Vornado Realty Trust Reports Lower-Than-Expected Earnings and Revenue

May 3, 2023

Trending News ☀️

To the disappointment of investors, the company’s Funds From Operations (FFO) of $0.60 per share fell short of the market’s expectations by $0.02, while its revenue of $445.92 million also disappointed, coming in lower than expected by $6.78 million. Vornado Realty Trust ($NYSE:VNO) owns and manages a portfolio of retail, office, and residential properties across the United States. Its focus on urban and metropolitan locations has enabled the company to maintain an impressive portfolio of premier real estate assets. In addition to its core business activities, the company also invests in other real estate related ventures such as acquiring interests in companies and developments, providing financing for real estate transactions, and managing construction projects. Despite its lower-than-expected results, Vornado Realty Trust remains a leader in real estate ownership and management, as well as a strong presence in the real estate investment trust industry.

Stock Price

The company’s stock opened at $14.9, and closed the day at $14.7, representing a decrease of 2.2% from the previous day’s closing price of $15.0. Despite these efforts to reward shareholders, investors remain concerned about the impact of the pandemic on Vornado Realty Trust’s business in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for VNO. More…

| Total Revenues | Net Income | Net Margin |

| 1.8k | -429.93 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for VNO. More…

| Operations | Investing | Financing |

| 798.94 | -906.86 | -801.27 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for VNO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.27k | 9.91k | 29.66 |

Key Ratios Snapshot

Some of the financial key ratios for VNO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 16.0% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

