Rexford Industrial Realty Closes $357.2M Deal for Three Industrial Properties in Southern California

April 8, 2023

Trending News 🌥️

Rexford Industrial Realty ($NYSE:REXR), a Los Angeles-based real estate investment trust (REIT) focusing on the acquisition, ownership, and management of industrial properties in Southern California, has recently closed a deal for three industrial properties in the region. The total cost of the acquisition amounts to $357.2 million. This latest acquisition is an important milestone for Rexford Industrial Realty and further expands its presence in Southern California. This is a strategic move by Rexford Industrial Realty to take advantage of the region’s favorable market conditions and further capitalize on its expertise in the industrial real estate sector.

Share Price

With this deal, the company solidifies its presence in the industrial real estate market. The stock opened at $58.5 and closed at $58.1, down by 0.6% from the last closing price of 58.5. This is a major move for the company, and it is expected that this development will increase the potential for future success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for REXR. More…

| Total Revenues | Net Income | Net Margin |

| 631.2 | 157.48 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for REXR. More…

| Operations | Investing | Financing |

| 327.69 | -2.45k | 2.11k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for REXR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.26k | 2.34k | 33.85 |

Key Ratios Snapshot

Some of the financial key ratios for REXR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 34.8% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

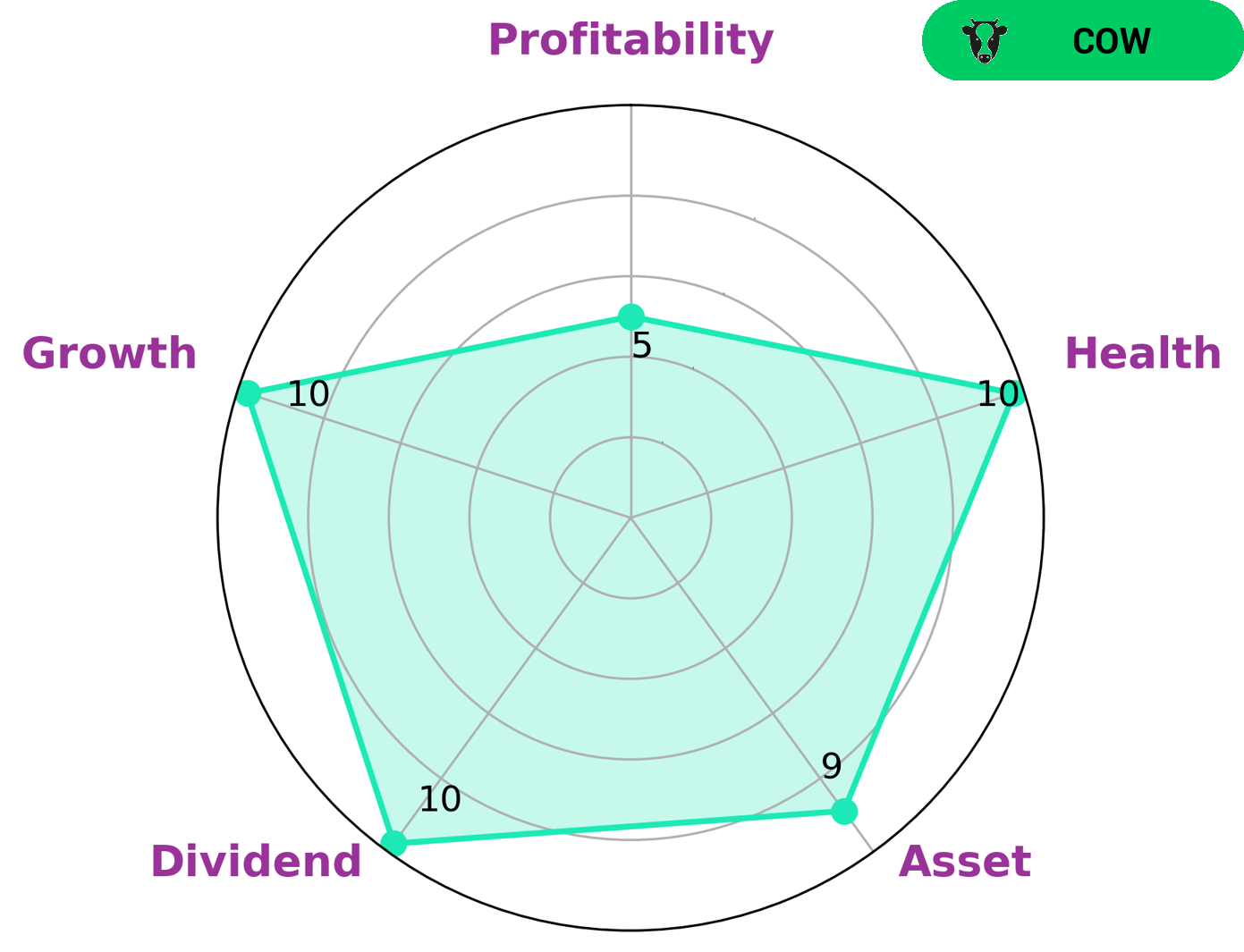

At GoodWhale, we recently conducted an analysis of REXFORD INDUSTRIAL REALTY’s wellbeing. Our Star Chart gave REXFORD INDUSTRIAL REALTY a high health score of 10/10 with regard to its cashflows and debt, revealing that the company is well-equipped to pay off debt and fund future operations. Additionally, we classified this company as a ‘cow’–a type of company that we have determined is reliable in its dividend payments. These strong financials have us wondering what type of investors may be interested in such a company. We can tell that REXFORD INDUSTRIAL REALTY is strong in asset and dividend growth, and medium in profitability. This combination could make it appealing to a wide variety of investors, from passive income seekers, to those interested in long-term capital appreciation. More…

