National Retail Properties Reports Impressive Earnings with $0.80 FFO and $204.11M Revenue

May 3, 2023

Trending News ☀️

NATIONAL ($NYSE:NNN): NRP is a real estate investment trust (REIT) that invests in free-standing retail stores, primarily in the United States. The company owns and operates a portfolio of properties with a focus on discount, drugstore, convenience store, and grocery store segments. Their strategy is to acquire properties for long-term investments, with the goal of achieving stability and income growth. NRP has been successful in delivering strong returns to investors year after year, making it an attractive investment option.

The company’s impressive results prove that their long-term strategy is paying off. With an increasing demand for retail store investments, NRP looks set to continue its success in the coming years. Investors should consider adding NRP to their portfolio to gain exposure to the retail industry and reap the rewards of its strong performance.

Market Price

On Tuesday, National Retail Properties (NRP) reported a strong set of earnings, with Funds From Operations (FFOs) of $0.80 per share and total revenue of $204.11 million. At the close of the market, NRP stock opened at $43.2 and closed at the same price, only a 0.1% drop from its prior closing price of $43.3.

In addition, the results highlight NRP’s focus on providing attractive and profitable investments for shareholders. Analysts have taken note of NRP’s success and are making positive predictions for its future performance. This is reflected in the stock’s current price and is likely to continue as NRP looks to expand its portfolio and capitalize on the opportunities presented by current market conditions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NNN. More…

| Total Revenues | Net Income | Net Margin |

| 773.05 | 334.11 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NNN. More…

| Operations | Investing | Financing |

| 578.36 | -777.63 | 34.73 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NNN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.15k | 4.02k | 22.72 |

Key Ratios Snapshot

Some of the financial key ratios for NNN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 61.2% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

