Mapletree Pan Asia Commercial Trust Reports Quarterly DPU of 2.42 SG Cents.

February 6, 2023

Trending News ☀️

Mapletree Pan Asia ($SGX:N2IU) Commercial Trust (MAPLETREE PAN ASIA COMMERCIAL TRUST) is a real estate investment trust (REIT) listed on the Singapore Exchange. It is the first Pan-Asian retail REIT in Asia and the first REIT to be listed in Singapore comprising of retail malls, office, and serviced apartments located in the major cities across Asia. Recently, Mapletree Pan Asia Commercial Trust’s Distribution Per Unit (DPU) for the quarter was reported to be 2.42 Singapore Cents. The DPU represents the total distributions paid out to unitholders during the quarter, and reflects the performance of the Trust’s portfolio of quality assets and its ability to generate stable income for its unitholders. The trust’s portfolio consists of nine retail malls located in Singapore, China, Japan, South Korea and Malaysia. The portfolio also includes five office properties and one serviced apartment property in Singapore.

Mapletree Pan Asia Commercial Trust has established a track record of consistently delivering stable income distributions to its unitholders. The trust’s focus on delivering stable income to its unitholders for the quarter was reflected in the DPU of 2.42 Singapore Cents. Mapletree Pan Asia Commercial Trust has demonstrated its ability to generate stable income for its unitholders and its commitment to delivering long-term value to its investors. With its focus on high-quality assets, prudent financial management and a portfolio of well-located assets, it is well-positioned to provide sustainable returns to its unitholders in the long run.

Price History

This was the first quarterly DPU report since the company was listed on the Singapore Exchange last month. So far, the media sentiment towards the company has been mostly positive. On Tuesday, MAPLETREE PAN ASIA COMMERCIAL TRUST stock opened at SG$1.8 and closed at SG$1.8, down by 0.5% from previous closing price of 1.8. MAPLETREE PAN ASIA COMMERCIAL TRUST has a portfolio of 10 properties located in Singapore, China, Japan and Malaysia, which are leased to a diverse range of tenants.

The trust is well-positioned to benefit from the growing demand for quality office space in the region. Investors should monitor the company’s performance and evaluate the potential for further upside in its stock price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for N2IU. More…

| Total Revenues | Net Income | Net Margin |

| 681.53 | 547.1 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for N2IU. More…

| Operations | Investing | Financing |

| 542.25 | -2.28k | 1.85k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for N2IU. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.92k | 7.32k | 1.83 |

Key Ratios Snapshot

Some of the financial key ratios for N2IU are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 73.7% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

