Public Storage and Solar Landscape Partner Up for Multistate Project

August 7, 2023

🌥️Trending News

Public Storage ($NYSE:PSA), one of the largest self-storage companies in the United States, has partnered with Solar Landscape, a commercial and industrial rooftop solar developer, to launch a multistate solar project. This is the first of its kind for both companies and is made possible thanks to the expertise of both Public Storage and Solar Landscape. It offers secure storage solutions for both business and personal customers in its climate-controlled units. Solar Landscape, an energy solutions provider, designs, builds and maintains solar power systems with an aim to reduce energy costs and carbon footprint. The multistate solar project will involve installing solar systems on rooftops of Public Storage’s facilities in multiple states.

The project will allow businesses to maximize their savings by taking advantage of tax credits and other incentives for renewable energy sources. It will also help to reduce the company’s carbon footprint and create a more sustainable future. This is an exciting partnership for both companies and marks a new chapter in their respective histories. With this project, Public Storage and Solar Landscape are working together to bring energy savings and environmental sustainability to many businesses across the United States.

Share Price

On Friday, PUBLIC STORAGE, one of the world’s largest self-storage providers, announced a major partnership with Solar Landscape, a renewable energy company, for a multistate project. The project will involve the installation of hundreds of solar panels on the roofs of PUBLIC STORAGE locations throughout California, Nevada, and Arizona. The news of the partnership sent ripples across the market, driving PUBLIC STORAGE’s stock down 3.9% from its previous closing price of 287.0 to 275.7. The partnership is expected to lower the company’s electricity costs while also reducing their environmental footprint.

Both companies are optimistic that this venture will be beneficial to their respective businesses as well as the environment. It is the first of many renewable energy projects that PUBLIC STORAGE has announced in recent years as part of their commitment to reducing their carbon footprint. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Public Storage. More…

| Total Revenues | Net Income | Net Margin |

| 4.39k | 4.07k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Public Storage. More…

| Operations | Investing | Financing |

| 3.24k | 1.17k | -4.77k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Public Storage. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.56k | 7.4k | 32.57 |

Key Ratios Snapshot

Some of the financial key ratios for Public Storage are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 51.9% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

