CI Investments Increases Investment in Ryman Hospitality Properties,

March 6, 2023

Trending News 🌥️

CI Investments Inc. recently announced its increased investment in Ryman Hospitality Properties ($NYSE:RHP), Inc., one of the largest owners of premium hotel and entertainment assets in the United States. Ryman Hospitality Properties is a real estate investment trust that focuses on owning and operating high-end hospitality assets and branded hospitality development projects in the United States. The company owns major properties such as the Gaylord Palms Resort & Convention Center, Gaylord National Resort & Convention Center, Gaylord Opryland Resort & Convention Center, and Gaylord Texan Resort & Convention Center. It also owns entertainment venues such as the Grand Ole Opry, the General Jackson Showboat, and the Ole Red entertainment brands. CI Investments’ increased investment in Ryman Hospitality Properties is part of a strategic move to strengthen the company’s growth and expand its portfolio of premium hospitality assets.

By taking a larger ownership stake in Ryman, CI Investments can take advantage of the company’s success as it continues to expand its presence in the hospitality industry. This investment will also help CI Investments to capitalize on the growing demand for high-quality hospitality services, as well as the growing desire of consumers to experience premium services. The partnership between CI Investments and Ryman Hospitality Properties is an exciting development for both companies, as it allows them to capitalize on each other’s strengths and create a strong presence in the hospitality industry. With increased support from CI Investments, Ryman will be able to further develop its portfolio of premium hospitality assets and create more opportunities for growth in the future.

Share Price

News sentiment surrounding Ryman Hospitality Properties, Inc. (RYMAN) received a boost on Friday when CI Investments Inc. announced that it had increased its stake in the company. In response to the news, the share price for Ryman opened at $96.2 and closed at $95.6, up 0.1% from its previous closing price of $95.5. Analysts have suggested that the news is indicative of increasing positive sentiment, which could result in future performance gains. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for RHP. More…

| Total Revenues | Net Income | Net Margin |

| 1.81k | 128.99 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for RHP. More…

| Operations | Investing | Financing |

| 419.93 | -189.31 | 50.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for RHP. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.04k | 3.63k | -0.4 |

Key Ratios Snapshot

Some of the financial key ratios for RHP are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 18.2% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

