Xenia Hotels & Resorts Opens at $13.50 Following Consistent Average Trading Volume

January 18, 2023

Trending News 🌥️

Xenia Hotels & Resorts ($NYSE:XHR) Inc. is a publicly traded real estate investment trust (REIT) that owns and operates a portfolio of hotels and resorts located throughout the United States. The company’s shares are traded on the New York Stock Exchange under the symbol XHR and closed at $13.45 on the previous trading day. Following the close, Xenia opened at $13.50 on the next trading day, supported by a consistent average trading volume. Xenia has a diverse portfolio of hotels and resorts, ranging from luxury to midscale, located in major cities and resort destinations across the United States. The company also owns one non-operating hotel property.

Xenia’s management team is experienced and well-qualified, with extensive knowledge of the hospitality industry and expertise in operations, development, capital markets and strategy. The company’s strategy is focused on maximizing value through disciplined capital allocation, active management of assets and opportunistic acquisitions. In addition to its hotel portfolio, Xenia also provides third-party hotel management services for hotels owned by third parties. The company is committed to providing superior customer service, delivering a superior guest experience and creating value for its owners, guests, associates and shareholders.

Market Price

At the time of writing, news about the company is mostly positive. On the same day, stock opened at $13.7 and closed at $13.9, up by 1.8% from its previous closing price of 13.7. The company has a diversified portfolio of hotels and resorts that span across multiple brands like Hilton, Marriott, Intercontinental Hotels Group, and Hyatt Hotels Corporation.

Analysts have given it a ‘Buy’ rating due to its strong fundamentals and potential for growth. With a diversified portfolio of hotels and resorts and strong fundamentals, it is one of the best investments in the hospitality industry right now. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for XHR. More…

| Total Revenues | Net Income | Net Margin |

| 938.04 | -2.27 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for XHR. More…

| Operations | Investing | Financing |

| 169.3 | -338.52 | -72.07 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for XHR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.09k | 1.63k | 12.63 |

Key Ratios Snapshot

Some of the financial key ratios for XHR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 10.4% |

