MID-AMERICA APARTMENT COMMUNITIES Reports Record Breaking Quarter, Increases Guidance

April 27, 2023

Trending News 🌥️

MID-AMERICA APARTMENT COMMUNITIES ($NYSE:MAA) (MAA) recently reported record-breaking quarterly financial results, surpassing expectations and prompting the company to raise its guidance. MAA is a leading owner, operator and developer of multifamily apartment communities located across the Sunbelt region of the United States. Their focus has been on acquiring and developing quality apartment communities in select markets while delivering superior customer service and creating value for shareholders. In the most recent quarter, MAA reported Funds From Operations (FFO) of $2.28, exceeding the consensus estimate of $2.25 by $0.03, as well as revenue of $529.03M that also exceeded expectations of $528.4M by $0.63M.

These impressive results indicate a strong performance from MAA, which has allowed the company to raise its guidance for the remainder of the year. MAA plans to focus on optimizing their existing portfolio by increasing in-place rents, driving occupancy growth and reducing operating expenses, as well as continue their disciplined strategy of selective acquisitions in order to drive long-term value for shareholders. The company remains confident in its ability to grow and generate value over the next few years.

Market Price

MID-AMERICA APARTMENT COMMUNITIES had a record breaking quarter and increased their guidance on Wednesday. The stock opened at $147.7 and closed at $147.4, down by 0.3%. This is a slight decrease from their previous closing price of $147.8. It was an overall positive quarter for the company as they reported strong earnings per share and an increase in their guidance.

MID-AMERICA APARTMENT COMMUNITIES also highlighted their strong portfolio of apartment communities that helped to fuel their success. Going forward, the company plans to continue to focus on their core strengths and expand their presence in the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MAA. More…

| Total Revenues | Net Income | Net Margin |

| 2.02k | 633.31 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MAA. More…

| Operations | Investing | Financing |

| 1.06k | -405.24 | -722.77 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MAA. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.24k | 5.03k | 52.18 |

Key Ratios Snapshot

Some of the financial key ratios for MAA are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 31.1% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

