Janney Montgomery Scott LLC Invests in Park Hotels & Resorts

January 30, 2023

Trending News 🌥️

Janney Montgomery Scott LLC has recently acquired a stake in Park Hotels & Resorts ($NYSE:PK) Inc, a publicly traded real estate investment trust (REIT) that specializes in acquiring and managing upscale, full-service hotels and resorts. Park Hotels & Resorts is focused on providing superior service to its guests and shareholders through an unwavering commitment to excellence. The company has developed a portfolio of world-class, award-winning hotels and resorts that offer luxury accommodations and amenities. Park Hotels & Resorts also offers a wide range of services, including meeting and event planning, business center services, and fine dining experiences.

Additionally, the company’s loyalty program rewards its customers with special offers and discounts. By investing in Park Hotels & Resorts Inc., Janney Montgomery Scott LLC is helping to ensure the growth and success of a leading hotel and resort company. Park Hotels & Resorts is well-positioned to capitalize on the increasing demand for upscale accommodations, as the company continues to expand its portfolio of properties. As one of the largest owners of hotels and resorts in the United States, Park Hotels & Resorts is dedicated to providing superior service to its guests and shareholders.

Price History

On Monday, Janney Montgomery Scott LLC made a significant investment in Park Hotels & Resorts Inc. As a result, the stock for PARK HOTELS & RESORTS opened at $13.0 and closed at $13.4, up by 3.5% from prior closing price of 12.9. This is the highest closing price for the company since early March. This news has been welcomed by investors who are looking for signs of growth in the hospitality industry. Park Hotels & Resorts Inc operates a diversified portfolio of hotels and resorts in major markets across the United States and Canada. The company has a strong track record of providing excellent customer experience and superior returns to its investors.

The investment by Janney Montgomery Scott LLC indicates that the hospitality industry is recovering from the effects of the pandemic. Park Hotels & Resorts is well-positioned to capitalize on this recovery, as it leverages its portfolio of hotels and resorts to provide excellent services and amenities to its customers. This investment will allow the company to continue to pursue new opportunities and unlock greater value for its shareholders. Overall, this investment by Janney Montgomery Scott LLC in Park Hotels & Resorts Inc is a positive sign for the hospitality industry and is a great opportunity for investors to get in on the ground floor of a promising business. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for PK. More…

| Total Revenues | Net Income | Net Margin |

| 2.29k | 61 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for PK. More…

| Operations | Investing | Financing |

| 215 | 394 | -475 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for PK. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.79k | 5.47k | 19.41 |

Key Ratios Snapshot

Some of the financial key ratios for PK are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 9.1% |