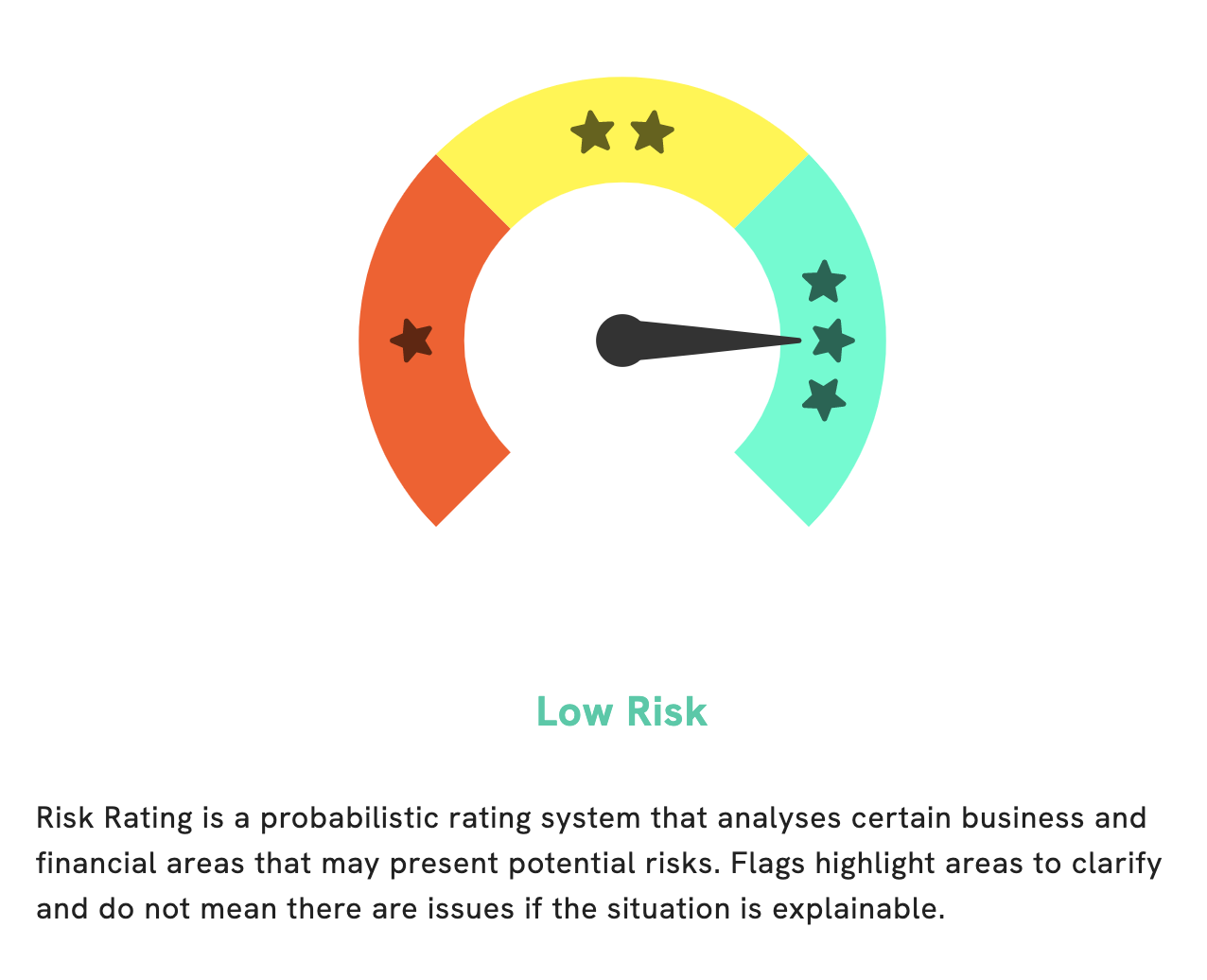

At GoodWhale, we have conducted an in-depth analysis of PUBLIC STORAGE‘s fundamentals. We have concluded that PUBLIC STORAGE is a low risk investment based on our Risk Rating. However, our analysis did detect one risk warning in the company’s balance sheet. If you would like to know more about this risk warning, please become a registered user at GoodWhale. We would be happy to provide you with more detailed information about the risk factor associated with PUBLIC STORAGE’s balance sheet. More…

Peers

Public Storage is a real estate investment trust that invests in self-storage facilities. The company was founded in 1972 and is headquartered in Glendale, California. Public Storage has over 2,200 locations in the United States and Europe. The company’s competitors include Life Storage Inc, Extra Space Storage Inc, and National Storage Affiliates Trust.

– Life Storage Inc ($NYSE:LSI)

Life Storage Inc is a US based self storage company. As of December 31, 2020, it operated 969 self storage facilities across the United States. The company has a market capitalization of $8.69 billion as of February 2021.

– Extra Space Storage Inc ($NYSE:EXR)

Extra Space Storage is a real estate investment trust that owns and operates self-storage properties across the United States. As of December 31, 2020, the company had 1,871 self-storage properties located in 40 states, Washington, D.C., and Puerto Rico. Extra Space Storage is the second largest self-storage company in the United States with a market cap of $22.22 billion as of February 2021.

– National Storage Affiliates Trust ($NYSE:NSA)

National Storage Affiliates Trust is a publicly traded real estate investment trust focused on the ownership, operation and acquisition of self storage properties located within the United States. As of December 31, 2020, the Company owned and operated 783 self storage properties located in 38 states with approximately 54.3 million rentable square feet.

Summary

Public Storage has recently begun constructing its first joint solar project with Solar Landscape, a commercial and industrial rooftop solar developer. Despite this promising news, the stock price of Public Storage moved down on the same day. Investors should keep an eye on how this project progresses, as it could be a strong indication of how Public Storage’s future investments will fare.

Additionally, monitoring how the company’s competitors respond to this news should also be considered when making investing decisions. As with any stock, investors should be sure to do their research and consider multiple factors before investing in Public Storage.

Recent Posts