| FCF Margin | ROE | ROA |

| – | – | – |

VI Analysis

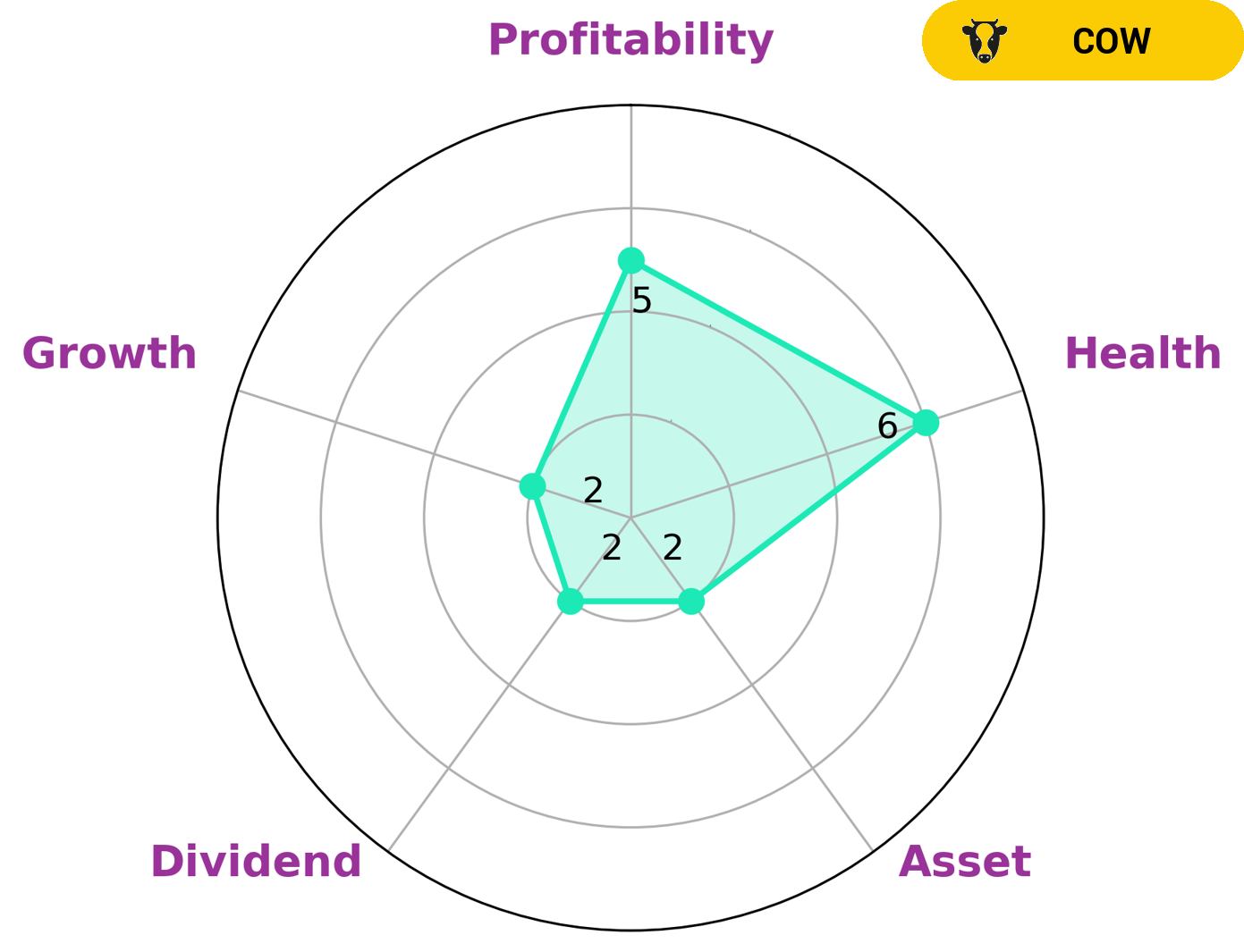

XENIA HOTELS & RESORTS is a company that has strong fundamentals and potential for long-term growth. With the help of VI app, its investors were able to get a comprehensive understanding of the company’s performance. According to the VI Star Chart, XENIA HOTELS & RESORTS was found to be strong in certain areas, medium in profitability and weak in asset, dividend, and growth. It is classified as a ‘cow’, which indicates that the company has a track record of paying out consistent and sustainable dividends. Such a company may be of interest to value investors, who seek to invest in companies with strong fundamentals and long-term potential. XENIA HOTELS & RESORTS has an intermediate health score of 6/10 with regards to its cashflows and debt, indicating that it might be able to pay off its debt and fund future operations. Investors should take into consideration all factors when deciding whether to invest in XENIA HOTELS & RESORTS. The company’s performance should be monitored over time to determine whether or not it is a good investment option. More…

VI Peers

The company’s portfolio consists of 63 hotels with over 12,400 rooms across the United States. RLJ Lodging Trust is a hospitality real estate investment trust that focuses on investing in premium branded, select-service, extended stay and independent hotels. The company’s portfolio consists of 157 properties with over 27,000 rooms across the United States. Diamondrock Hospitality Company is a real estate investment trust that focuses on owning premium full service hotels. The company’s portfolio consists of 31 properties with over 9,400 rooms across the United States. Braemar Hotels & Resorts, Inc. is a publicly traded real estate investment trust that focuses on owning and investing in upscale, full-service hotels located in resort and urban business markets. The company’s portfolio consists of 19 properties with over 3,700 rooms across the United States.

– RLJ Lodging Trust ($NYSE:RLJ)

RLJ Lodging Trust is a real estate investment trust that invests in upscale, full-service hotels. The company has a market cap of $1.96 billion as of March 2022. RLJ Lodging Trust is headquartered in Bethesda, Maryland, and has over 140 properties in the United States and Canada.

– Diamondrock Hospitality Co ($NYSE:DRH)

As of 2022, Diamondrock Hospitality Company has a market capitalization of 1.92 billion. The company is a real estate investment trust that focuses on owning and operating premium hotels across the United States.

– Braemar Hotels & Resorts Inc ($NYSE:BHR)

Braemar Hotels & Resorts Inc is a publicly traded company that owns, operates, and develops hotels and resorts. As of 2022, the company has a market capitalization of 281.54 million.

Braemar Hotels & Resorts was founded in 1968 and is headquartered in Dallas, Texas. The company’s portfolio includes properties in the United States, Canada, Mexico, and the Caribbean. Braemar Hotels & Resorts is a leading operator of full-service hotels and resorts.

Summary

Xenia Hotels & Resorts Inc. is an attractive investment opportunity for those interested in the hospitality industry. The company opened at $13.50, with a consistent average trading volume. News reports surrounding the company have been largely positive, demonstrating that it is a safe and reliable investment. It is a great choice for those looking to diversify their portfolio and invest in a strong and stable business.

The company’s financials are solid, showing strong growth potential and a reliable income stream. It also has a history of outperforming the industry as a whole. Xenia Hotels & Resorts Inc. is an ideal choice for those looking to make a smart investment in a company that is profitable and has a bright future.

Recent Posts