Keppel DC REIT Shares Surge 3% After Securing €50 Million Loan Facility.

February 2, 2023

Trending News ☀️

Keppel ($SGX:AJBU) DC REIT is a Singapore-based real estate investment trust (REIT) that focuses on data centers. The REIT is managed by Keppel Capital and is listed on the Mainboard of the Singapore Exchange. Recently, Keppel DC REIT’s unit successfully attained a €50 million loan facility, resulting in a 3% surge in their shares. This loan facility was provided by BNP Paribas and it will be used to refinance existing debt and for general corporate purposes. The loan facility has a maturity period of five years with two one-year extension options. It allows the company to refinance existing debt and free up resources for other purposes, such as investments in new data centers or expansions of existing ones. This loan facility also contributes to the company’s long-term sustainability and growth prospects.

The news of the loan facility also pushed up the share price of Keppel DC REIT, as investors reacted positively to the news. The share price surged 3%, which is a significant increase in a single trading day. This demonstrates the strong confidence investors have in the company’s performance and future growth potential. Overall, Keppel DC REIT’s successful attainment of the €50 million loan facility is great news for the company and its investors alike. It will provide a strong financial foundation for the company and serve as a catalyst for future growth. Investors have also responded positively to the news and have rewarded the company with a 3% surge in their share prices.

Share Price

The news was welcomed by investors, as the REITs share price opened at SG$2.1 and closed at SG$2.1, up by 3.4% from the last closing price of 2.0. The loan facility is structured to have a one-year period with an option to extend for up to two more years. The facility will be used by KEPPEL DC REIT for general corporate purposes and to further strengthen its financial position. The loan facility is provided by a syndicate of banks and is secured by a pool of the REIT’s assets. KEPPEL DC REIT is managed by Keppel Capital, a leading integrated financial services provider in Singapore.

The REIT focuses on investing in data centres, which are an important asset class for investors due to their high demand and low volatility. The REIT has a portfolio of data centres located in Singapore, the UK, the Netherlands, and Germany. The stock has seen an increase of 3.4% since the announcement, and the loan facility should provide KEPPEL DC REIT with additional financial stability. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AJBU. More…

| Total Revenues | Net Income | Net Margin |

| 271.46 | 320.56 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AJBU. More…

| Operations | Investing | Financing |

| 191 | -445.63 | 234.99 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AJBU. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.89k | 1.49k | 1.37 |

Key Ratios Snapshot

Some of the financial key ratios for AJBU are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 79.4% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

