PK Intrinsic Value Calculator – Park Hotels & Resorts Reports Record Quarterly Earnings of $648M, Surpassing Expectations by $30.96M

May 2, 2023

Trending News 🌥️

The company reported funds from operations (FFO) of $0.37 per share, exceeding analyst expectations by $0.04 and revenue of $648 million, surpassing estimates by $30.96 million. This marks the first time that the company has achieved such financial success in its history. Park Hotels & Resorts ($NYSE:PK) is one of the country’s premier lodging companies, owning and operating premier hotels, resorts and other hospitality-related investments across the United States and internationally. The company’s strong performance in the first quarter is attributed to increased occupancy rates among its portfolio and improved pricing power. Park Hotels & Resorts also benefited from the continued consumer preference for longer-term stay options due to an increase in leisure travel and the shift to ‘work from home’.

The company also attributed their success to their cost-management strategies, which enabled them to reduce expenses. With a strong portfolio of properties and successful cost-management strategies, the company is well-positioned for continued growth in the coming quarters.

Price History

In response to the earnings report, the company’s stock opened at $12.6 and closed at $12.3, up 2.1% from its previous closing price of $12.0. These record earnings demonstrate the continued success and growth of PARK HOTELS & RESORTS, a testament to its leadership and commitment to providing quality service and accommodations to its guests and customers. With such strong financial results, Park Hotels & Resorts is sure to continue its impressive performance in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for PK. More…

| Total Revenues | Net Income | Net Margin |

| 2.5k | 162 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for PK. More…

| Operations | Investing | Financing |

| 409 | 87 | -320 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for PK. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.73k | 5.44k | 19.37 |

Key Ratios Snapshot

Some of the financial key ratios for PK are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 11.6% |

| FCF Margin | ROE | ROA |

| – | – | – |

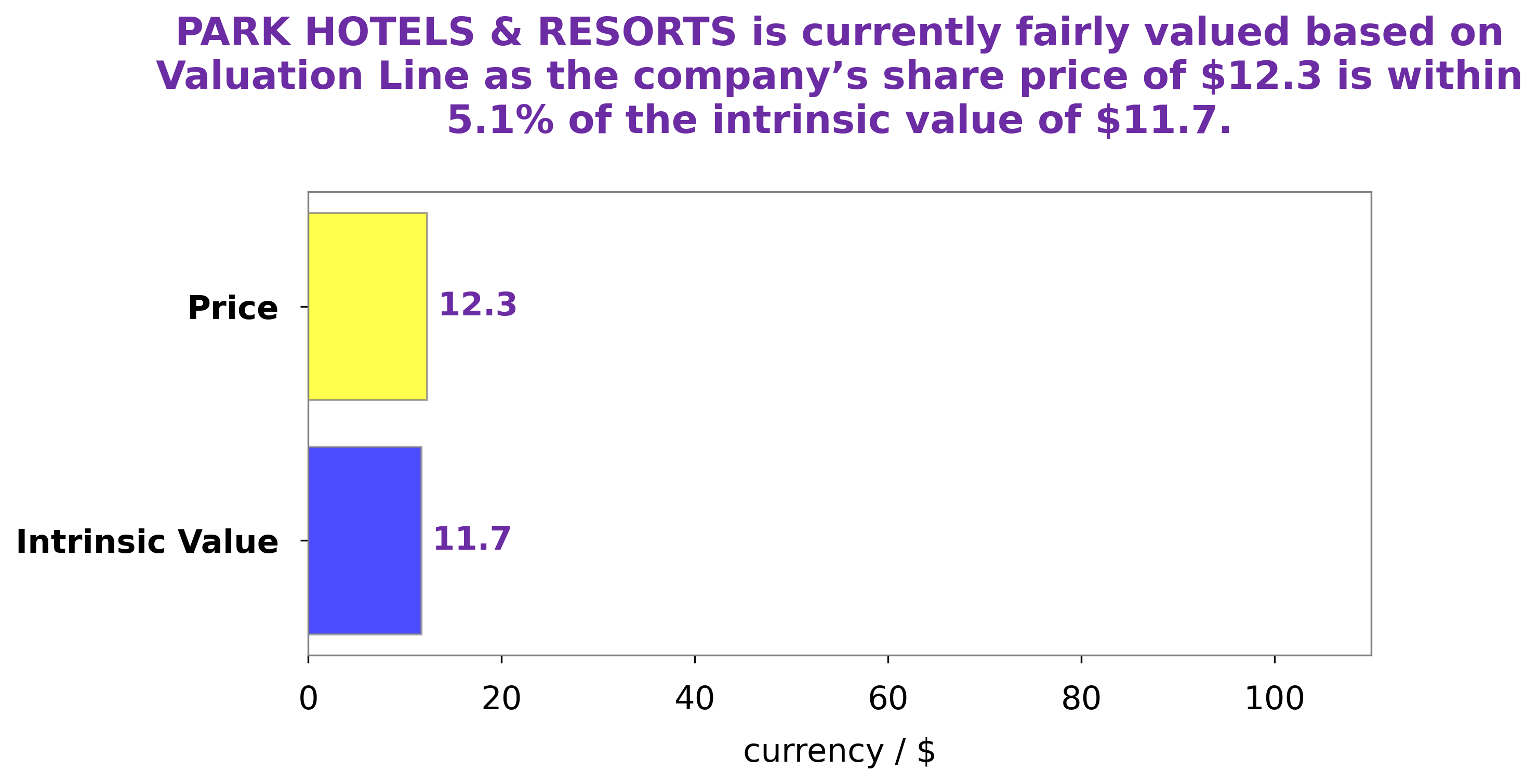

Analysis – PK Intrinsic Value Calculator

According to our proprietary valuation Line, the intrinsic value of the company’s stock is $11.7. Currently, the stock is being traded at $12.3, representing a 5.2% overvaluation. This means that there is an opportunity for investors to buy PARK HOTELS & RESORTS’s shares at a price that is slightly higher than what would be expected from a purely financial standpoint. More…

Peers

The company’s portfolio includes Marriott, Hilton, Hyatt, and Intercontinental hotels. Park Hotels & Resorts Inc’s competitors include Apple Hospitality REIT Inc, Ryman Hospitality Properties Inc, Pebblebrook Hotel Trust.

– Apple Hospitality REIT Inc ($NYSE:APLE)

Apple Hospitality REIT Inc. is a real estate investment trust (REIT) that owns and operates a portfolio of upscale, select-service hotels located in the United States. As of December 31, 2020, the Company’s portfolio consisted of 235 hotels with approximately 30,000 guest rooms.

– Ryman Hospitality Properties Inc ($NYSE:RHP)

Ryman Hospitality Properties Inc is a real estate investment trust that owns, operates, and develops hotels and resorts in the United States. The company has a market cap of 4.68B as of 2022. Ryman Hospitality Properties Inc was founded in 1994 and is headquartered in Nashville, Tennessee.

– Pebblebrook Hotel Trust ($NYSE:PEB)

Pebblebrook Hotel Trust is a real estate investment trust that owns and invests in hotels. The company has a market cap of 2.07B as of 2022. Pebblebrook Hotel Trust is headquartered in Bethesda, Maryland, and was founded in 2009. The company focuses on investing in hotel properties located in major urban markets in the United States.

Summary

Park Hotels & Resorts recently reported FFO of $0.37 per share, surpassing expectations of $0.04. Analysts remain bullish on the stock, pointing to the company’s strong balance sheet and commitment to cost cutting efforts as reasons for a positive outlook for Park Hotels & Resorts.

Recent Posts