AG Mortgage Investment Trust Showing Signs of Improvement, But Further Increase Needed

May 27, 2023

Trending News ☀️

AG ($NYSE:MITT) Mortgage Investment Trust (MITT) has recently been showing signs of improvement, but the numbers still don’t suggest a full recovery. AG MITT is an investment that pools capital from individual and institutional investors to buy mortgage-backed securities, intended to generate income from interest payments and potential appreciation. While the company has seen a recent increase in their share price, they are still down over the past year. Although the company has seen an increase in their share price, this hasn’t been enough to offset their losses and the company is still down over the past year. Furthermore, AG MITT has seen a decline in their total assets under management, meaning that they need to find more capital in order to invest in mortgage-backed securities.

The recent increase in share price is encouraging, but AG MITT needs to do more in order to fully recover from their losses. The company needs to find ways to increase their assets under management, as well as find new ways to generate income through their mortgage-backed securities investments. If they can accomplish this, then AG MITT might be able to see further increases in their share price and a full recovery from their losses.

Market Price

AG Mortgage Investment Trust (MITT) has seen a slight increase in stock prices on Friday, opening at $5.2 and closing at $5.3, a 2.9% rise from the previous closing price. This is an encouraging sign of improvement, however, further increase is needed in order for the company to reach its potential and become a successful investment for shareholders. The company must continue to focus on implementing strategies to drive growth and increase revenue in order to maintain a positive momentum in their stock prices.

In addition, investors must also remain confident and committed to the long-term performance of MITT if they want to benefit from its potential growth. It is important to note that any success or failure of the company depends on its ability to address challenges and capitalize on opportunities in the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MITT. More…

| Total Revenues | Net Income | Net Margin |

| 19.91 | -45.7 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MITT. More…

| Operations | Investing | Financing |

| 24.52 | -1.02k | 1.01k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MITT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.62k | 4.16k | 11.85 |

Key Ratios Snapshot

Some of the financial key ratios for MITT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