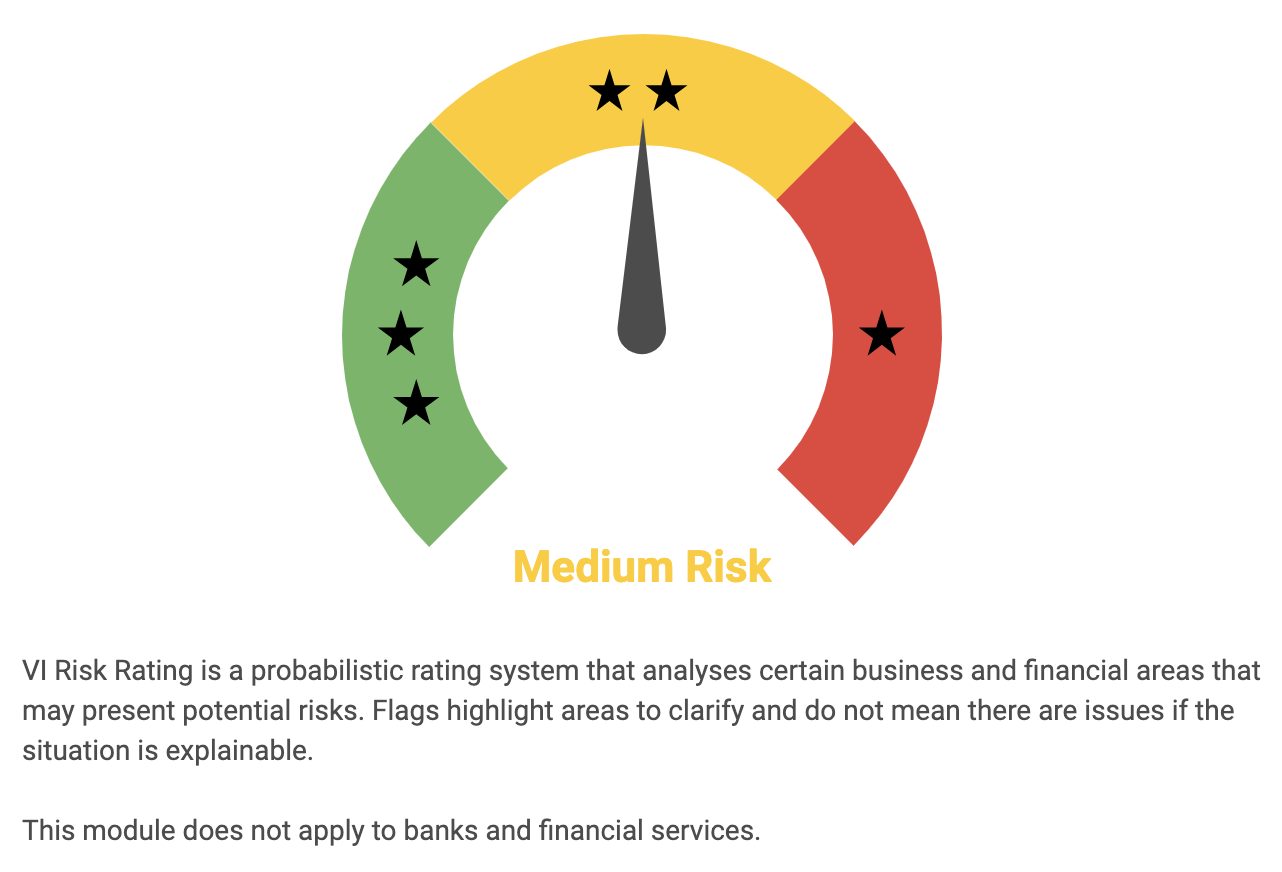

KEPPEL DC REIT has recently been subjected to an analysis by GoodWhale. The assessment was based on the fundaments of KEPPEL DC REIT, and the results have indicated that the REIT is a medium risk in terms of financial and business aspects. This means that investors should be aware that there is a certain risk associated with investing in KEPPEL DC REIT. GoodWhale has detected one risk warning in the balance sheet of KEPPEL DC REIT. Investors should be aware of this risk warning, as it could impact their decision to invest in the REIT. It is recommended that investors register with GoodWhale to gain access to more detailed information concerning this risk warning. Overall, KEPPEL DC REIT has been assessed as a medium risk investment. Investors should take into account the level of risk associated with investing in the REIT before making any decisions. In addition, investors should be aware of the risk warning detected in the balance sheet, and register with GoodWhale to gain further insights into this risk. More…

Peers

Keppel DC REIT is one of the leading data centre real estate investment trusts (REITs) in Asia Pacific and is managed by Keppel Capital Holdings Pte Ltd. It is listed on the Singapore Exchange (SGX) and has a portfolio of eight data centres located across Singapore, the Netherlands, Australia and Ireland. Keppel DC REIT’s main competitors include Mapletree Industrial Trust, MREIT Inc, and CapitaLand Ascendas REIT, all of which are also listed on the SGX and have similar portfolios of data centres in different locations in Asia and Europe.

– Mapletree Industrial Trust ($SGX:ME8U)

Mapletree Industrial Trust is a Singapore-based real estate investment trust that was established in 2005. The trust invests in a diversified portfolio of income-producing industrial real estate in Singapore. As of 2023, Mapletree Industrial Trust has a market capitalization of 6.46 billion dollars. This makes it one of the largest industrial REITs in Asia, with over 34 million square feet of gross floor area in strategic locations across Singapore. The trust’s portfolio includes a mix of business parks, logistics, and hi-tech industrial properties, which provide stable, long-term income and capital growth potential to its unitholders.

– MREIT Inc ($PSE:MREIT)

MREIT Inc is a mortgage real estate investment trust (REIT) that invests in a variety of mortgage-backed securities, residential and commercial mortgage loans, and other real estate-related assets. As of 2023, MREIT Inc has a market capitalization of 36.82 billion, making it one of the largest REITs in the world. Through its investments, MREIT Inc seeks to generate income and capital appreciation for its shareholders by delivering attractive risk-adjusted returns. The company takes advantage of its large portfolio and diversified investments to mitigate the risk of default and benefit from the strong performance of the U.S. housing market over the years.

– CapitaLand Ascendas REIT ($SGX:A17U)

CapitaLand Ascendas REIT is one of the largest real estate investment trusts in Asia, with a market cap of 12.19 billion as of 2023. The REIT manages a portfolio of industrial and business space properties located in Singapore, China, India, Australia, and other key Asian markets. The REIT’s portfolio consists mainly of industrial and business parks, science parks, hi-tech industrial estates, IT parks, office buildings and serviced apartments. It is a joint venture between CapitaLand Limited and Ascendas-Singbridge Group, and is listed on the Singapore Exchange (SGX). It has a diversified portfolio of properties across Asia, with a focus on income generation and capital preservation.

Summary

Keppel DC REIT has recently secured a €50 million loan facility, which has been largely seen as a positive move for the company. The news has driven the stock price to surge 3% on the same day, making it an attractive investment option. The REIT provides investors with exposure to a portfolio of data centres across Asia Pacific and Europe, allowing them to benefit from the growing global demand for data storage.

It offers a steady and sustainable dividend yield, with a history of consistent dividend payments over time. With a strong track record and long-term growth potential, Keppel DC REIT is an attractive investment opportunity for those looking to diversify their portfolios.

Recent Posts