Pennsylvania Public School Employees Retirement System Boosts Investment in Sunstone Hotel Investors, Inc

June 11, 2023

☀️Trending News

The Commonwealth of Pennsylvania Public School Employees Retirement System (PSERS) has recently boosted its investment in Sunstone Hotel Investors ($NYSE:SHO), Inc., a real estate investment trust (REIT). This marks the latest move by PSERS to expand its portfolio in the hospitality sector. Sunstone Hotel Investors is one of the largest lodging REITs in the United States. These investments have helped to bolster Sunstone’s presence in high-demand markets.

This move by PSERS is yet another indication of the continued confidence in Sunstone Hotel Investors, Inc. With their latest investment, PSERS joins a roster of other institutional investors that have put their faith in the hospitality REIT. Sunstone’s long-term success is reflective of the strong performance of the hospitality industry in recent years, and this increased stake from PSERS only serves to solidify Sunstone’s position as a top-performing hotel REIT.

Market Price

The company’s stock opened at $10.7 and closed at the same price, representing a decrease of 0.9% from the previous closing price of 10.8. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SHO. More…

| Total Revenues | Net Income | Net Margin |

| 983.18 | 79.67 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SHO. More…

| Operations | Investing | Financing |

| 243.48 | -352.55 | 0.18 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SHO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.07k | 1k | 8.64 |

Key Ratios Snapshot

Some of the financial key ratios for SHO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 13.3% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

