AlphaCentric Advisors LLC Invests $754,000 in Redwood Trust to Expand Investment Portfolio.

February 5, 2023

Trending News ☀️

Redwood Trust ($NYSE:RWT), Inc. is a real estate investment trust (REIT) that specializes in residential mortgage-backed securities and other financial products. It has a strong focus on residential finance and is one of the leading issuers of private-label residential mortgage-backed securities. AlphaCentric Advisors LLC has recently invested $754,000 in Redwood Trust Inc. to expand its investment portfolio. AlphaCentric Advisors is a registered investment advisor based out of California, offering diversified portfolios for a wide range of investors. With this investment, AlphaCentric Advisors will gain exposure to the residential mortgage-backed securities market and benefit from the potential growth and income opportunities that come with investing in the REIT sector. Redwood Trust Inc. has gained significant attention in the REIT sector due to its strong performance over the years.

Its portfolio consists of prime residential mortgage-backed securities (RMBS), residential mortgage loans, and commercial real estate loans. The company has also taken steps to diversify its portfolio by investing in other types of investments, such as private equity and venture capital. The company has also been expanding its presence in the US and international markets, further diversifying its portfolio and increasing its potential for growth. With this investment, AlphaCentric Advisors will gain access to the residential mortgage-backed securities market and benefit from the potential growth and income opportunities that come with investing in the REIT sector. This investment is expected to strengthen AlphaCentric Advisors’ portfolio and provide investors with additional options for diversifying their investments.

Share Price

Redwood Trust primarily focuses on investing in residential mortgage-backed securities, residential mortgage loans, and other financial services. The media’s exposure of the company has been mostly positive and the stock opened on Friday at $8.6 and closed at the same price. This was slightly down by 1.1% from its previous closing price of 8.7. Redwood Trust has a strong balance sheet and is well-positioned to capitalize on the current market conditions. Its portfolio of investments are diversified across different asset classes and its management team is experienced and qualified.

This makes it an attractive investment for AlphaCentric Advisors as it will provide them with a reliable source of income and potential growth in the future. The investment of $754,000 in Redwood Trust Inc. is expected to benefit both AlphaCentric Advisors LLC and Redwood Trust Inc. AlphaCentric Advisors LLC will have access to a reliable source of income and potential growth while Redwood Trust Inc. will be able to further diversify its portfolio and increase its financial stability. This investment could be a great opportunity for both companies to strengthen their positions in the market and benefit in the long run. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Redwood Trust. More…

| Total Revenues | Net Income | Net Margin |

| 82.23 | -74.95 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Redwood Trust. More…

| Operations | Investing | Financing |

| -3.53k | 1.4k | 4.28k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Redwood Trust. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.15k | 11.99k | 10.18 |

Key Ratios Snapshot

Some of the financial key ratios for Redwood Trust are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

