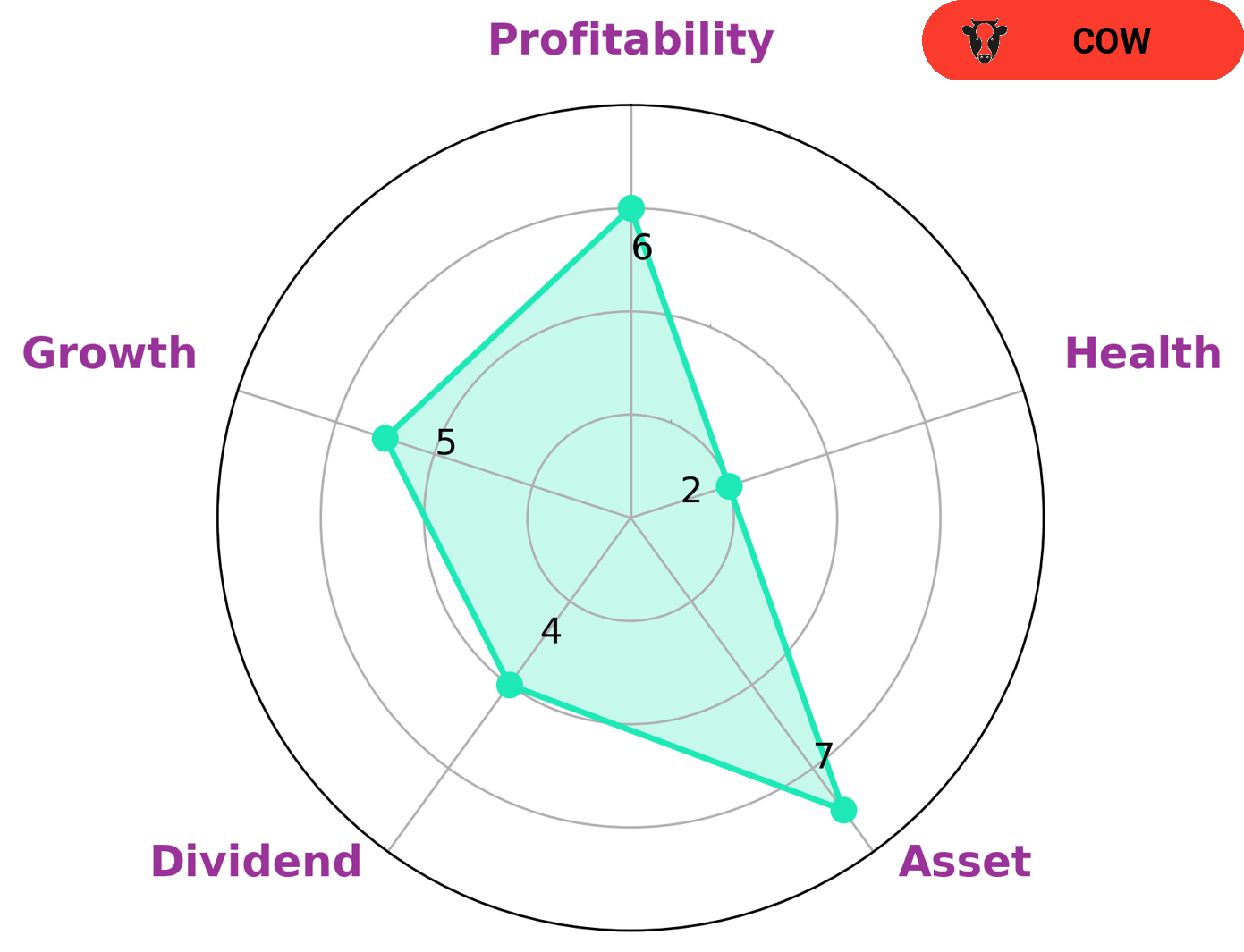

GoodWhale conducted an analysis of ACADIA REALTY TRUST’s financials and found that the company is strong in asset and medium in dividend, growth, and profitability. The Star Chart showed a low health score of 2/10, indicating that the company is less likely to safely ride out any crisis without the risk of bankruptcy. We classified the company as a ‘cow’, a type of company which has the track record of paying out consistent and sustainable dividends. Investors who are looking for companies with consistent and safe dividends may be interested in investing in ACADIA REALTY TRUST. The company has steady income sources and a good performance record when it comes to dividends. Additionally, the company has an impressive asset base, which could provide some additional stability for investors. Nevertheless, investors should be aware that the company’s health score indicates a relatively low level of protection from economic downturns. More…

Peers

Cedar Realty Trust Inc, Lippo Malls Indonesia Retail Trust, Slate Grocery REIT are all competitors in the real estate market.

– Cedar Realty Trust Inc ($SGX:D5IU)

Lippo Malls Indonesia Retail Trust (LMIRT) is a real estate investment trust that owns and operates a portfolio of shopping malls in Indonesia. The company has a market cap of $230.9 million as of March 2022. LMIRT’s portfolio includes 13 malls, which are located in major cities across Indonesia. The company’s malls are anchored by leading retailers, such as department store giant Matahari, hypermarket chain Carrefour, and electronics retailer Electronic City. LMIRT is majority-owned by Indonesian conglomerate Lippo Group.

– Lippo Malls Indonesia Retail Trust ($TSX:SGR.UN)

Slate Grocery REIT is a Canadian real estate investment trust that owns and operates a portfolio of grocery-anchored retail properties in Canada. The company’s market cap as of 2022 is 882.64M. The company’s portfolio consists of grocery-anchored retail properties located in major urban markets across Canada. The company’s primary business is the ownership and operation of grocery-anchored retail properties.

Summary

Sumitomo Mitsui Trust Holdings Inc. recently disclosed a $1.49 million investment in Acadia Realty Trust. Acadia Realty Trust is a publicly traded real estate investment trust (REIT) focused on owning, operating and developing retail real estate. Investors should view this as an opportunity to buy at an attractive price point. Investors should consider investing in Acadia as it is well-positioned to capitalize on the retail sector’s recovery.

Recent Posts