Ryman Hospitality Properties Rated “Moderate Buy” by Brokerages in 2023.

March 29, 2023

Trending News 🌥️

Ryman Hospitality Properties ($NYSE:RHP) Inc. (RHP) has been rated “Moderate Buy” by brokerages in 2023. This average rating has been based on an evaluation of the company’s fundamentals, financials and prospects. The company is engaged in the ownership, development, and management of hotels and resorts primarily in the United States. RHP has seen a steady increase in revenue over the past few years, indicating that the company is well-positioned for growth. The company has many well-known properties, including the Gaylord Hotels and Resorts and the Ryman Hotels and Resorts, which are two of the largest hospitality companies in the United States. Furthermore, Ryman Hospitality Properties has also acquired several other hotels and resorts in recent years, which has further strengthened their presence in the industry.

In addition to its impressive financials, Ryman Hospitality Properties also has a strong management team with extensive experience in the hospitality sector. The company is well managed and operates efficiently, which have contributed to its success. Overall, Ryman Hospitality Properties is a strong player in the hospitality industry and is well positioned for continued growth. The company’s financials, management team, and recent acquisitions all point to a bright future for the company. With a rating of “Moderate Buy” from brokerages, Ryman Hospitality Properties is an attractive investment opportunity.

Market Price

On Thursday, Ryman Hospitality Properties (NYSE: RHP) stock opened at $82.0 and closed at $79.3, representing a 3.0% decrease from the previous closing price of $81.8. Analysts have cited Ryman’s strong balance sheet and stable cash flows as positives to the company’s outlook in the coming year. Furthermore, Ryman has made considerable investments in its portfolio of properties, which have seen increased revenue over the last several years. As such, many have argued that Ryman is well-positioned to capitalize on the economic recovery and make further gains in 2023. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for RHP. More…

| Total Revenues | Net Income | Net Margin |

| 1.81k | 128.99 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for RHP. More…

| Operations | Investing | Financing |

| 419.93 | -189.31 | 50.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for RHP. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.04k | 3.63k | -0.4 |

Key Ratios Snapshot

Some of the financial key ratios for RHP are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 18.2% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

