Q4 Normalized FFO of $1.95 Beats Expectations by $0.06 for Innovative Industrial Properties

February 28, 2023

Trending News ☀️

The company credits their success to several deals including the sale leaseback of the Ohio medical-use cannabis cultivation facility, the acquisition of a Minnesota medical-use cannabis cultivation and processing facility, and a sale leaseback of the Michigan medical-use cannabis cultivation facility. Innovative Industrial Properties ($NYSE:IIPR) has also been busy with new developments, refurbishments, and redevelopments of existing properties in their portfolio that have led to a successful year for the company. With an experienced management team, access to capital, and steady demand for innovative industrial properties, the future is looking bright for this real estate giant.

Stock Price

Overall, the media response to the announcement has been quite positive, with analysts citing the company’s strong financial position and their ability to capitalize on the growing demand of medical cannabis. With its various investments in medical cannabis real estate, IIP is well-positioned to benefit from current and future growth in the sector. It will be interesting to see how IIP’s stock moves in the future, as it has now established itself as a strong competitor in the medical cannabis real estate market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for IIPR. More…

| Total Revenues | Net Income | Net Margin |

| 264.84 | 140.01 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for IIPR. More…

| Operations | Investing | Financing |

| 221.34 | -384.09 | 155.76 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for IIPR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.43k | 463.82 | 69.81 |

Key Ratios Snapshot

Some of the financial key ratios for IIPR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 61.9% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

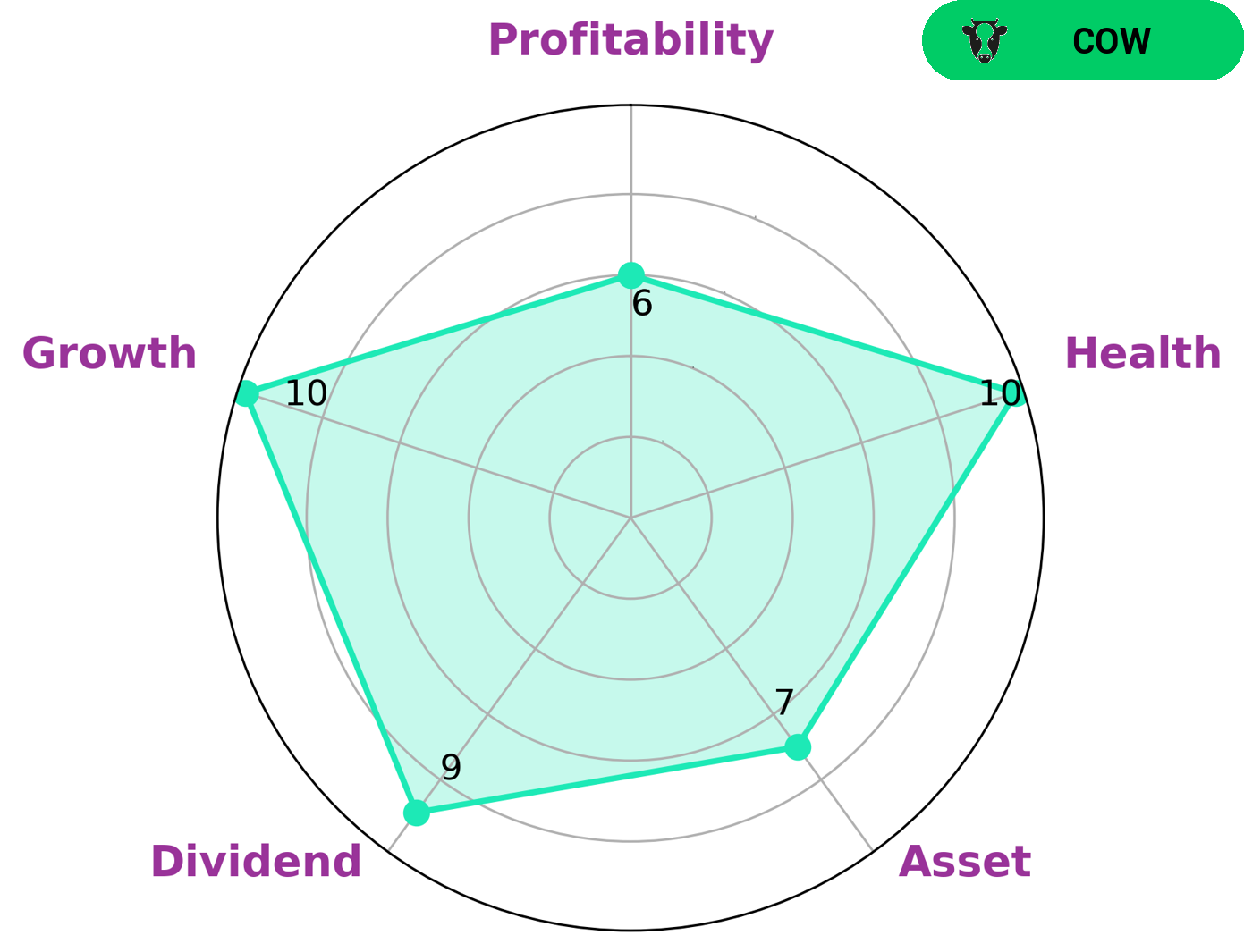

At GoodWhale, we recently conducted an analysis of INNOVATIVE INDUSTRIAL PROPERTIES’ wellbeing. Based on our Star Chart, INNOVATIVE INDUSTRIAL PROPERTIES is classified as a ‘cow’, meaning that it has a track record for paying out consistent and sustainable dividends. For investors that prefer a reliable income, INNOVATIVE INDUSTRIAL PROPERTIES is the perfect company to put their money in. It has a high health score of 10/10, which means that its cashflows and debt are in order, allowing it to safely ride out any crisis without the risk of bankruptcy. Furthermore, INNOVATIVE INDUSTRIAL PROPERTIES is strong in asset, dividend, and growth with medium profitability. All in all, with its great track record of steady dividends and high health score, we feel that INNOVATIVE INDUSTRIAL PROPERTIES is ideally suited for those investors that appreciate a dependable return on their investment. More…

Peers

The company’s competitors include Realty Income Corp, Prologis Inc, and Crown Castle International Corp.

– Realty Income Corp ($NYSE:O)

Realty Income Corporation is a real estate investment trust that focuses on the ownership of net-leased commercial properties in the United States. As of December 31, 2020, the Company owned 6,573 properties across 49 states and Puerto Rico. The Company’s leased properties are primarily leased to retail (70.3%), industrial (12.8%), healthcare (9.4%), and other commercial tenants (7.5%).

– Prologis Inc ($NYSE:PLD)

Prologis Inc is a leading global provider of logistics real estate with a focus on the industrial sector. As of 2022, the company has a market cap of 100.2 billion. Prologis owns and operates approximately 585 million square feet of industrial space in 19 countries. The company’s properties are located in key markets around the world, including North America, Europe, Asia and Latin America. Prologis’ focus on the industrial sector provides its customers with access to a wide range of logistics solutions, including warehouses, distribution centers, last-mile facilities and transshipment hubs.

– Crown Castle International Corp ($NYSE:CCI)

Crown Castle International Corp is a holding company that provides wireless infrastructure services in the United States. Its primary business is owning, operating, and leasing wireless communications towers and small cell nodes. As of 2021, the company had approximately 40,000 wireless communications towers and approximately 60,000 small cell nodes across the United States. The company was founded in 1994 and is headquartered in Canonsburg, Pennsylvania.

Recent Posts