Federal Realty Investment Trust Gaps Up 4.4% in After-Hours Trading, Guides 2023 FFO to Exceed Estimates.

February 12, 2023

Trending News ☀️

Federal Realty Investment ($NYSE:FRT) Trust is a publicly traded real estate investment trust that owns and operates shopping centers and mixed-use properties primarily in the United States. It is one of the country’s largest owners, operators and developers of neighborhood, community and lifestyle centers. On Wednesday after-hours trading saw Federal Realty Investment Trust stock jump by 4.4%, as the retail REIT’s Q4 profits and sales both surpassed analysts’ forecasts and increased from the prior year.

In addition, Federal Realty Investment Trust also projected that 2023 FFO would exceed the average consensus estimate. This was based on a combination of factors, including continued portfolio stabilization, new leasing activity, and cost savings initiatives. Overall, Federal Realty Investment Trust’s strong performance in the fourth quarter was a welcome surprise to investors and analysts alike. The company’s solid leasing and occupancy figures, combined with its robust guidance for 2023 FFO, have driven significant gains in after-hours trading on Wednesday.

Price History

Federal Realty Investment Trust (FRT) experienced a significant gain in after-hours trading on Wednesday, with the stock opening at $110.1 and closing at $109.2, down by 0.8% from the prior closing price of $110.1. The company also released a financial guidance for the 2023 fiscal year which exceeded analyst estimates. The strong financial guidance for 2023 is driven by FRT’s long-term strategy which includes strong execution of its development pipeline and capital recycling program. The company has several ongoing projects such as the redevelopment of Fairfax Corner in Fairfax County, Virginia, and the transformation of UTC Mall in San Diego, California. The company has also increased its focus on e-commerce and digital technology to better serve customers and boost sales.

It has already implemented several initiatives, such as the deployment of digital concierge services, contactless payment options, and loyalty programs. Overall, Federal Realty Investment Trust’s strong financial guidance and long-term strategy have driven its stock higher in after-hours trading on Wednesday. With more projects in the pipeline, FRT is well-positioned to continue its growth trajectory in the coming years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for FRT. More…

| Total Revenues | Net Income | Net Margin |

| 1.07k | 376.13 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for FRT. More…

| Operations | Investing | Financing |

| 516.77 | -786 | 190.41 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for FRT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.23k | 5.02k | 34.35 |

Key Ratios Snapshot

Some of the financial key ratios for FRT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 33.7% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