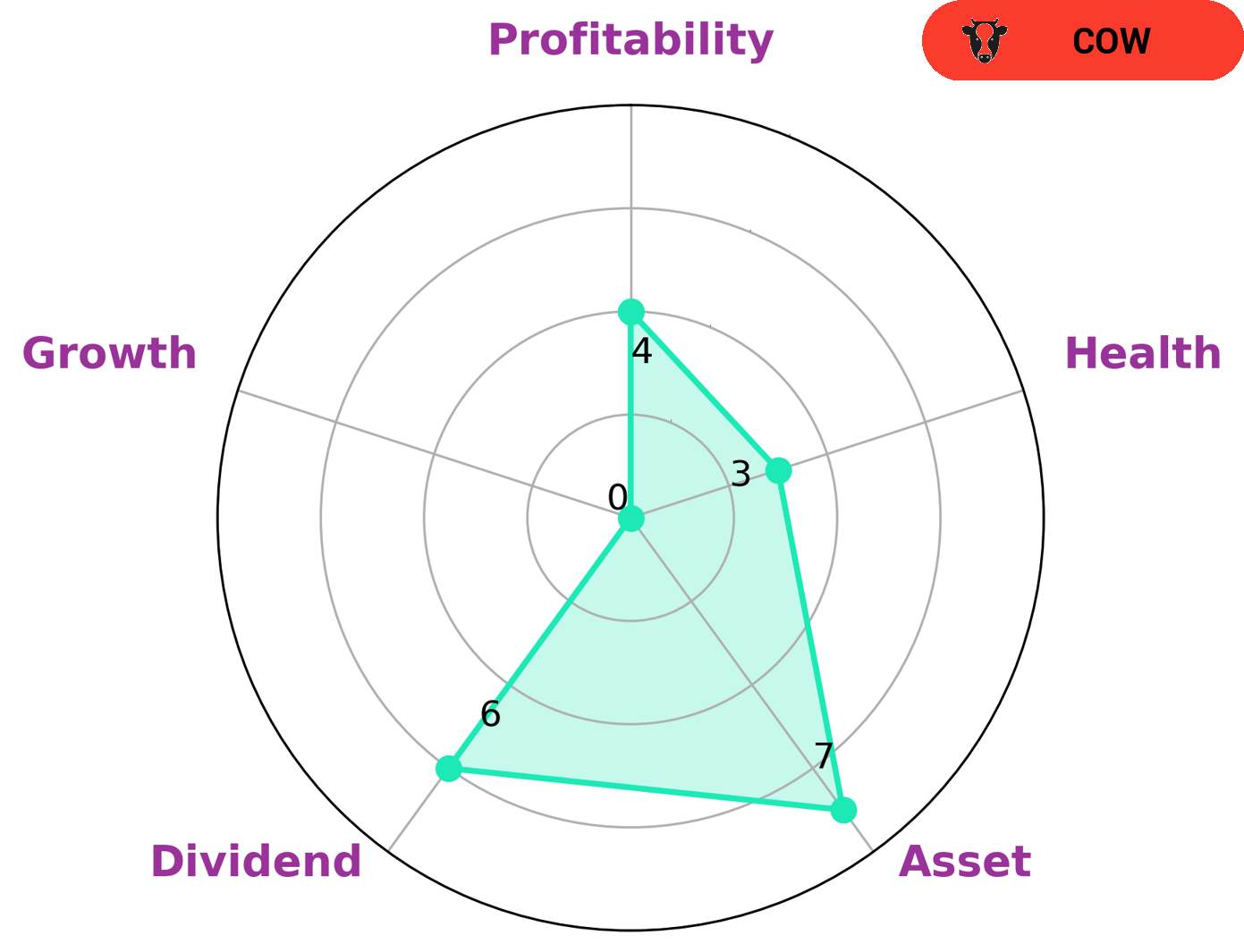

Our Star Chart revealed that the company has a low health score of 3/10, particularly in terms of cashflows and debt. This raises some concerns about the company’s ability to sustain operations in times of crisis. We also found that AG MORTGAGE INVESTMENT TRUST is strong in asset, medium in dividend, profitability and weak in growth. Based on this information, we classified AG MORTGAGE INVESTMENT TRUST as a ‘cow’, a type of company which has the track record of paying out consistent and sustainable dividends. Given its low health score and its ability to pay out consistent dividends, AG MORTGAGE INVESTMENT TRUST may be an interesting option for investors looking for a steady income stream. It may also be appealing to those who are looking for steady capital growth over time. More…

Peers

The company’s competitors include Annaly Capital Management Inc, Ellington Residential Mortgage REIT, AGNC Investment Corp.

– Annaly Capital Management Inc ($NYSE:NLY)

Annaly Capital Management Inc is a real estate investment trust. The Company owns, finances and manages a portfolio of real estate-related investments, which includes mortgage pass-through certificates, collateralized mortgage obligations, agency callable debentures, other securities and investments, commercial real estate loans and other real estate-related assets.

– Ellington Residential Mortgage REIT ($NYSE:EARN)

Ellington Residential Mortgage REIT is a mortgage real estate investment trust that acquires, invests in, and manages residential mortgage- and real estate-related assets in the United States. The company has a market cap of 91.82M as of 2022. It operates through three segments: Mortgage Origination, Mortgage Servicing, and Mortgage Investments. The Mortgage Origination segment originates and acquires residential mortgage loans. The Mortgage Servicing segment services mortgage loans. The Mortgage Investments segment invests in mortgage-related assets, including residential mortgage loans, real estate securities, and other real estate-related investments.

– AGNC Investment Corp ($NASDAQ:AGNC)

AGNC Investment Corp is a real estate investment trust that invests in residential mortgage-backed securities. The company has a market cap of $5.4 billion as of 2022. It is headquartered in Bethesda, Maryland, and has over $100 billion in assets under management. AGNC is one of the largest REITs in the United States and is publicly traded on the New York Stock Exchange.

Summary

AG Mortgage Investment Trust (MITT) has been performing well in recent months, with its stocks rising in value and showing signs of potential growth. Though the company still faces certain risks including higher interest rates and exposure to mortgage losses, it is also continuing to focus on diversifying its portfolio to reduce risk. The company is expanding its investments in residential mortgage-backed securities and commercial mortgage-backed securities, as well as investing in non-agency products such as collateralized loan obligations.

Furthermore, AG MITT is actively seeking to capitalize on potential opportunities in the real estate market. While investors should remain cautious of the risks associated with this investment, AG MITT’s strong portfolio and experienced management make it a promising investment option.

Recent Posts