Kimco Realty Reports Flat Q1 Funds From Operations, Updates 2023 FFO Outlook

May 2, 2023

Trending News 🌥️

Kimco Realty ($NYSE:KIM), one of the largest publicly traded owners, developers, and operators of open-air shopping centers in the United States, reported Thursday that its Q1 funds from operations of $0.39 per diluted share remained the same as the previous year. This met the average analyst estimate. The real estate investment trust also updated its outlook for 2023 funds from operations. Kimco Realty’s portfolio is anchored by several major tenants including Walmart, Walgreens, Publix Super Markets, and The Home Depot.

With its updated outlook on 2023 funds from operations, Kimco Realty is looking ahead to a resilient financial performance. Kimco Realty’s financial results for Q1 clearly demonstrate strength and potential for continued growth. The company’s solid financial performance, combined with its focus on reducing debt and increasing long-term profitability, should make it an attractive investment option for investors.

Share Price

The stock opened at $19.1 that day and closed at $18.8, down 1.8% from the previous closing price of $19.2. In addition, KIMCO REALTY announced its capital expenditure plan, which includes investing in existing properties as well as increasing investments in new developments, acquisitions, and redevelopment projects. The company also noted that it will be looking to expand its portfolio with the addition of mixed-use and industrial properties to drive growth in the years ahead. With the new outlook and capital expenditure plan in place, KIMCO REALTY looks to be in a strong position for future growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kimco Realty. More…

| Total Revenues | Net Income | Net Margin |

| 1.74k | 152.5 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kimco Realty. More…

| Operations | Investing | Financing |

| 861.11 | -63.22 | -982.73 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kimco Realty. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.96k | 8.08k | 15.39 |

Key Ratios Snapshot

Some of the financial key ratios for Kimco Realty are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 33.2% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