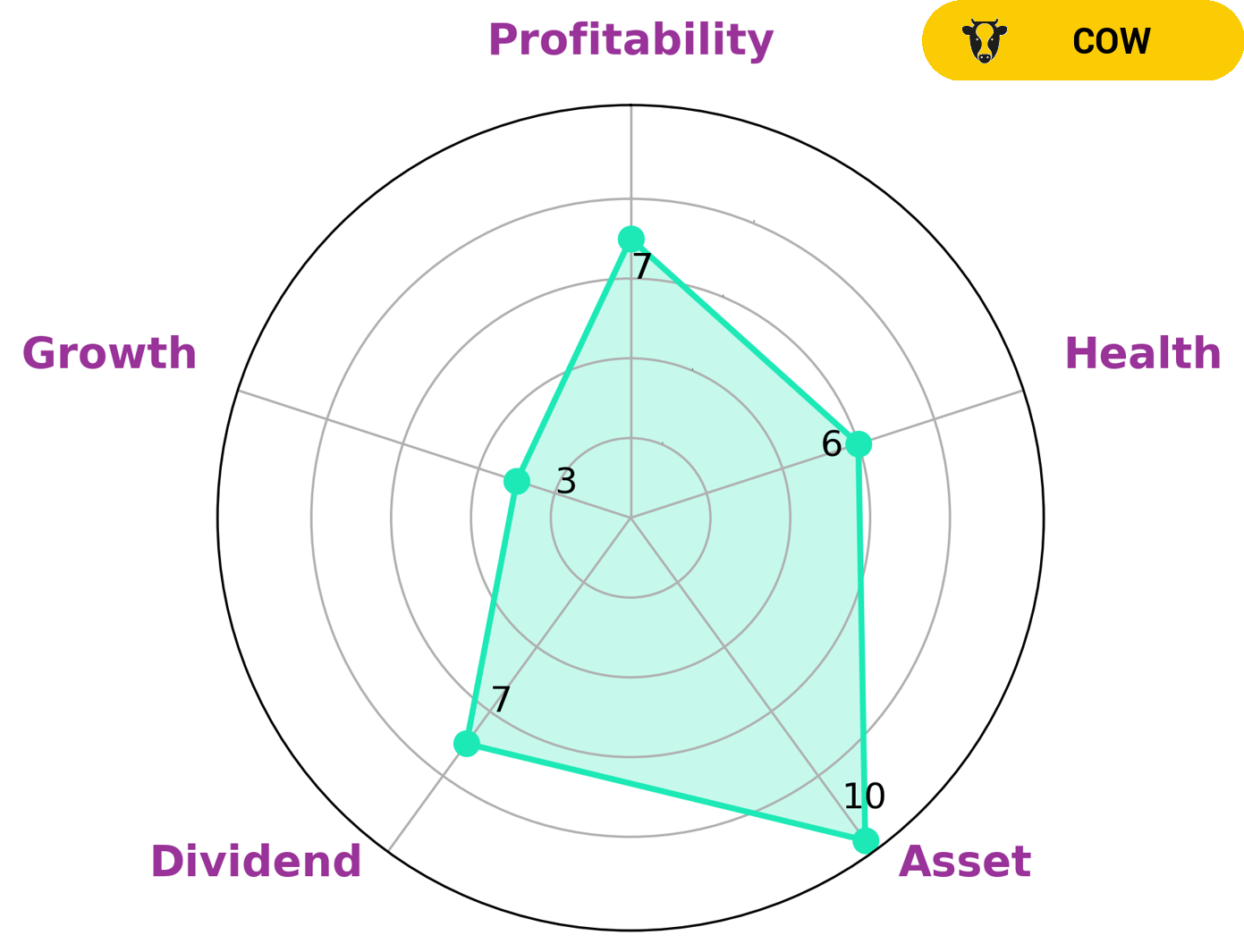

Its cashflows and debt suggest that it has the potential to pay off its debt and fund future operations. It is classified as a ‘cow’ – a company that has a track record of paying out consistent and sustainable dividends. Investors who are looking for a company with strong asset and dividend performance may find Federal Realty Investment Trust attractive. The company has a strong profitability score, making it appealing to those who are looking for reliable income. However, its weak growth score may be off-putting for investors who are looking for companies with high growth potential. Overall, Federal Realty Investment Trust is a solid choice for investors who are looking for a reliable income source. Its intermediate health score and cashflow and debt status suggest that it is well-positioned to pay off its debt and fund future operations. Its strong asset and dividend performance also make it an attractive option for investors. However, its weak growth score should be taken into consideration before investing. More…

Peers

As of December 31, 2019, the company owned 86 shopping centers and street retail properties comprising 22.5 million square feet. Its competitors include Regency Centers Corp, Charter Hall Retail REIT, and BHG Retail REIT.

– Regency Centers Corp ($NASDAQ:REG)

Regency Centers is a real estate investment trust that owns, operates, and develops shopping centers. The company’s portfolio includes properties in the United States, Puerto Rico, and the Virgin Islands. As of December 31, 2020, Regency Centers owned 446 retail properties with a total of 106.9 million square feet of space. The company’s tenants include grocery stores, restaurants, banks, and other service businesses.

– Charter Hall Retail REIT ($ASX:CQR)

Charter Hall Retail REIT is an Australian real estate investment trust that owns and operates a portfolio of shopping centers across Australia. The company has a market cap of 2.3 billion as of 2022. The company’s portfolio includes over 50 shopping centers, with a total value of over A$6 billion. The company’s properties are located in major metropolitan areas across Australia, including Sydney, Melbourne, Brisbane, Perth, and Adelaide.

– BHG Retail REIT ($SGX:BMGU)

BHG Retail REIT has a market cap of 274.27M as of 2022. The company focuses on owning and operating retail properties in the United States. As of December 31, 2020, the company owned and operated 89 retail properties, which consisted of 78 neighborhood and community shopping centers, six freestanding retail buildings, and one retail condominium.

Summary

Federal Realty Investment Trust (FRIT) has seen a positive reaction in after-hours trading, with shares up 4.4%. The company has also guided its 2023 Funds From Operations (FFO) to exceed estimates. This news has been received positively by investors, as FRIT is a leading real estate investment trust that focuses on the ownership, management, and redevelopment of high-quality retail and mixed-use properties located primarily in major coastal markets from Washington, D.C. to Boston as well as San Francisco and Los Angeles. As a result of their strategic investments in redeveloping their properties, FRIT has a portfolio of stable and profitable properties that generates strong cash flows, creating value for their shareholders over the long term.

Recent Posts