Barclays PLC Increases Investment in Ryman Hospitality Properties,

February 10, 2023

Trending News 🌥️

Barclays PLC announced a major increase in its ownership of Ryman Hospitality Properties ($NYSE:RHP), Inc. This move is a big sign of confidence in the hospitality industry as a whole. The hotels owned by Ryman Hospitality include brands such as Marriott, Hilton, Hyatt, and Intercontinental. Barclays PLC’s increased investment in Ryman Hospitality Properties, Inc. is sure to further solidify the company’s place in the hospitality industry. This move will also help Ryman Hospitality expand its reach and strengthen its position both financially and operationally. The increased ownership will provide Ryman Hospitality with more resources to continue its growth and development. The hospitality industry has seen a dramatic shift towards digitalization in recent years and Ryman Hospitality Properties, Inc. has been quick to take advantage of this change. The company has worked hard to improve its online booking capabilities, making it easier and more efficient for customers to book rooms through their website and mobile apps.

Additionally, Ryman Hospitality has sought to improve customer experience through the introduction of innovative technologies such as virtual reality and artificial intelligence. Ryman Hospitality Properties, Inc. has been praised for its commitment to sustainability and its efforts to reduce its environmental impact. The company is committed to reducing energy usage and utilizing environmentally friendly practices across its hotels and resorts. With Barclays PLC’s increased investment, Ryman Hospitality is sure to continue its commitment to sustainability and environmental responsibility. This move will give Ryman Hospitality a much-needed boost financially as well as an opportunity to expand their reach and further strengthen their position in the market.

Share Price

On Monday, shareholders of RYMAN HOSPITALITY PROPERTIES (RHP) Inc. witnessed a slight decrease in their stock price after the opening bell. The stock opened at $93.8 and closed at $92.7, representing a drop of 1.9% from the prior closing price of $94.5. The investment is expected to benefit RHP Inc in terms of capital and liquidity, as it seeks to expand its portfolio of hotels, resorts and other hospitality properties across the US. RHP Inc is a real estate investment trust (REIT) which specializes in lodging and hospitality, owning and operating a diversified portfolio of hotels and resorts located across America. The recent investment from Barclays PLC is seen as an endorsement of the company’s business model and growth strategy, providing additional capital to facilitate future expansion plans.

The news of Barclays PLC’s latest investment in RHP Inc follows the company’s recent announcement of a merger with another REIT to create one of the largest lodging companies in America. Overall, the recent investment from Barclays PLC in RHP Inc is a positive sign for the company and its shareholders, as it demonstrates the faith investors have in the company’s future prospects. With the additional capital and liquidity, RHP Inc is well-positioned to capitalize on its current growth opportunities and continue its expansion into new markets. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for RHP. More…

| Total Revenues | Net Income | Net Margin |

| 1.61k | 64.92 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for RHP. More…

| Operations | Investing | Financing |

| 334.55 | -160.6 | 68.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for RHP. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.95k | 3.59k | 0.94 |

Key Ratios Snapshot

Some of the financial key ratios for RHP are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 14.8% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

