CALPERS Reduces Stake in First Industrial Realty Trust by 4.3%

May 19, 2023

Trending News ☀️

First Industrial Realty ($NYSE:FR) Trust, Inc. is a real estate investment trust that specializes in the ownership, management, acquisition, development, and construction of industrial real estate across the United States. During the third quarter, the California Public Employees Retirement System (CalPERS) reduced its ownership of First Industrial Realty Trust, Inc. stocks by 4.3%. This is part of a larger trend of divestment from real estate investments among CalPERS, which has recently made similar moves to reduce its ownership of other publicly traded real estate firms. While the company’s stock may have dropped off as a result of the divestment, their overall portfolio has continued to perform well and they remain a strong player in the industrial real estate market.

Analysis

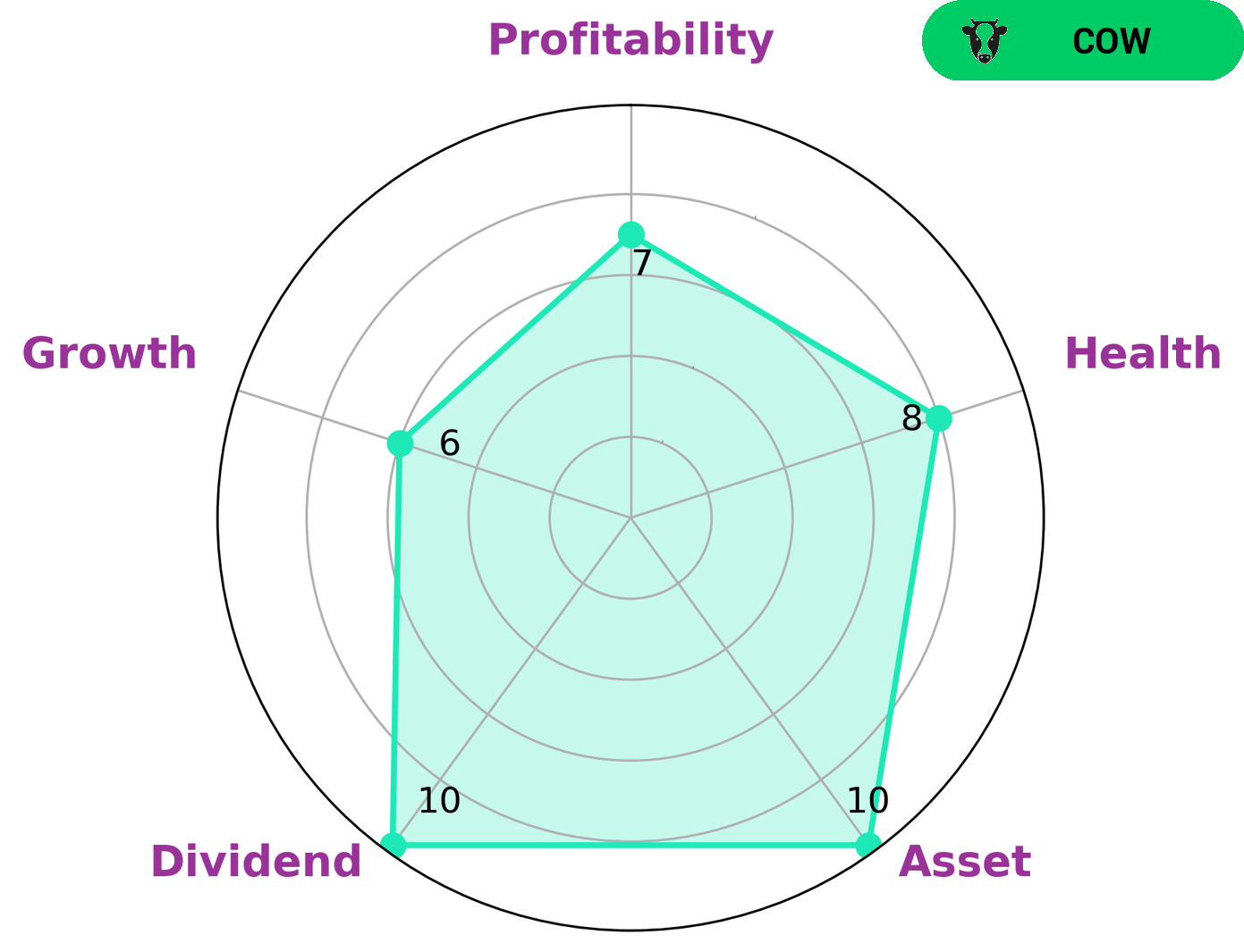

GoodWhale’s analysis of FIRST INDUSTRIAL REALTY TRUST’s financials reveals that it is strong in asset, dividend, profitability, and medium in growth. On the Star Chart, FIRST INDUSTRIAL REALTY TRUST has a high health score of 8/10, indicating that it is able to safely ride out any crisis without the risk of bankruptcy. In addition, due to its track record of paying out consistent and sustainable dividends, FIRST INDUSTRIAL REALTY TRUST is classified as a ‘cow’. Given these facts, investors who are looking for a safe and reliable investment, with the potential to generate steady returns through dividends, would likely be interested in FIRST INDUSTRIAL REALTY TRUST. Furthermore, investors with a longer-term outlook may also be interested in FIRST INDUSTRIAL REALTY TRUST due to its relatively high health score and strong financial performance in assets, dividends and profitability. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for FR. More…

| Total Revenues | Net Income | Net Margin |

| 563.84 | 378.48 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for FR. More…

| Operations | Investing | Financing |

| 410.9 | -629.11 | 304.55 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for FR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.95k | 2.42k | 19.12 |

Key Ratios Snapshot

Some of the financial key ratios for FR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 39.8% |

| FCF Margin | ROE | ROA |

| – | – | – |

Peers

First Industrial‘s competitors include LXP Industrial Trust, Prologis Inc, and Stag Industrial Inc.

– LXP Industrial Trust ($NYSE:LXP)

LXP Industrial Trust is a real estate investment trust that owns, operates, and leases a portfolio of approximately 50 industrial properties in the United States. The company’s properties are located in major markets across the country, including Los Angeles, Chicago, Dallas, Houston, and Atlanta. LXP Industrial Trust is publicly traded on the New York Stock Exchange under the ticker symbol “LXP.”

– Prologis Inc ($NYSE:PLD)

Prologis Inc is a real estate investment trust (REIT) that owns, operates, and develops warehouses and distribution centers. As of December 31, 2020, the company owned or had investments in 3,813 properties in 19 countries.

The company’s market capitalization is $94.6 billion as of 2022. Prologis Inc is one of the largest REITs in the world and is the largest owner, operator, and developer of warehouses and distribution centers.

– Stag Industrial Inc ($NYSE:STAG)

Stag Industrial Inc is a publicly traded real estate investment trust focused on the acquisition, ownership, and operation of single-tenant industrial properties across the United States. The company’s portfolio includes over 170 properties in 33 states, totaling over 26 million square feet of leasable space.

Summary

First Industrial Realty Trust, Inc. has recently seen a decrease in its share ownership by the California Public Employees Retirement System. This trend signals that investors may be reassessing the company’s performance in the industrial real estate market. Analysts suggest that investors look closely at current earnings reports and consider updating their portfolios with other industrial real estate plays. The company’s stock may be more volatile in the short-term, so investors should carefully evaluate the risks associated with any potential investment.

Recent Posts