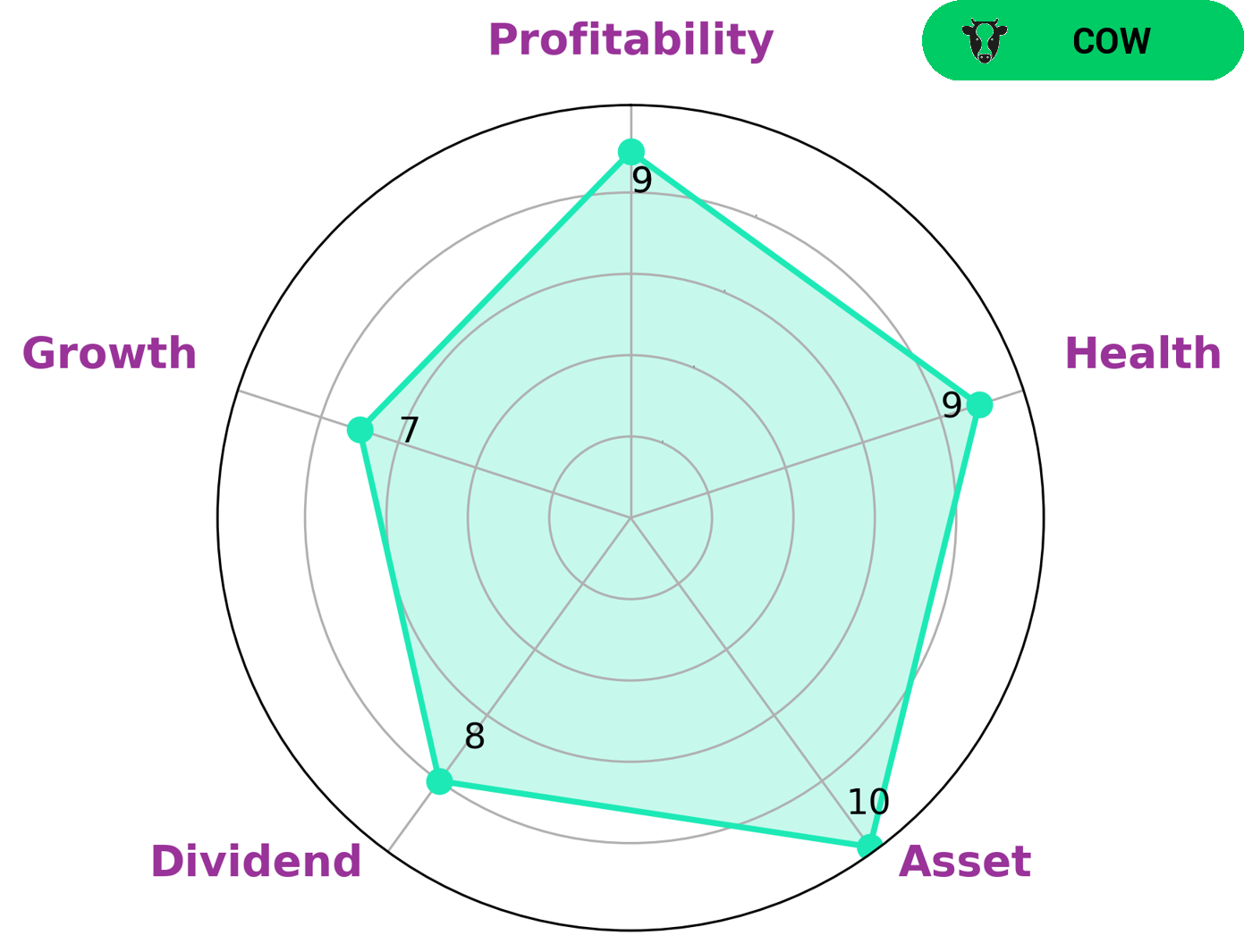

This means that the company is in a strong financial position with cashflows and debt that are capable of riding out any crisis without the risk of bankruptcy. In addition, MAPLETREE PAN ASIA COMMERCIAL TRUST is classified as a ‘cow’, meaning it has a history of paying out consistent and sustainable dividends. This makes MAPLETREE PAN ASIA COMMERCIAL TRUST an attractive investment opportunity for those looking for a steady income stream. In addition, the company is strong in terms of its assets, dividend, growth, and profitability. This makes it an attractive option for investors looking to benefit from potential capital gains as well as regular income. In addition, MAPLETREE PAN ASIA COMMERCIAL TRUST is well positioned to benefit from any potential economic upturns, as it has the necessary financial stability to capitalize on any opportunities that arise. Furthermore, this makes the company a safe option for investors looking to build up their portfolios over the long term. Overall, MAPLETREE PAN ASIA COMMERCIAL TRUST is in a strong position both in terms of its financial health and long-term prospects. Investors looking for steady income streams, potential capital gains and long-term portfolio growth should consider adding MAPLETREE PAN ASIA COMMERCIAL TRUST to their portfolio. More…

Peers

It operates in various countries, including Singapore, China, South Korea, Japan, and Vietnam. MAPACT is one of the biggest real estate investment trusts in Asia and competes with CapitaLand Integrated Commercial Trust, Champion Real Estate Investment Trust, and CapitaLand Ascott Trust. All four of these investment trusts focus on retail and office properties in the Asia-Pacific region with a primary focus on the Singapore market.

– CapitaLand Integrated Commercial Trust ($SGX:C38U)

CapitaLand Integrated Commercial Trust (CICT) is a Singapore-based real estate investment trust that invests primarily in income-producing commercial properties. As of 2022, CICT has a market cap of 13.4 billion Singapore dollars. The company’s portfolio consists of retail malls and office buildings, with a focus on real estate in Singapore. CICT is managed by CapitaLand Investment Management, a subsidiary of CapitaLand Limited, one of Asia’s largest diversified real estate groups. CICT has become a major player in the Singaporean commercial property market, thanks to its strong portfolio and established track record of delivering strong returns to its investors.

– Champion Real Estate Investment Trust ($SEHK:02778)

Champion Real Estate Investment Trust is a real estate investment trust (REIT) listed on the Hong Kong Stock Exchange. It has a market cap of 17.2 billion as of 2022, making it one of the largest REITs in Hong Kong. The company invests in office, retail and industrial properties in major cities across Asia, including Hong Kong, Singapore, Tokyo, Seoul, Shanghai and Sydney. It is known for its high-quality assets and its ability to generate stable returns for investors. The trust is managed by Champion Asset Management Limited and its board is chaired by Mr. Chen Tair-jinn.

– CapitaLand Ascott Trust ($SGX:HMN)

CapitaLand Ascott Trust is a hospitality real estate investment trust that owns and manages a portfolio of serviced residences and hotel properties in key cities across the Asia-Pacific, Europe, the Middle East and Africa. With a market capitalization of 3.51 billion, CapitaLand Ascott Trust is one of the largest serviced residence owners in the world. Its portfolio comprises more than 110,000 units located within over 300 properties in over 80 cities. It partners with some of the world’s most renowned hospitality brands such as Ascott, Citadines, Somerset, Quest, lyf and Adina Apartment Hotels. The trust’s business model is to acquire income-producing properties, refurbish them and optimise them to generate long-term returns for its shareholders.

Summary

Overall, the media sentiment towards this announcement has been largely positive, with analysts citing the strong performance of its retail portfolio as a major contributing factor to the growth in DPU. For investors looking to diversify their portfolios, MAPLETREE may be a viable option given its high dividend yield and potential for further growth.

Recent Posts