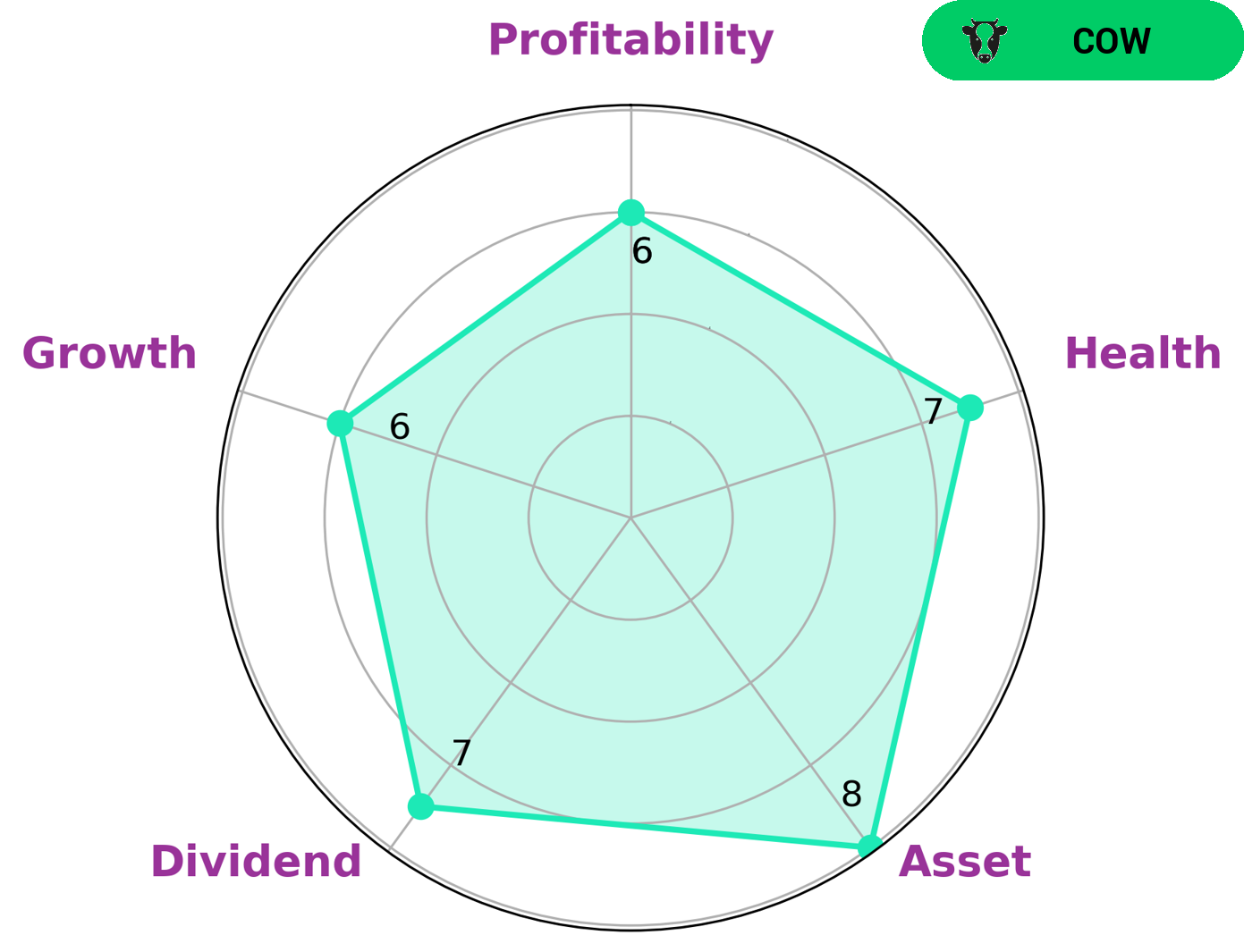

As GoodWhale, we have conducted an analysis on KIMCO REALTY’s fundamentals. Our Star Chart shows that KIMCO REALTY is classified as a ‘cow’, a type of company that we have concluded has the track record of paying out consistent and sustainable dividends. As a result, KIMCO REALTY may be of interest to income investors who are seeking a steady stream of returns from their investments. Moreover, KIMCO REALTY has a high health score of 7/10 considering its cashflows and debt and is thus capable of servicing its debt and funding future operations. In addition, it scored strong in asset and dividend, while being medium in growth and profitability. Investors looking to add KIMCO REALTY to their portfolio can expect a steady income stream with moderate growth potential. More…

Peers

Kimco Realty Corp is one of the largest real estate investment trusts in the United States. The company owns and operates open-air shopping centers. Kimco’s competitors include Brixmor Property Group Inc, Morguard North American Residential Real Estate Investment Trust, and Strategic Realty Trust Inc.

– Brixmor Property Group Inc ($NYSE:BRX)

Brixmor Property Group Inc is a publicly traded real estate investment trust that owns, operates, and leases a portfolio of open-air shopping centers in the United States. As of December 31, 2020, the company’s portfolio consisted of 468 shopping centers spanning approximately 75.4 million square feet of gross leasable area. Brixmor’s properties are leased to a diversified mix of national, regional, and local tenants. Notable tenants include grocery stores, discount stores, restaurants, entertainment venues, and service providers.

– Morguard North American Residential Real Estate Investment Trust ($TSX:MRG.UN)

Morguard North American Residential Real Estate Investment Trust is a real estate investment trust that invests in, owns, and operates a diversified portfolio of residential properties in Canada and the United States. The company has a market capitalization of $591.44 million as of 2022.

– Strategic Realty Trust Inc ($OTCPK:SGIC)

Strategic Realty Trust Inc is a real estate investment trust that owns and operates a portfolio of properties in the United States. The company has a market cap of 7.63M as of 2022. Strategic Realty Trust Inc was founded in 2010 and is headquartered in New York, New York.

Summary

Kimco Realty reported Q1 funds from operations of $0.39 per diluted share, which was flat compared to the prior year. The company also updated its 2023 funds from operations outlook. To assess the potential of an investment, investors should analyze Kimco Realty’s financial performance and fundamentals, such as its debt-to-equity ratio, dividend yield, and price-earnings ratio.

Furthermore, it is important to consider the macroeconomic conditions and industry dynamics, as well as the company’s competitive advantage and management team. Due diligence and a thorough assessment of risk is key for making an informed investment decision.

Recent Posts