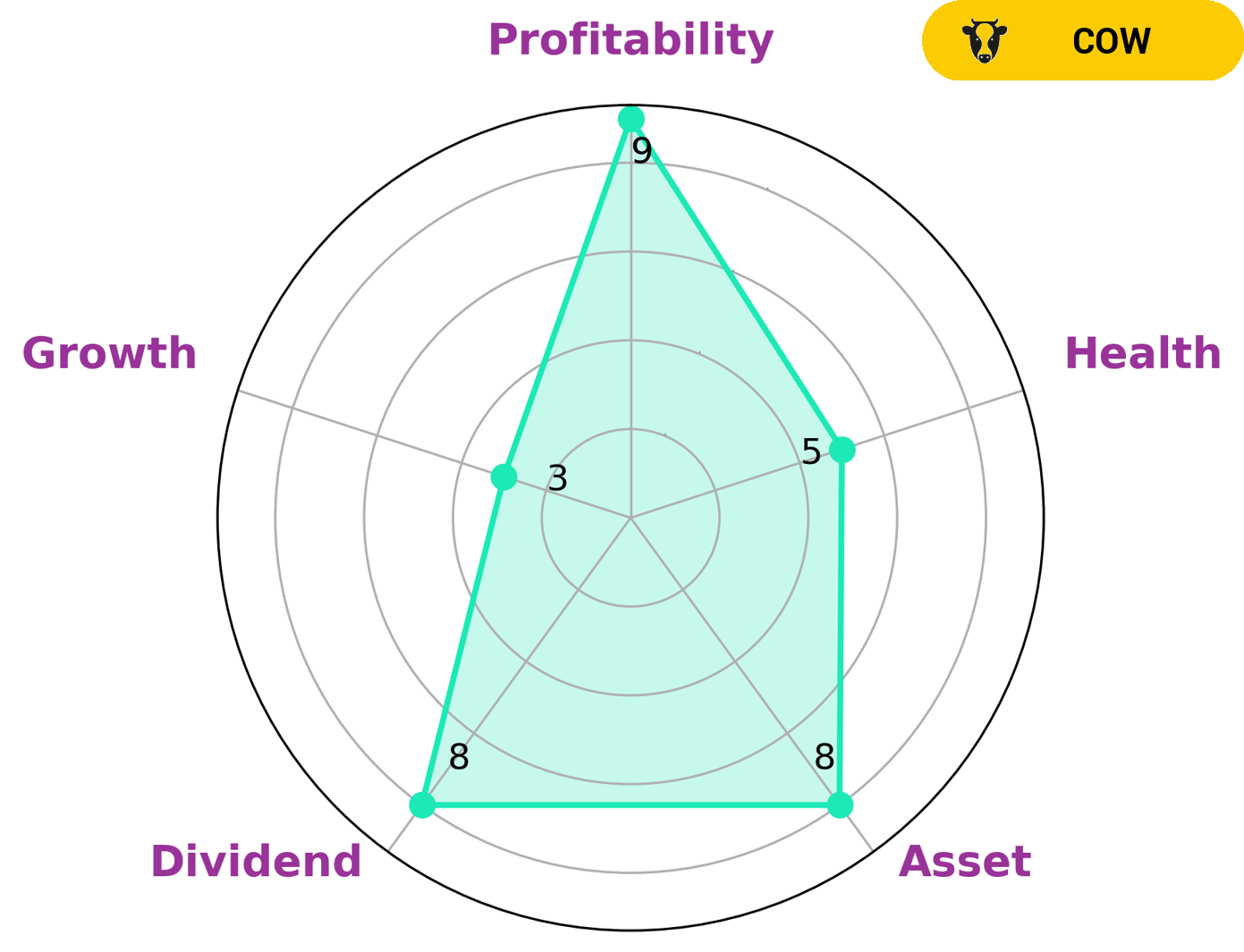

GoodWhale conducted an analysis of NATIONAL RETAIL PROPERTIES’s well-being. According to our Star Chart, NATIONAL RETAIL PROPERTIES is strong in asset and dividend, but weak in growth and profitability. We assigned an intermediate health score of 5/10 to NATIONAL RETAIL PROPERTIES. We assess that NATIONAL RETAIL PROPERTIES might be able to pay off debt and fund future operations. At GoodWhale, we classify NATIONAL RETAIL PROPERTIES as a ‘cow’, which we deem to have the track record of paying out consistent and sustainable dividends. Investors who are interested in such companies, who are looking for a regular income stream, may find that NATIONAL RETAIL PROPERTIES is worth their attention. More…

Peers

The company’s portfolio consists of freestanding retail properties, strip centers, neighborhood centers, and malls. National Retail Properties Inc. has a market capitalization of $8.6 billion and its stock is traded on the New York Stock Exchange. The company’s competitors include STORE Capital Corp, Realty Income Corp, and W.P. Carey Inc.

– STORE Capital Corp ($NYSE:STOR)

As of 2022, STORE Capital Corp has a market cap of 8.92B. The company is a leading provider of capital to the US middle market, with a focus on durable, service-based businesses. STORE Capital has a diversified portfolio of over 1,800 investments in 47 states, across more than 340 different industries.

– Realty Income Corp ($NYSE:O)

Realty Income Corporation is a real estate investment trust which focuses on the ownership of commercial real estate in the United States. Its portfolio includes office buildings, retail properties, warehouses, and distribution centers. The company has a market capitalization of $35.49 billion as of 2022.

– W.P. Carey Inc ($NYSE:WPC)

W.P. Carey Inc is a publicly traded real estate investment trust (REIT) that provides financing solutions for commercial real estate owners and operators. The company has a market cap of 14.58B as of 2022. The company operates through two segments: Real Estate Ownership and Real Estate Investment Management. The Real Estate Ownership segment acquires, owns, leases, and operates commercial real estate properties. The Real Estate Investment Management segment provides investment management services to institutional and private investors.

Summary

FFO came in at $0.80, beating the analyst consensus estimate by $0.01. Investors should keep an eye out for expected improvements in FFO and revenue as well as the company’s response to the current pandemic.

Recent Posts