National Retail Properties Closes Trading Day Down -0.99% at $42.97

April 20, 2023

Trending News 🌥️

National Retail Properties ($NYSE:NNN) Inc. (NRE) closed trading day down -0.99% at $42.97, a decrease from yesterday’s closing price of $43.40. Despite today’s dip in price, investors may consider looking towards the future of National Retail Properties Inc. stock as it has seen steady growth over the past few months and appears to have good potential for future growth. Analysts have given the company’s stock an average rating of ‘buy’, citing strong fundamentals such as strong cash flow, low debt-to-equity ratio and growing occupancy rates.

It remains to be seen if the stock will continue to trade lower or if it will rebound in the coming weeks. Investors should pay close attention to news and developments related to the company and its stock to help them make more informed decisions about their investments.

Share Price

Despite the small gains, the stock’s overall performance on Wednesday was bearish and caused it to close at a loss for the day. Investors will be watching to see if NRP can continue its positive performance into the future, or if this decline is reflective of a broader downward trend in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NNN. More…

| Total Revenues | Net Income | Net Margin |

| 773.05 | 334.11 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NNN. More…

| Operations | Investing | Financing |

| 578.36 | -777.63 | 34.73 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NNN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.15k | 4.02k | 22.72 |

Key Ratios Snapshot

Some of the financial key ratios for NNN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 61.2% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

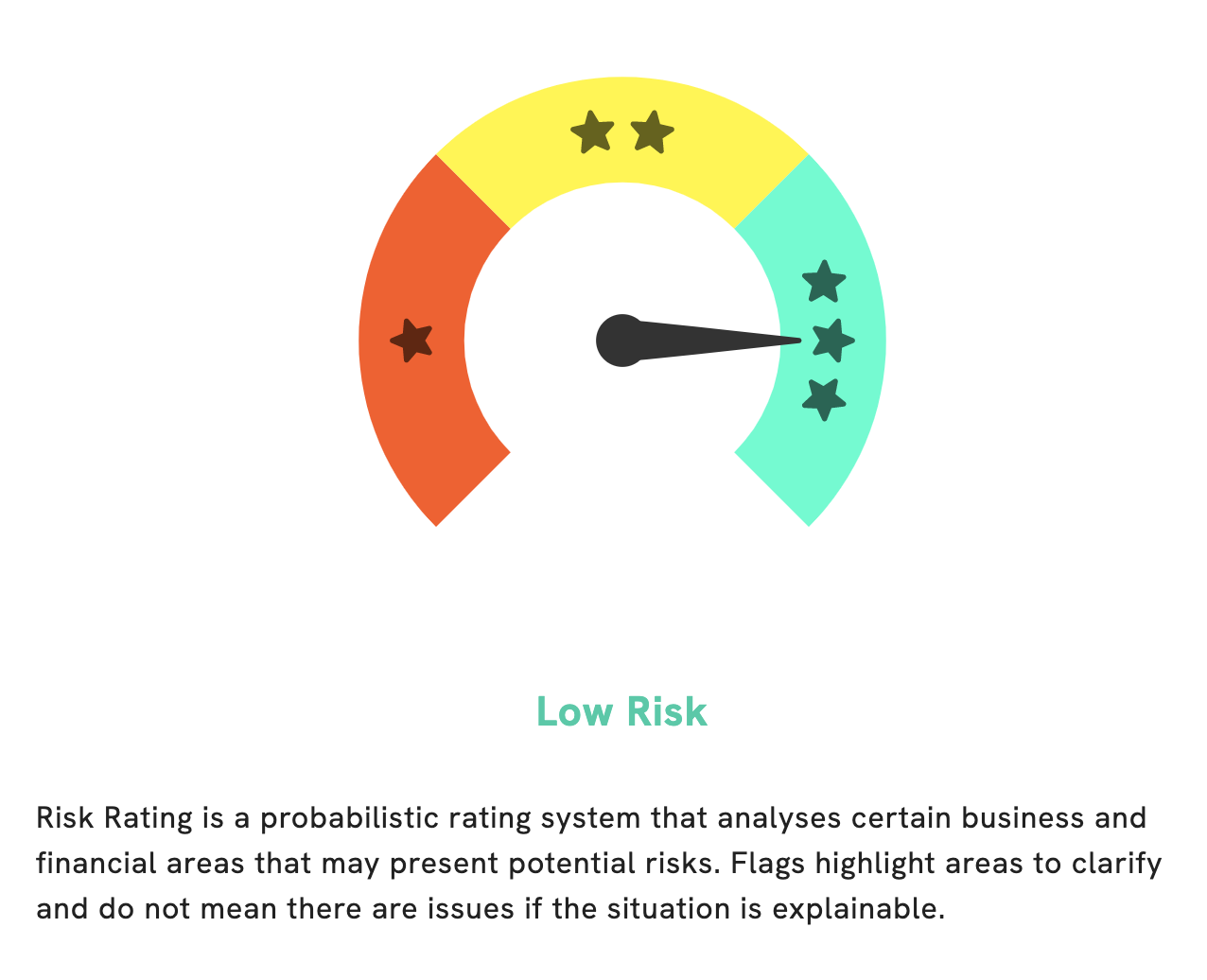

At GoodWhale, we conducted an analysis of NATIONAL RETAIL PROPERTIES’s wellbeing. According to our Risk Rating results, NATIONAL RETAIL PROPERTIES is a low risk investment, based on both financial and business aspects. We have detected one risk warning in their balance sheet and we recommend registered users to check it out. Our report provides a comprehensive overview of the company and its performance, helping investors to make informed decisions. We strive to provide the highest quality analysis and insights for our users, in order to ensure a safe and secure investment. More…

Peers

The company’s portfolio consists of freestanding retail properties, strip centers, neighborhood centers, and malls. National Retail Properties Inc. has a market capitalization of $8.6 billion and its stock is traded on the New York Stock Exchange. The company’s competitors include STORE Capital Corp, Realty Income Corp, and W.P. Carey Inc.

– STORE Capital Corp ($NYSE:STOR)

As of 2022, STORE Capital Corp has a market cap of 8.92B. The company is a leading provider of capital to the US middle market, with a focus on durable, service-based businesses. STORE Capital has a diversified portfolio of over 1,800 investments in 47 states, across more than 340 different industries.

– Realty Income Corp ($NYSE:O)

Realty Income Corporation is a real estate investment trust which focuses on the ownership of commercial real estate in the United States. Its portfolio includes office buildings, retail properties, warehouses, and distribution centers. The company has a market capitalization of $35.49 billion as of 2022.

– W.P. Carey Inc ($NYSE:WPC)

W.P. Carey Inc is a publicly traded real estate investment trust (REIT) that provides financing solutions for commercial real estate owners and operators. The company has a market cap of 14.58B as of 2022. The company operates through two segments: Real Estate Ownership and Real Estate Investment Management. The Real Estate Ownership segment acquires, owns, leases, and operates commercial real estate properties. The Real Estate Investment Management segment provides investment management services to institutional and private investors.

Summary

National Retail Properties Inc. is a real estate investment trust (REIT) focused on acquiring, owning, and managing freestanding retail properties across the United States. Its portfolio is diversified across several retail industries, including convenience stores, restaurants, home improvement stores, health and fitness centers, and service stations. The company’s current stock price of $42.97 is down 0.99% from its previous closing price of $43.40. Analysts recommend investing in this stock for its attractive dividends and potential for long-term capital appreciation.

The stock also has a good history of dividend payments, with positive annual returns over the past five years. This suggests that investors should consider investing in the stock for its balance sheet strength and growth potential.

Recent Posts