Peers

Rexford Industrial Real Estate Trust is a real estate investment trust focused on the ownership of industrial properties in the United States. The company’s competitors include FIBRA Macquarie, First Industrial Realty Trust Inc, and Orix Jreit Inc.

– FIBRA Macquarie ($OTCPK:DBMBF)

FIBRA Macquarie is a Mexican real estate investment trust (REIT) that invests in income-producing real estate, primarily industrial properties, in Mexico. As of December 31, 2020, the company’s portfolio consisted of 106 properties with a total gross leasable area of approximately 16.6 million square feet. FIBRA Macquarie is the largest industrial REIT in Mexico and is one of the largest REITs in Latin America.

– First Industrial Realty Trust Inc ($NYSE:FR)

First Industrial Realty Trust is a real estate investment trust that owns and operates industrial properties. The company has a market cap of $5.82 billion as of 2022. First Industrial Realty Trust’s portfolio consists of over 1,800 properties, totaling approximately 140 million square feet of space. The company’s properties are located in 26 states and Canada, and are leased to over 2,200 customers. First Industrial Realty Trust is headquartered in Chicago, Illinois.

– Orix Jreit Inc ($TSE:8954)

Orix Jreit Inc is a Japanese real estate investment trust that was founded in 2002. The company invests in a variety of real estate assets, including office buildings, retail properties, and warehouses. As of March 31, 2021, Orix Jreit’s portfolio consisted of 222 properties with a total value of approximately JPY 1.8 trillion. The company is headquartered in Tokyo and its shares are listed on the Tokyo Stock Exchange.

Summary

Rexford Industrial Realty is a publicly traded real estate investment trust (REIT) that specializes in buying and managing industrial properties across the United States. The acquisition is expected to generate significant long-term value for investors, as it will provide a stable income stream from rent and increase the company’s visibility and competitiveness in the region. Furthermore, due to the increasing demand for industrial properties, this purchase should generate long-term growth in rental income. Rexford’s experienced management team is well-positioned to capitalize on these opportunities and continue to deliver strong returns to shareholders.

Recent Posts