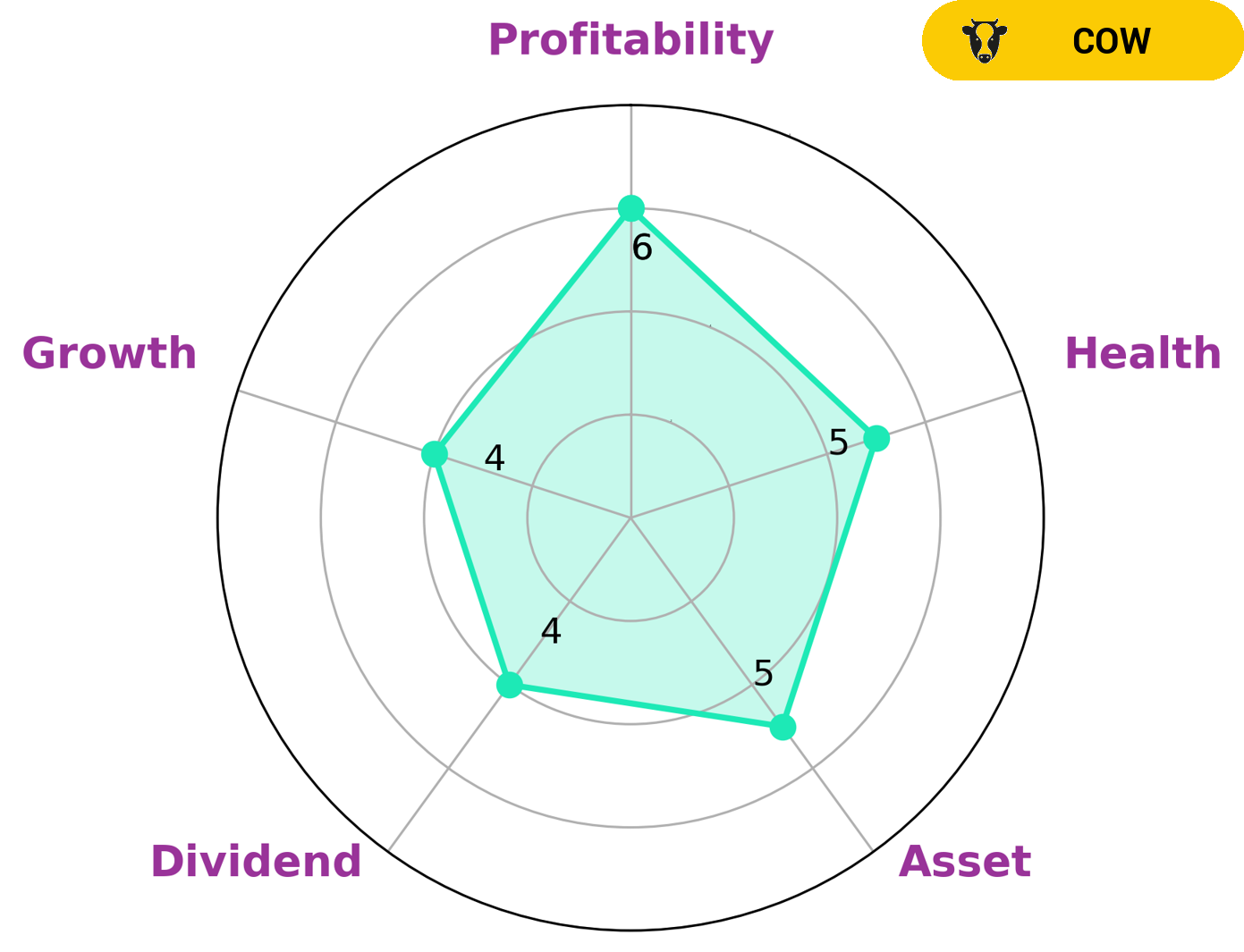

GoodWhale has recently conducted an analysis of RYMAN HOSPITALITY PROPERTIES’s financials. According to our Star Chart, RYMAN HOSPITALITY PROPERTIES is strong in asset, dividend, growth, and profitability, and medium in these categories. After conducting an analysis of RYMAN HOSPITALITY PROPERTIES, we can conclude that it is a ‘cow’ type of company that has the track record of paying out consistent and sustainable dividends. Investors looking for such a company may be interested in RYMAN HOSPITALITY PROPERTIES. Our analysis also indicates that RYMAN HOSPITALITY PROPERTIES has an intermediate health score of 5/10 considering its cashflows and debt, which suggests that it may be able to safely ride out any crisis without the risk of bankruptcy. More…

Peers

The company owns or operates a portfolio of properties, including the historic Ryman Auditorium, the Grand Ole Opry, and the Opryland Hotel in Nashville, Tennessee. Ryman also owns and operates a number of other hotels and resorts, including the Gaylord Palms Resort & Convention Center in Orlando, Florida and the Gaylord Texan Resort & Convention Center in Grapevine, Texas. Sunstone Hotel Investors, Inc. is a real estate investment trust (REIT) that specializes in owning, acquiring, redeveloping, and operating upscale, full-service hotels in the United States. Braemar Hotels & Resorts, Inc. is a real estate investment trust (REIT) that specializes in owning and operating upscale, full-service hotels and resorts in the United States. Summit Hotel Properties, Inc. is a real estate investment trust (REIT) that specializes in owning premium-branded, select-service hotels in the United States.

– Sunstone Hotel Investors Inc ($NYSE:SHO)

Sunstone Hotel Investors Inc., a real estate investment trust (REIT), focuses on the ownership of upscale, full-service hotels in the United States. As of December 31, 2020, the company’s portfolio consisted of 97 hotels with a total of 19,011 rooms. The company was founded in 1995 and is headquartered in Irvine, California.

– Braemar Hotels & Resorts Inc ($NYSE:BHR)

As of 2022, Braemar Hotels & Resorts Inc’s market cap is $333 million. The company owns, operates, and develops hotels and resorts. Its portfolio includes properties in North America, Europe, and Asia.

– Summit Hotel Properties Inc ($NYSE:INN)

Summit Hotel Properties, Inc. owns, acquires, renovates, develops, repositions and operates premium hotels in the upper-upscale segment of the lodging industry. As of December 31, 2020, the Company’s portfolio consisted of 69 hotels with 11,196 rooms across 31 markets in 23 states.

Summary

RYMAN HOSPITALITY PROPERTIES has been rated “Moderate Buy” by brokerages in 2023. Despite this, the stock price moved down the day of the rating release. This could be attributed to a number of factors such as high competition, uncertainty in the market due to the pandemic, or industry-specific issues.

However, investors should pay attention to the rating and consider it in their long-term investment strategy. It is important to research the company, the industry, and understand how the company is positioned relative to its competitors in order to make a more informed decision. It is also important to consider the potential risks associated with investing in RYMAN HOSPITALITY PROPERTIES, such as changes in the market, government policies, or other external forces. Ultimately, investors should carefully weigh the risks and rewards of investing in RYMAN HOSPITALITY PROPERTIES before making a decision.

Recent Posts