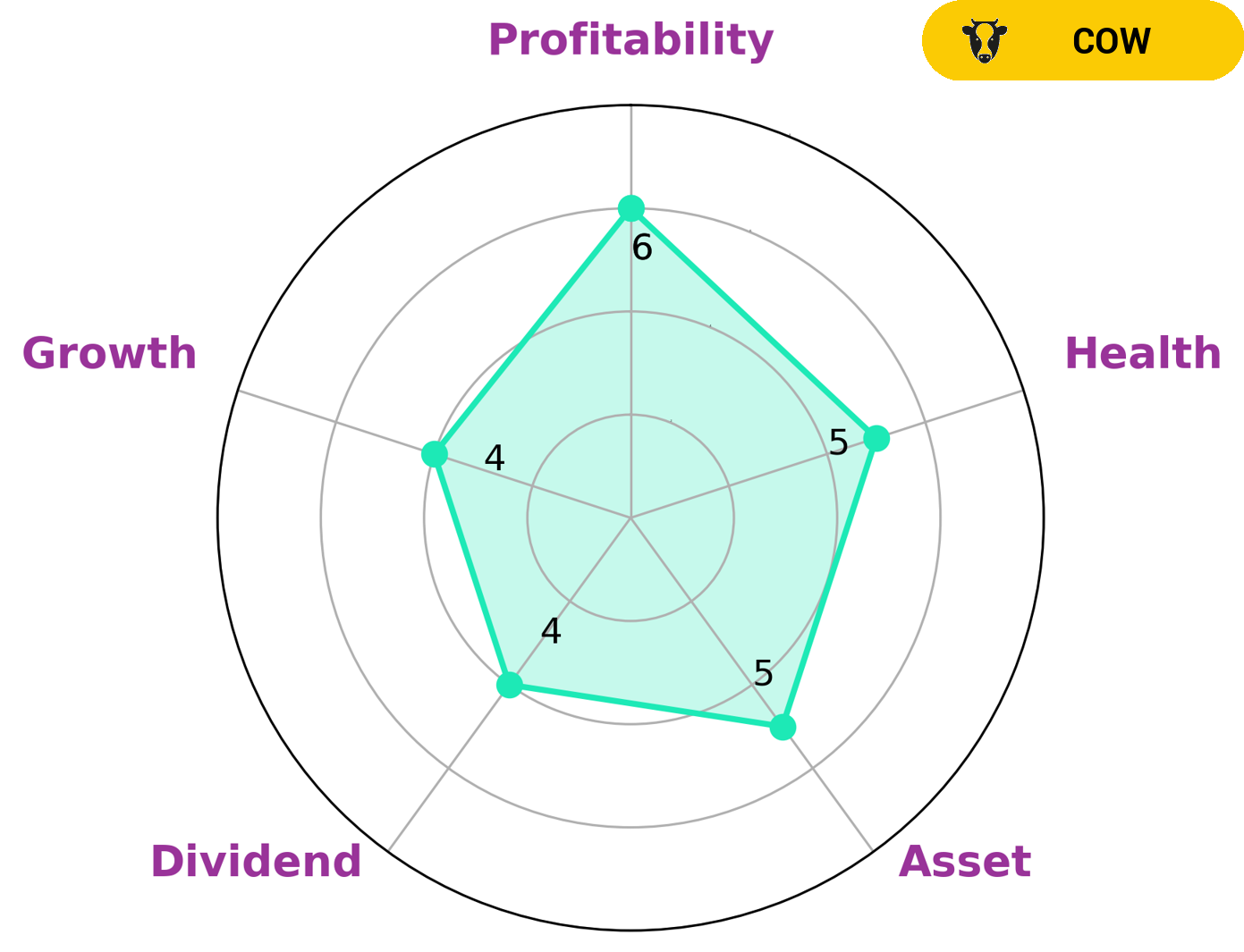

According to the Star Chart, RYMAN HOSPITALITY PROPERTIES is in a strong position in asset, dividend, growth and profitability, and in a medium position for those measures. This makes it a ‘cow’, a type of company that pays out consistent and sustainable dividends. This makes it an attractive choice for investors looking for a safe and reliable dividend income. The health score of RYMAN HOSPITALITY PROPERTIES is 5/10, which means that it is in an intermediate position when considering its cashflows and debt. This suggests that the company should be able to ride out any crisis safely without the risk of bankruptcy. More…

Peers

The company owns or operates a portfolio of properties, including the historic Ryman Auditorium, the Grand Ole Opry, and the Opryland Hotel in Nashville, Tennessee. Ryman also owns and operates a number of other hotels and resorts, including the Gaylord Palms Resort & Convention Center in Orlando, Florida and the Gaylord Texan Resort & Convention Center in Grapevine, Texas. Sunstone Hotel Investors, Inc. is a real estate investment trust (REIT) that specializes in owning, acquiring, redeveloping, and operating upscale, full-service hotels in the United States. Braemar Hotels & Resorts, Inc. is a real estate investment trust (REIT) that specializes in owning and operating upscale, full-service hotels and resorts in the United States. Summit Hotel Properties, Inc. is a real estate investment trust (REIT) that specializes in owning premium-branded, select-service hotels in the United States.

– Sunstone Hotel Investors Inc ($NYSE:SHO)

Sunstone Hotel Investors Inc., a real estate investment trust (REIT), focuses on the ownership of upscale, full-service hotels in the United States. As of December 31, 2020, the company’s portfolio consisted of 97 hotels with a total of 19,011 rooms. The company was founded in 1995 and is headquartered in Irvine, California.

– Braemar Hotels & Resorts Inc ($NYSE:BHR)

As of 2022, Braemar Hotels & Resorts Inc’s market cap is $333 million. The company owns, operates, and develops hotels and resorts. Its portfolio includes properties in North America, Europe, and Asia.

– Summit Hotel Properties Inc ($NYSE:INN)

Summit Hotel Properties, Inc. owns, acquires, renovates, develops, repositions and operates premium hotels in the upper-upscale segment of the lodging industry. As of December 31, 2020, the Company’s portfolio consisted of 69 hotels with 11,196 rooms across 31 markets in 23 states.

Summary

CI Investments Inc. recently increased their investment in Ryman Hospitality Properties, Inc. (RYMAN). Analysis of the company’s performance in recent months has indicated positive trends, which makes this a good time to invest. The stock has also experienced an increase in value of over 10%, indicating that investors have faith in the company’s future prospects.

Recent Posts