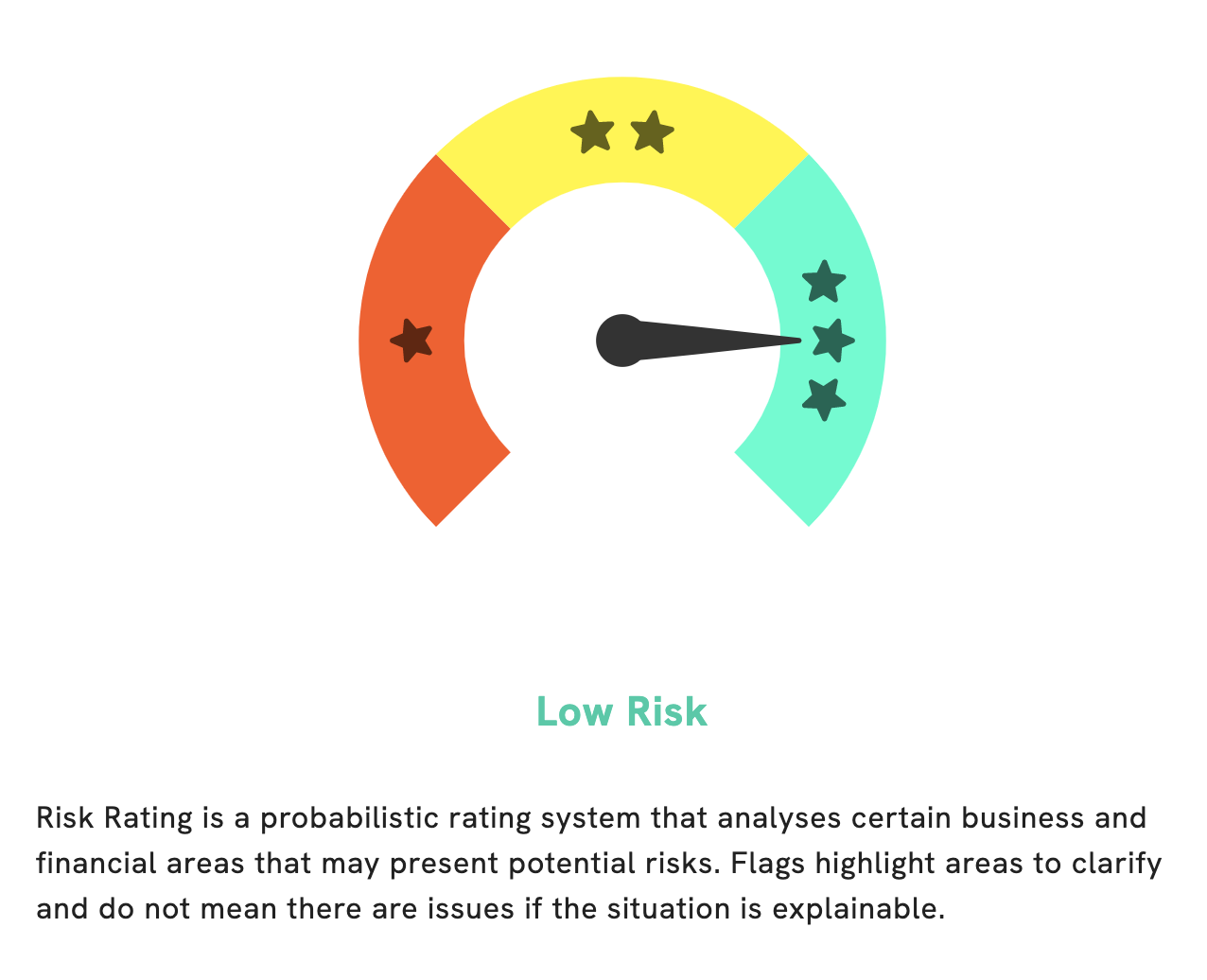

At GoodWhale, we have conducted an in-depth analysis of MID-AMERICA APARTMENT COMMUNITIES’s financials. Our Risk Rating indicates that this is a low risk investment in terms of both financial and business aspects. However, we have identified one risk warning in the balance sheet which we would encourage potential investors to consider. To view the risk warning in more detail, simply become a registered user with GoodWhale. More…

Peers

Mid-America Apartment Communities Inc (MAA) is a real estate investment trust that owns, operates, and develops apartment communities in the United States. MAA has a portfolio of over 100,000 apartments in 21 states. MAA’s competitors include Centerspace, American Homes 4 Rent, and Sun Communities Inc.

– Centerspace ($NYSE:CSR)

Centerspace is a leading provider of real estate solutions and services. It has a market cap of 1.01B as of 2022. The company offers a comprehensive range of services including property management, asset management, development, and investment management. It has a strong presence in the United States, Canada, and Europe.

– American Homes 4 Rent ($NYSE:AMH)

American Homes 4 Rent is a publicly traded real estate investment trust that invests in, acquires, and operates residential properties in the United States. As of December 31, 2020, the Company owned 54,537 single-family homes in 26 states. The Company’s homes are leased to residents on a month-to-month basis and are not subject to long-term leases.

– Sun Communities Inc ($NYSE:SUI)

Sun Communities Inc. is a real estate investment trust that owns, operates, and develops manufactured housing and RV communities. As of December 31, 2020, the company owned, operated, or had an interest in 358 manufactured housing and RV communities comprising approximately 148,000 developed sites. It serves customers in the United States. The company was founded in 1976 and is based in Southfield, Michigan.

Summary

FFO was reported as $2.28, beating estimates by $0.03, while revenue of $529.03M beat expectations by $0.63M. The company also raised their guidance for the year.

Recent Posts