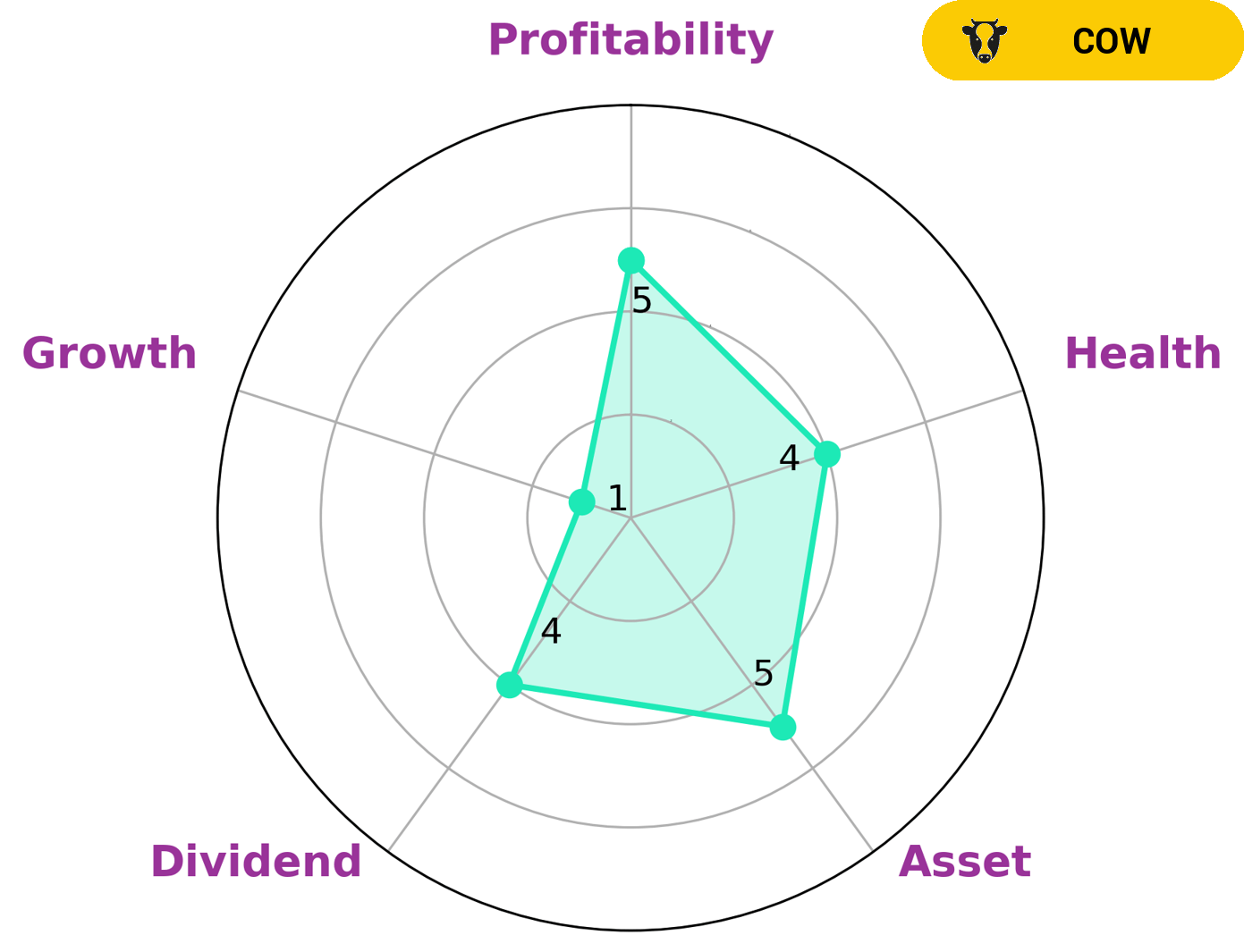

GoodWhale has conducted an in-depth analysis of VORNADO REALTY TRUST’s wellbeing. Through our Star Chart, we found that VORNADO REALTY TRUST is strong in assets, dividend, and profitability, but weak in growth. VORNADO REALTY TRUST has an intermediate health score of 4/10 with regard to its cashflows and debt, which indicates that it may be able to sustain future operations in times of crisis. We have classified VORNADO REALTY TRUST as a ‘cow’, a type of company that has a track record of paying out consistent and sustainable dividends. We believe that investors interested in long-term investments, such as those looking for dividend and income, may be interested in VORNADO REALTY TRUST. These investors can be sure that the company will be able to pay out consistent dividends despite changing economic conditions. More…

Peers

Vornado owns and operates office, retail, and hotel properties in the United States. The company was founded in 1959 and became a public company in 1971. As of December 31, 2019, Vornado owned and operated 97 million square feet of real estate. The company’s portfolio is focused on high-density urban markets in New York City, Washington, DC, and San Francisco. Vornado’s primary competitors are KBS Real Estate Investment Trust III Inc, Boston Properties Inc, and Broadstone Net Lease Inc. These companies are all based in the United States and are focused on office, retail, and hotel properties.

– KBS Real Estate Investment Trust III Inc ($OTCPK:KBSR)

KBS Real Estate Investment Trust III Inc is a real estate investment trust that owns and operates a portfolio of properties in the United States. The company’s portfolio includes office, retail, industrial, and hotel properties. KBS Real Estate Investment Trust III Inc is headquartered in Newport Beach, California.

– Boston Properties Inc ($NYSE:BXP)

Boston Properties Inc is a real estate investment trust that owns, manages, and develops properties in the United States. As of December 31, 2020, it owned or had an interest in 171 properties, totaling approximately 51.4 million square feet. The company was founded in 1970 and is headquartered in Boston, Massachusetts.

– Broadstone Net Lease Inc ($NYSE:BNL)

The company’s market cap is 2.79B as of 2022. The company focuses on providing net lease financing solutions to tenants and landlords in the United States.

Summary

Vornado Realty Trust is a real estate investment trust that focuses on owning, managing and investing in office, retail, and other properties in the United States. These results suggest that investors may need to adjust their outlook for this REIT, as it is not meeting expectations. The company’s stock price may fall in the short term, but analysts will keep a close eye on the results of future quarters to get a better indication of the company’s long-term prospects. It is important for investors to maintain a long-term perspective when evaluating investments in Vornado Realty Trust.

Recent Posts