| FCF Margin | ROE | ROA |

| – | – | – |

VI Analysis

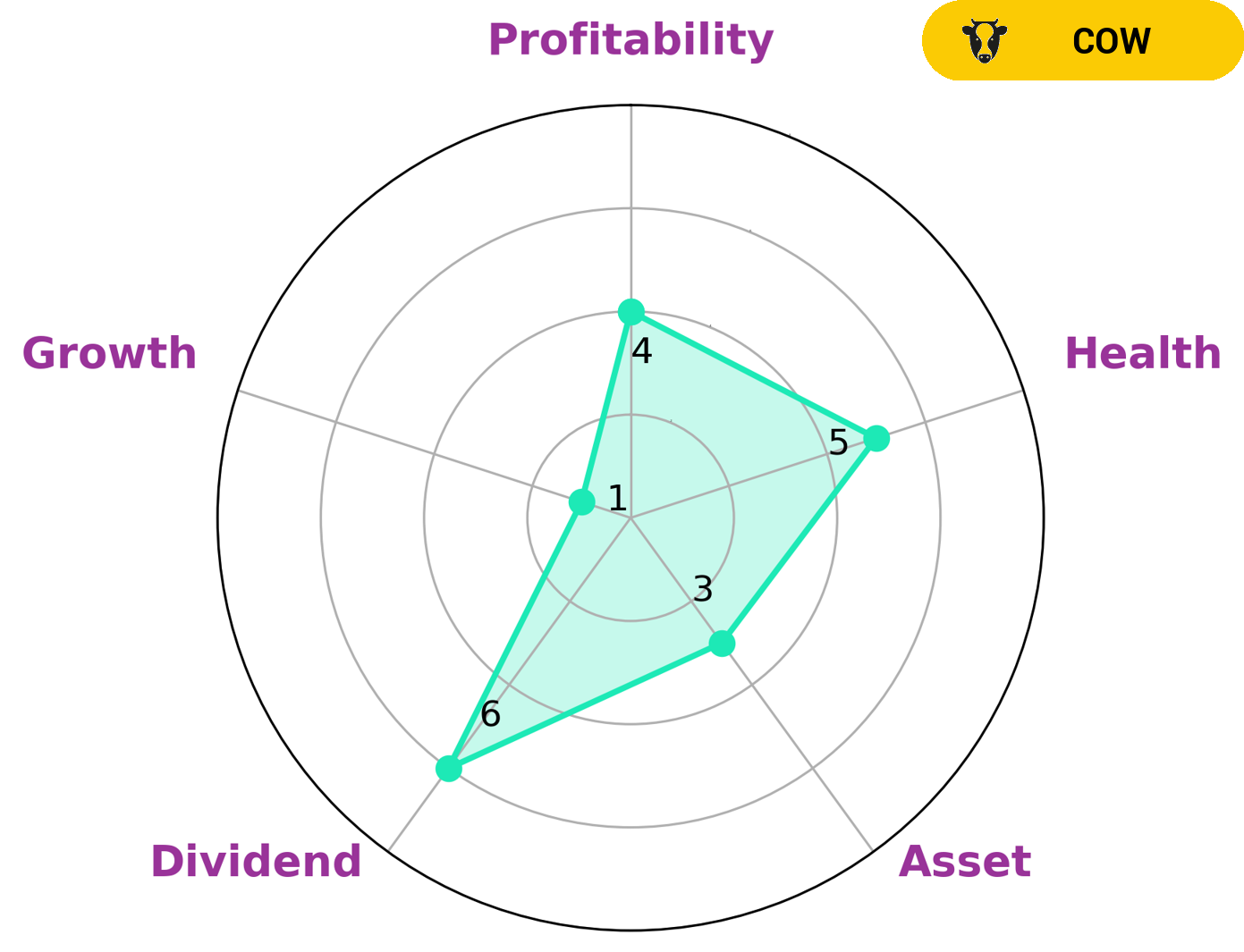

Investors looking for consistent and sustainable dividends may be interested in PARK HOTELS & RESORTS as the VI Star Chart classified them as a ‘cow’, indicating a track record of such. The company’s fundamentals also reflect its long term potential, as per the VI app analysis. PARK HOTELS & RESORTS has an intermediate health score of 5/10, indicating that it might be able to pay off debt and fund future operations. When it comes to the key metrics, PARK HOTELS & RESORTS is strong in cash flows, medium in dividend, profitability and weak in asset and growth. Investors should take all these factors into consideration before investing in companies like PARK HOTELS & RESORTS. They should also look into company performance in terms of revenue, profits and cash flows and assess the company’s financial stability based on its balance sheet. Additionally, they should look into the company’s competitive advantage to determine the potential for long-term growth. Overall, PARK HOTELS & RESORTS may be a good option for investors who are looking for stable, consistent dividends, but they should consider all the factors before making an investment decision. More…

VI Peers

The company’s portfolio includes Marriott, Hilton, Hyatt, and Intercontinental hotels. Park Hotels & Resorts Inc’s competitors include Apple Hospitality REIT Inc, Ryman Hospitality Properties Inc, Pebblebrook Hotel Trust.

– Apple Hospitality REIT Inc ($NYSE:APLE)

Apple Hospitality REIT Inc. is a real estate investment trust (REIT) that owns and operates a portfolio of upscale, select-service hotels located in the United States. As of December 31, 2020, the Company’s portfolio consisted of 235 hotels with approximately 30,000 guest rooms.

– Ryman Hospitality Properties Inc ($NYSE:RHP)

Ryman Hospitality Properties Inc is a real estate investment trust that owns, operates, and develops hotels and resorts in the United States. The company has a market cap of 4.68B as of 2022. Ryman Hospitality Properties Inc was founded in 1994 and is headquartered in Nashville, Tennessee.

– Pebblebrook Hotel Trust ($NYSE:PEB)

Pebblebrook Hotel Trust is a real estate investment trust that owns and invests in hotels. The company has a market cap of 2.07B as of 2022. Pebblebrook Hotel Trust is headquartered in Bethesda, Maryland, and was founded in 2009. The company focuses on investing in hotel properties located in major urban markets in the United States.

Summary

Investing in Park Hotels & Resorts Inc. is a smart move for investors as the stock has recently seen an increase in price. The company specializes in owning and operating hotels and resorts in the United States and has seen a steady increase in revenue over the years. The company is well-diversified and has a broad portfolio of properties, giving investors a range of choices when investing. Analysts believe the company is well-positioned to continue its growth trajectory, making it an attractive option for long-term investors.

The company also has strong financials and a strong balance sheet, making it an appealing choice for those looking to diversify their portfolio. Park Hotels & Resorts Inc. is one of the top picks in the industry, making it a great choice for investors.

Recent Posts