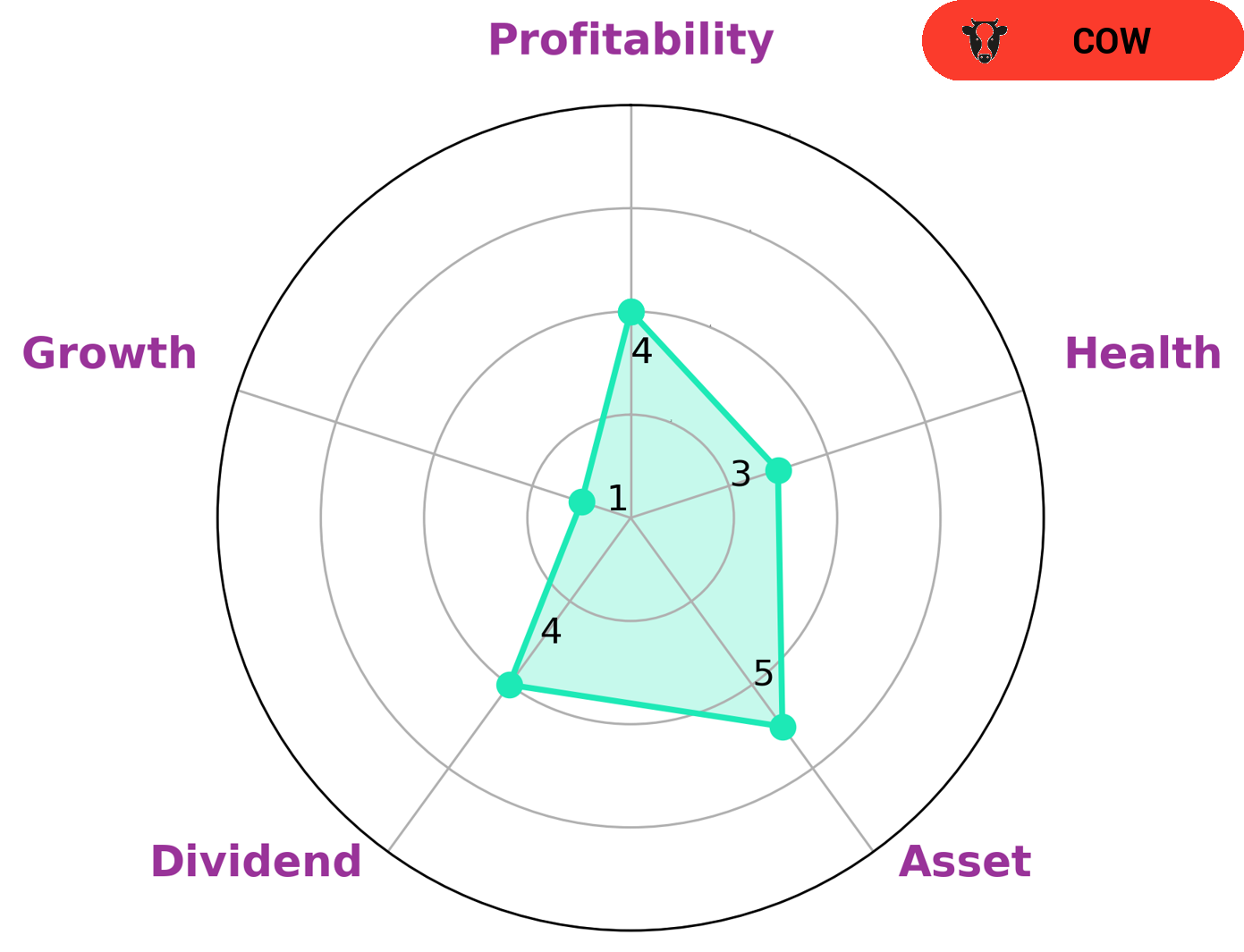

REDWOOD TRUST is a company whose financials have been analyzed by GoodWhale. According to the Star Chart, REDWOOD TRUST has a low health score of 3/10 with regard to its cashflows and debt, making it less likely to sustain future operations in times of crisis. Other aspects of REDWOOD TRUST’s financials include it being strong in asset, medium in dividend, profitability and weak in growth. REDWOOD TRUST has been classified as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. Investors who are interested in such companies may be looking for steady returns over the long term. Companies such as REDWOOD TRUST offer a reliable cash flow and dividend income, which may be attractive to investors who are looking for an income stream that is safe and consistent. Dividend investors may also be attracted to REDWOOD TRUST for its reliable dividend payments and low risk. Furthermore, investors who are looking for low-risk investments may be drawn to REDWOOD TRUST due to its low health score and its ability to sustain operations in times of crisis. In conclusion, REDWOOD TRUST is a company that may be attractive to investors who are looking for steady returns, reliable dividend payments and low risk investments. Its classification as a ‘cow’ indicates that it is capable of providing consistent and sustainable dividends, making it a desirable option for those looking for a safe and dependable income stream. More…

Peers

In the world of real estate investment trusts, or REITs, competition is fierce. Among the top competitors are Redwood Trust Inc, Cherry Hill Mortgage Investment Corp, Granite Point Mortgage Trust Inc, and MFA Financial Inc. All four companies are publicly traded on the stock market and offer investors a way to invest in the real estate market without actually owning property.

– Cherry Hill Mortgage Investment Corp ($NYSE:CHMI)

Cherry Hill Mortgage Investment Corporation, a real estate investment trust, acquires, invests in, and manages residential mortgage assets in the United States. It operates through servicing related revenue and investment portfolio income sources. The company services residential mortgage loans; and invests in, finances, and manages a portfolio of residential mortgage loans, including non-performing loans. Cherry Hill Mortgage Investment Corporation was founded in 2012 and is headquartered in Horsham, Pennsylvania.

– Granite Point Mortgage Trust Inc ($NYSE:GPMT)

Granite Point Mortgage Trust Inc is a real estate investment trust that focuses on originating, financing, and managing senior floating rate commercial mortgage loans. The company has a market cap of 350.75M as of 2022. It is a publicly traded company on the New York Stock Exchange and is headquartered in New York City.

– MFA Financial Inc ($NYSE:MFA)

MFA Financial Inc is a real estate investment trust that focuses on investing in residential mortgage assets. As of December 31, 2020, the company had a market capitalization of $925.3 million. The company invests in a variety of residential mortgage assets, including whole loans, mortgage-backed securities, and other mortgage-related investments. MFA Financial is headquartered in New York, New York.

Summary

Redwood Trust Inc. is an American publicly traded real estate investment trust (REIT) headquartered in Mill Valley, California. The company specializes in the acquisition, securitization, and management of residential mortgage-backed securities and other mortgage-related investments. Recently, AlphaCentric Advisors LLC has invested $754,000 in Redwood Trust Inc. to expand their investment portfolio. Analysts have generally been positive on the company’s prospects.

Redwood Trust has an impressive track record of creating value through loan originations and investing in mortgage-backed securities. It is well-positioned to benefit from the current low-interest rate environment and looks to be a solid long-term investment.

Recent Posts