Sun Communities Reports Decrease in Q1 Core Funds from Operations

May 6, 2023

Trending News 🌥️

Capital IQ’s survey of analysts showed this. This decrease in core funds from operations has been attributed to the slower pace of rent collections due to the coronavirus pandemic, as well as higher operating costs and increased maintenance expenses. The company is committed to providing quality living experiences to its customers and is focused on creating value for its shareholders. Sun Communities ($NYSE:SUI) is listed on the New York Stock Exchange (NYSE) under the symbol SUI and has grown to become one of the largest publicly traded real estate investment trusts in the U.S. The company offers a variety of amenities to residents such as pools, spas, pet parks, business centers, playgrounds, and other recreational activities. The decrease in Q1 core funds from operations per share will likely put pressure on Sun Communities’ stock price in the near future. Investors should monitor the company’s financials closely as it continues to navigate through the coronavirus pandemic.

However, Sun Communities has a proven track record of success and is poised for long-term growth as a valuable asset for REIT investors.

Market Price

The company stock opened at $138.8 and closed at $139.2, up by 0.2% from last closing price of 138.9. The company’s President and Chief Executive Officer, Gary A. Shiffman stated that despite the difficult environment posed by pandemic, Sun Communities was able to manage their balance sheet and liquidity position, and achieved their FFO guidance for the quarter. He further added that the company is focused on enhancing their existing properties, expanding their portfolio and advancing their strategic initiatives for long-term growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sun Communities. More…

| Total Revenues | Net Income | Net Margin |

| 3.03k | 211.2 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sun Communities. More…

| Operations | Investing | Financing |

| 734.9 | -3.06k | 2.35k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sun Communities. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.36k | 9.29k | 61.84 |

Key Ratios Snapshot

Some of the financial key ratios for Sun Communities are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 18.3% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

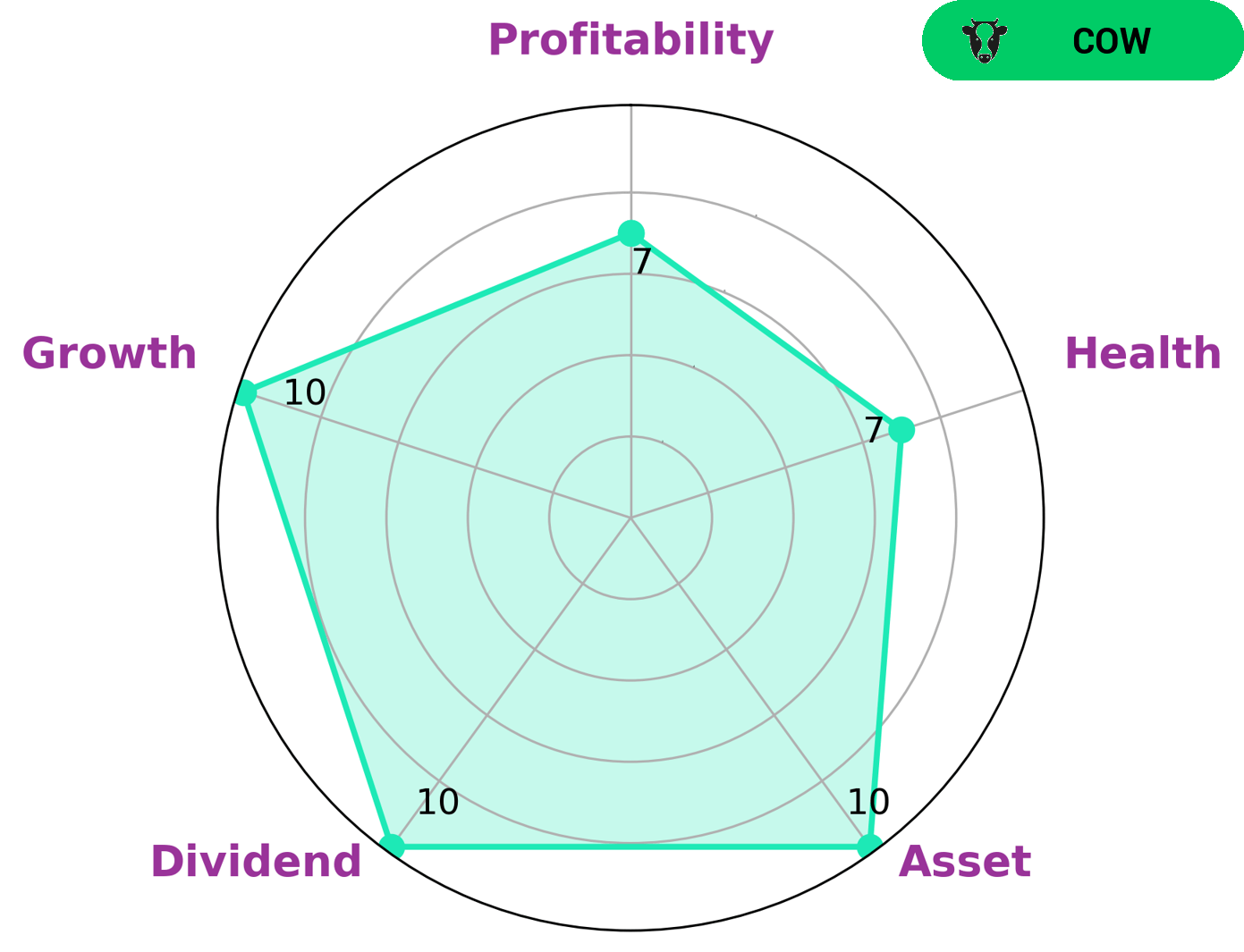

This makes it an ideal target for income-focused investors looking for a steady stream of income. In terms of financial performance, SUN COMMUNITIES appears to be strong in asset, dividend, growth and profitability. GoodWhale’s health score for SUN COMMUNITIES is 7/10, indicating that the company is in good health, with enough cashflows and debt to pay off debt and fund future operations. All in all, SUN COMMUNITIES is an attractive option for investors looking for steady dividend payments in a well-managed company. More…

Peers

The competition between Sun Communities Inc and its competitors American Homes 4 Rent, American Campus Communities Inc, Canadian Apartment Properties Real Estate Investment Trust is fierce. All four companies are vying for the top spot in the market and are constantly innovating and improving their offerings to attract and retain customers. While Sun Communities Inc may have the edge in terms of size and scale, its competitors are not far behind and are constantly challenging it.

– American Homes 4 Rent ($NYSE:AMH)

American Homes 4 Rent is a real estate investment trust that focuses on acquiring, renovating, and leasing single-family homes as rental properties. The company was founded in 2012 and is based in Agoura Hills, California. As of December 31, 2020, American Homes 4 Rent owned 53,949 single-family homes in 26 states.

– American Campus Communities Inc ($TSX:CAR.UN)

Canadian Apartment Properties Real Estate Investment Trust is a real estate investment trust that owns, operates and invests in apartment buildings in Canada. The company has a market cap of $6.83 billion as of 2022.

Summary

The decrease in FFO can be attributed to higher expenses, primarily from higher property taxes and repairs and maintenance. For investors, this news is indicative of a slower start to the year for Sun Communities. Sun Communities will need to make more efficient use of their resources and turn these expenses into revenue to help improve FFO in the coming quarters.

Recent Posts