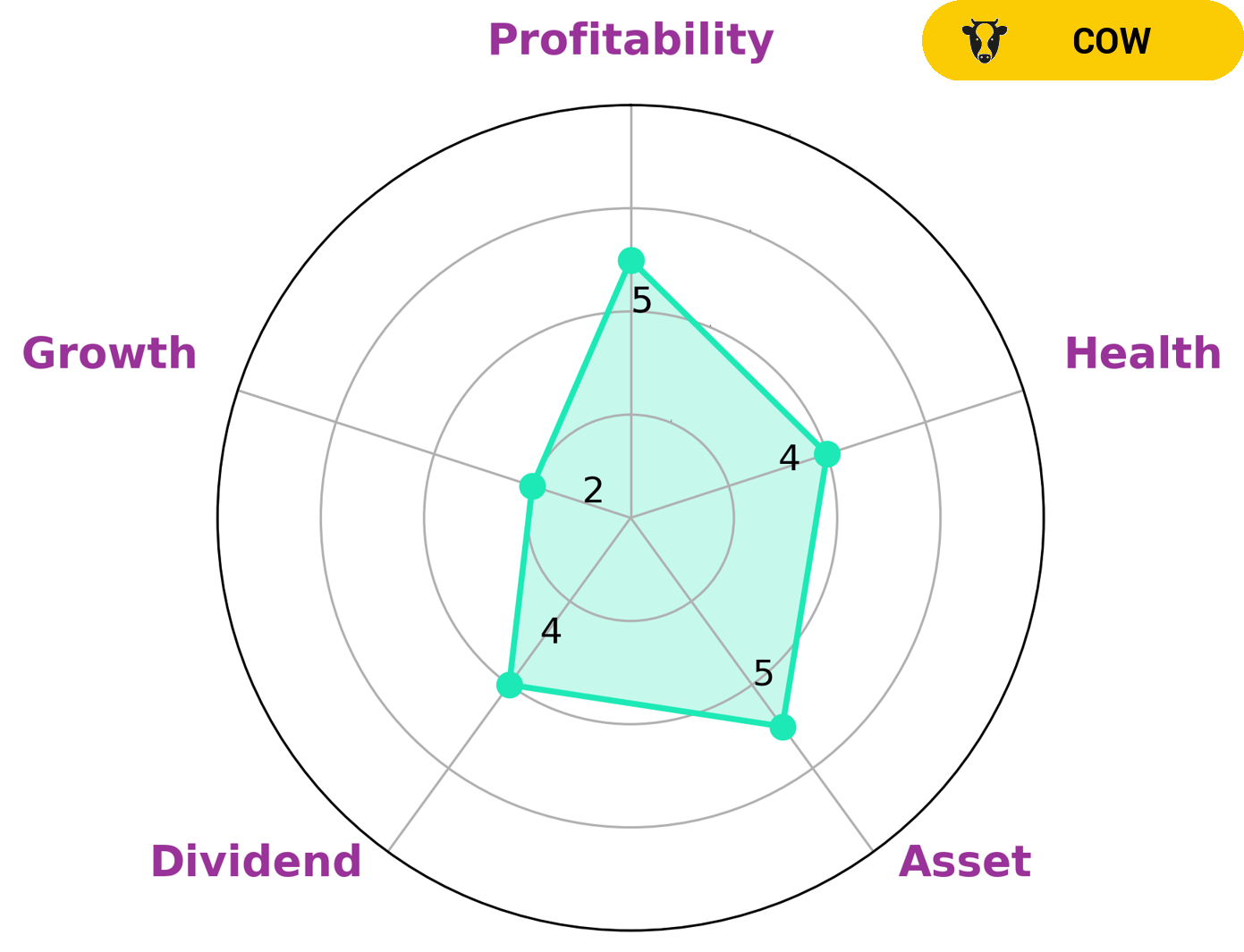

RYMAN HOSPITALITY PROPERTIES is a real estate investment trust (REIT) that invests in hotels and resorts. With the help of GoodWhale, it is possible to analyze the fundamentals of RYMAN HOSPITALITY PROPERTIES. The Star Chart shows that the company is strong in asset, dividend and profitability while it is weak in growth. Furthermore, RYMAN HOSPITALITY PROPERTIES has an intermediate health score of 4/10 considering its cashflows and debt, suggesting that it is likely to pay off debt and fund future operations. RYMAN HOSPITALITY PROPERTIES is classified as a ‘cow’, which is a type of company that has the track record of paying out consistent and sustainable dividends. Investors who are interested in such company tend to be investors who are looking for long-term investments in companies with reliable dividend payments and steady cash flows. These investors may also be looking for low-risk investments that provide stable returns over extended periods of time. Additionally, since RYMAN HOSPITALITY PROPERTIES is a REIT, investors may be interested in the tax benefits associated with investing in these types of companies. Finally, investors may also be looking for diversified investment portfolios that include REITs such as RYMAN HOSPITALITY PROPERTIES. More…

Peers

The company owns or operates a portfolio of properties, including the historic Ryman Auditorium, the Grand Ole Opry, and the Opryland Hotel in Nashville, Tennessee. Ryman also owns and operates a number of other hotels and resorts, including the Gaylord Palms Resort & Convention Center in Orlando, Florida and the Gaylord Texan Resort & Convention Center in Grapevine, Texas. Sunstone Hotel Investors, Inc. is a real estate investment trust (REIT) that specializes in owning, acquiring, redeveloping, and operating upscale, full-service hotels in the United States. Braemar Hotels & Resorts, Inc. is a real estate investment trust (REIT) that specializes in owning and operating upscale, full-service hotels and resorts in the United States. Summit Hotel Properties, Inc. is a real estate investment trust (REIT) that specializes in owning premium-branded, select-service hotels in the United States.

– Sunstone Hotel Investors Inc ($NYSE:SHO)

Sunstone Hotel Investors Inc., a real estate investment trust (REIT), focuses on the ownership of upscale, full-service hotels in the United States. As of December 31, 2020, the company’s portfolio consisted of 97 hotels with a total of 19,011 rooms. The company was founded in 1995 and is headquartered in Irvine, California.

– Braemar Hotels & Resorts Inc ($NYSE:BHR)

As of 2022, Braemar Hotels & Resorts Inc’s market cap is $333 million. The company owns, operates, and develops hotels and resorts. Its portfolio includes properties in North America, Europe, and Asia.

– Summit Hotel Properties Inc ($NYSE:INN)

Summit Hotel Properties, Inc. owns, acquires, renovates, develops, repositions and operates premium hotels in the upper-upscale segment of the lodging industry. As of December 31, 2020, the Company’s portfolio consisted of 69 hotels with 11,196 rooms across 31 markets in 23 states.

Summary

Barclays PLC has recently increased its investment in Ryman Hospitality Properties, Inc., a real estate investment trust. The move is seen as a positive indicator of growth and investor confidence in the company. The investment has been made in order to capitalize on the potential for strong returns in the hospitality sector and to diversify the portfolio of Barclays PLC.

The new investment follows in the footsteps of other successful investments in the company, and is likely to improve the financial performance of Ryman Hospitality Properties, Inc. in the future. The move has been welcomed by analysts, who believe that it provides further evidence of the firm’s commitment to investing in businesses with positive long-term prospects.

Recent Posts