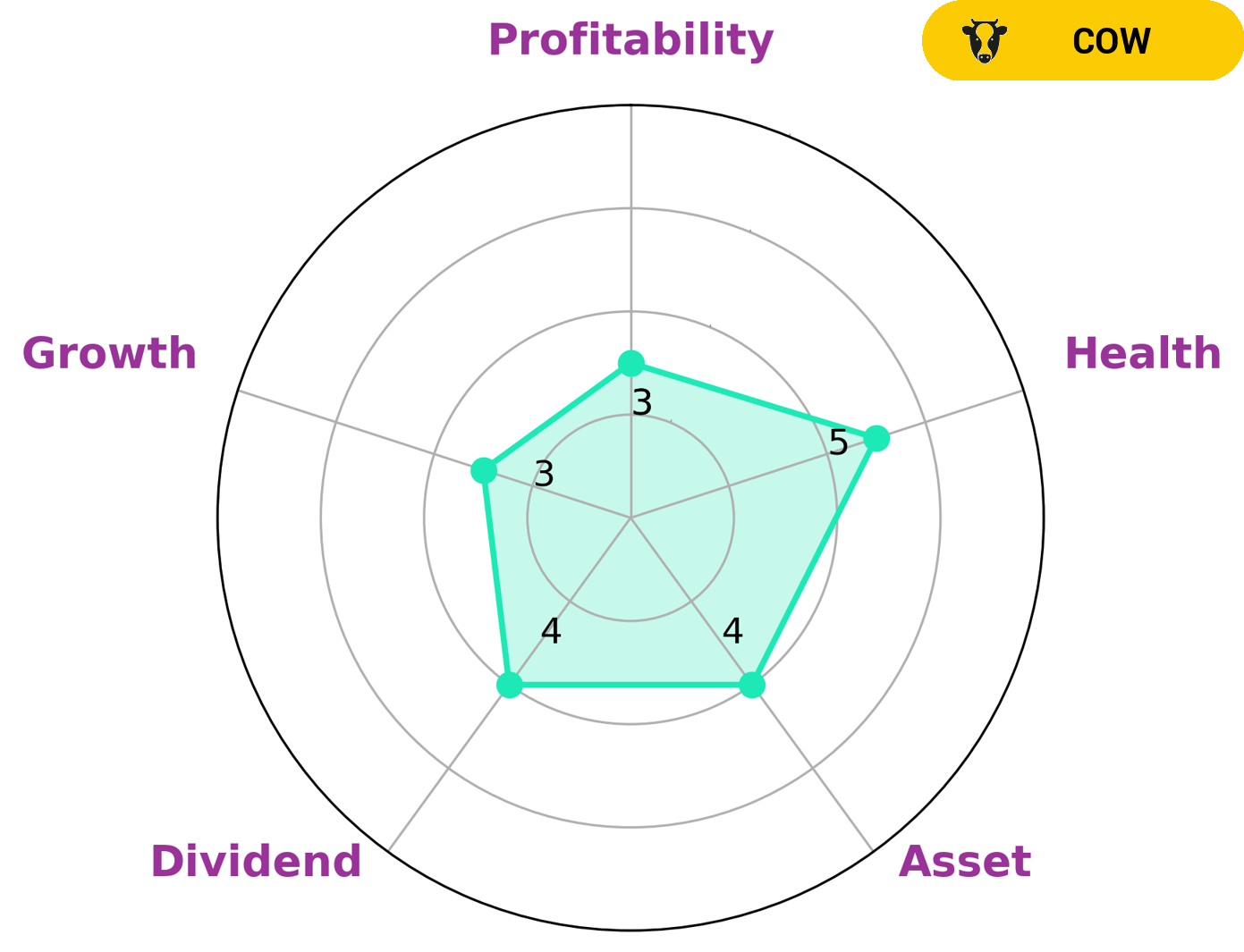

After conducting a comprehensive analysis of SUNSTONE HOTEL INVESTORS’s wellbeing, GoodWhale has classified the company as a ‘cow’ on our Star Chart. This type of company is typically known for paying out consistent and sustainable dividends. As such, investors who are looking for steady income streams may be particularly interested in this company. Furthermore, our analysis revealed that SUNSTONE HOTEL INVESTORS has an intermediate health score of 5/10 with regard to its cashflows and debt. This suggests that it is likely to safely ride out any crisis without the risk of bankruptcy. Additionally, the company is strong in asset quality, medium in dividend stability, and weak in growth and profitability. More…

Peers

In the hotel industry, Sunstone Hotel Investors Inc is in competition with Summit Hotel Properties Inc, Apple Hospitality REIT Inc, and Service Properties Trust. These companies are all competing for market share in the hotel industry. Its competitors are also well-known and have a strong presence in the market.

– Summit Hotel Properties Inc ($NYSE:INN)

Summit Hotel Properties, Inc. is a real estate investment trust. The Company focuses on owning premium-branded select-service and extended-stay hotels in the U.S. REITs are company’s that own, and in some cases, operate income-producing real estate.

– Apple Hospitality REIT Inc ($NYSE:APLE)

The company’s market cap is 3.66B as of 2022. The company focuses on providing hospitality real estate investment trusts (REITs) in the United States. It operates through two segments, Hotel Operations and Development. The Hotel Operations segment acquires, owns, leases, operates, and disposes of Marriott branded hotels. The Development segment is involved in developing Marriott branded hotels. As of December 31, 2020, the company owned 269 properties with 74,761 rooms.

– Service Properties Trust ($NASDAQ:SVC)

Service Properties Trust is a real estate investment trust that owns, operates, and develops hotels and resorts. The company has a market cap of $1.24 billion as of 2022. Service Properties Trust is headquartered in Boston, Massachusetts.

Summary

Sunstone Hotel Investors, Inc., a real estate investment trust (REIT), has seen an increase in its stake in the company by the Commonwealth of Pennsylvania Public School Employees Retirement System (PSERS). The investment indicates confidence in the company’s prospects and long-term growth potential. Analysts believe this signals a strong belief in Sunstone’s ability to generate attractive returns for investors. The company is set to benefit from favorable industry trends such as increasing demand for hotel rooms driven by a stronger economy and the emergence of online travel agents.

Sunstone also stands to benefit from its strategy of increasing its portfolio of select service and upscale hotels. Analysts expect the increase in PSERS’ stake to result in increased value for Sunstone stockholders over time.

Recent Posts