SL Green Realty Secures 31 Office Leases Totaling 299,137 Square Feet in 60 Days

June 7, 2023

☀️Trending News

SL ($NYSE:SLG) Green Realty is a leading real estate investment trust and the largest commercial property owner in New York City. As commercial real estate activity continues to rebound since pre-pandemic levels, SL Green has been at the forefront of driving this growth and providing opportunities to tenants in key markets across the country. This latest round of leasing activity stretches from coast to coast, with prominent properties in both New York City and Los Angeles. The 31 leases encompass a variety of portfolio types, from single-tenant office spaces to larger corporate campuses.

These properties have attracted a cross-section of tenants such as business services, media/entertainment, and technology companies. SL Green has been actively working to provide attractive spaces and competitive terms to these renters, allowing them to remain in prime locations while still keeping costs in check. This accomplishment is likely to serve as an indication of the increasing optimism among investors that the commercial real estate market is on track for a strong recovery.

Share Price

SL Green Realty, the commercial real estate giant based in New York City, has achieved an impressive milestone in less than two months. This is a remarkable feat considering the current market conditions. This influx of new business is a testament to the strength of the company’s services and its ability to attract lucrative clients. This news was reflected in the company’s stock performance on Monday.

SL Green Realty stock opened at $23.7 and closed at $23.3, down by 1.8% from the prior closing price of $23.8. Despite this slight dip in price, investors remain bullish on the future of the company as it continues to bring in new business. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SLG. More…

| Total Revenues | Net Income | Net Margin |

| 862.35 | -142.72 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SLG. More…

| Operations | Investing | Financing |

| 276.09 | 425.81 | -654.82 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SLG. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.34k | 7.36k | 65.84 |

Key Ratios Snapshot

Some of the financial key ratios for SLG are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 19.0% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

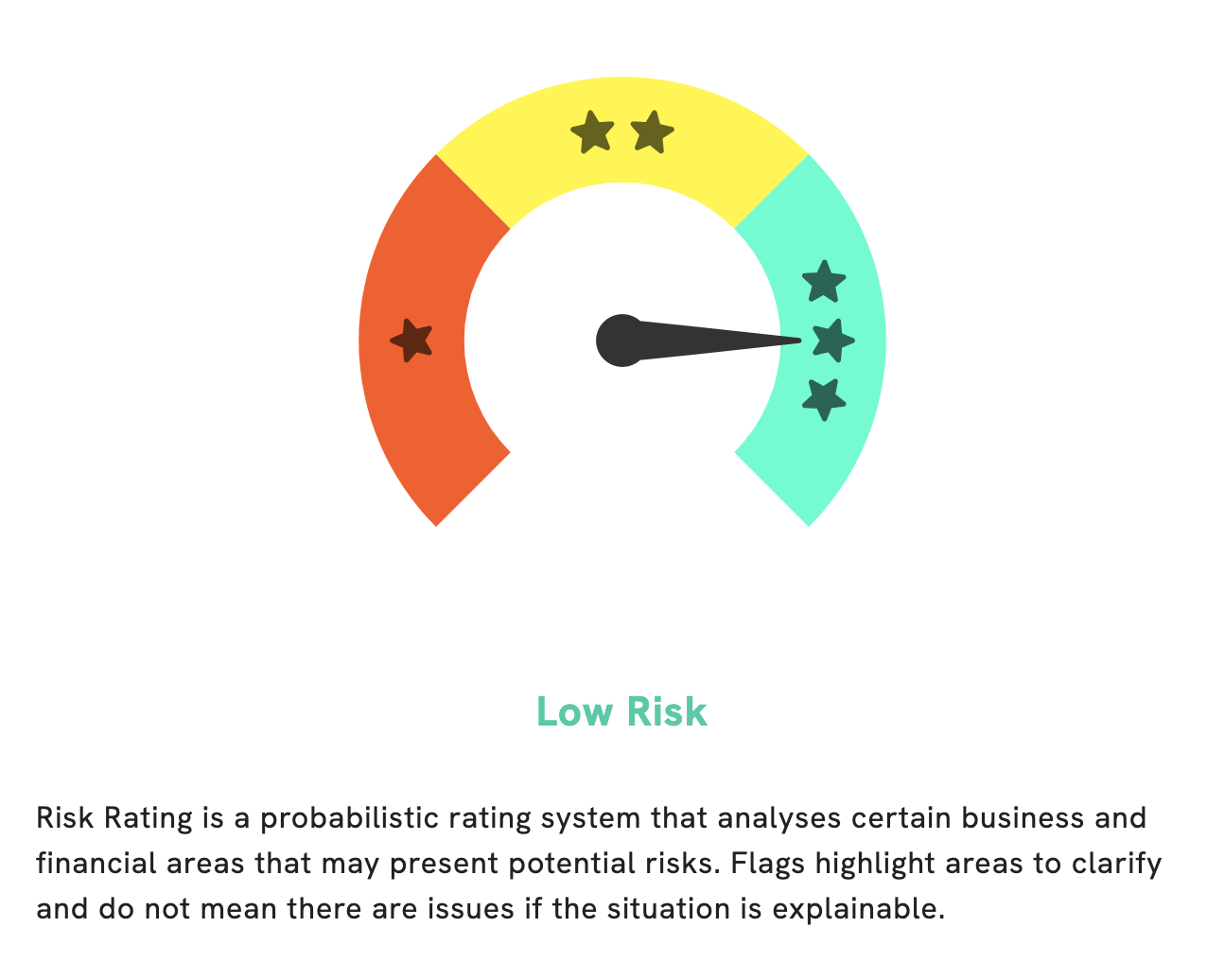

At GoodWhale, we can help you analyze SL GREEN REALTY’s financials with ease. After a thorough assessment, we have determined that this company is a low risk investment in terms of financial and business aspects. We have detected one risk warning in its balance sheet, which you can access by signing up with us. With GoodWhale, you can get a comprehensive analysis of SL GREEN REALTY’s financials and the associated risks. More…

Peers

The commercial real estate industry is highly competitive, with a large number of companies vying for market share. SL Green Realty Corp is one of the largest and most successful commercial real estate firms in the industry, with a long track record of success. The company’s main competitors are Picton Property Income Ltd, DDMP REIT Inc, and Cromwell Property Group. These firms are all large and well-established companies with significant resources and a strong presence in the industry.

– Picton Property Income Ltd ($LSE:PCTN)

The company’s market cap is 468.15M as of 2022. The company is a property income fund that invests in a portfolio of UK commercial properties. The company’s objective is to provide shareholders with an attractive level of income and capital growth by investing in a diversified portfolio of UK commercial properties.

– DDMP REIT Inc ($PSE:DDMPR)

Dividend and income-oriented real estate investment trust that owns and operates a diversified portfolio of real estate assets in the United States. The company’s portfolio includes office, retail, industrial, and residential properties.

– Cromwell Property Group ($ASX:CMW)

Cromwell Property Group is a real estate investment trust that owns and operates a portfolio of properties across Australia, New Zealand, and Europe. The company has a market cap of 5.46 billion as of 2022. Cromwell Property Group’s portfolio includes office, retail, industrial, and logistics properties. The company also owns and operates a number of hotels and serviced apartments.

Summary

SL Green Realty is a publicly traded real estate investment trust that is one of the largest owners, managers, and developers of commercial office properties in New York City. Furthermore, the company appears to have a healthy pipeline of tenants and its portfolio of properties should continue to produce strong returns in the future. Investors looking to capitalize on the real estate market should consider SL Green Realty as a great opportunity.

Recent Posts