Short Interest in Healthcare Realty Trust Increases by 20.2%

January 6, 2023

Trending News ☀️

Healthcare Realty Trust ($NYSE:HR) is a real estate investment trust (REIT) that specializes in acquiring, owning, and managing real estate properties that cater to the healthcare industry. Healthcare Realty Trust is traded on the New York Stock Exchange under the symbol HR. Short interest is defined as the total number of shares of a security that have been sold short but not yet covered or closed out. In other words, this means that more investors are betting against the stock’s future performance. It is unclear why short interest in Healthcare Realty Trust has increased so sharply. It could be due to a variety of factors, including changes in the real estate market or issues with the company’s performance. It could also be due to increasing concerns about the potential impact of the COVID-19 pandemic on the healthcare industry.

Despite the increase in short interest, Healthcare Realty Trust’s stock price has remained relatively stable. This may be due to investors’ belief that the company will continue to perform well, despite any challenges it may face in the future. Investors should also keep in mind that short interest can change quickly and dramatically, so it is important to keep up to date with any news or developments related to the company. Overall, Healthcare Realty Trust remains a viable investment option for those seeking exposure to the healthcare real estate sector. Despite the recent increase in short interest, the company’s fundamentals remain strong and it continues to offer investors a good opportunity for long-term growth.

Price History

There has been a positive news coverage surrounding the company in recent days. On Tuesday, the stock opened at $19.5 and closed at $19.7, which is a 2.1% increase from its prior closing price of 19.3. This is a major indication of investor confidence in the company. The company’s stock has been on an uptrend lately, with its price rising steadily over the past few weeks. This could be attributed to the positive news coverage surrounding the company, as well as the fact that healthcare-related real estate assets are generally considered to be a safe investment.

Moreover, Healthcare Realty Trust’s strong portfolio of assets gives investors confidence in their ability to make sound investments. The positive news coverage and strong portfolio of assets gives investors confidence in their decision to invest in the company. Furthermore, the stock’s price has been steadily increasing over the past few weeks, indicating a positive outlook for the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for HR. More…

| Total Revenues | Net Income | Net Margin |

| 731 | 95.91 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for HR. More…

| Operations | Investing | Financing |

| 189.03 | 1.23k | -1.38k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for HR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.2k | 6.36k | 20.3 |

Key Ratios Snapshot

Some of the financial key ratios for HR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 11.5% |

| FCF Margin | ROE | ROA |

| – | – | – |

VI Analysis

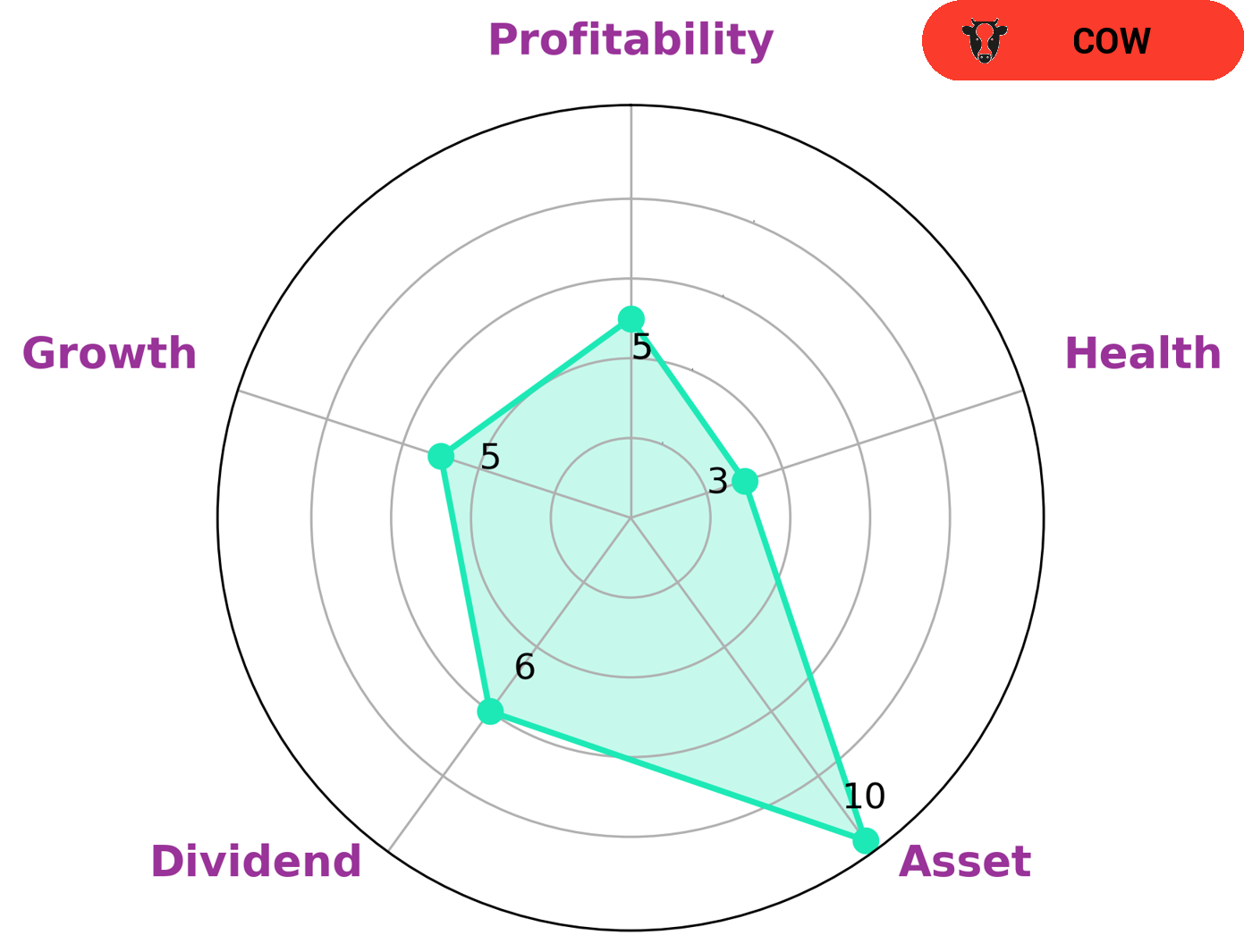

HEALTHCARE REALTY TRUST is classified as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. It is a sign of the company’s strong fundamentals and long term potential. It is an attractive investment for those looking for steady, long-term income. According to the VI Star Chart, HEALTHCARE REALTY TRUST has a strong asset base and medium scores in dividend, growth and profitability. This indicates that the company is stable but may not have the most aggressive growth or dividend strategy. Investors looking for steady returns over time may find this company attractive. However, the company has a low health score of 3/10 with regard to its cashflows and debt. This suggests that it is less likely to pay off debt and fund future operations. Therefore, investors should be aware of this risk before investing in the company. Overall, HEALTHCARE REALTY TRUST is a good option for those looking for steady, long-term income. Although the company has a low health score, it still has strong fundamentals and potential for growth. Investors should consider these factors when making their decision. More…

VI Peers

The company’s properties include hospitals, medical office buildings, senior housing facilities, and other healthcare-related facilities. The company’s portfolio is diversified across the United States, with properties in 26 states. Healthcare Realty Trust Inc’s competitors include Sabra Health Care REIT Inc, Omega Healthcare Investors Inc, and LTC Properties Inc. These companies are also involved in the ownership and operation of healthcare-related properties.

– Sabra Health Care REIT Inc ($NASDAQ:SBRA)

Sabra Health Care REIT Inc has a market cap of 2.97B as of 2022. The company is a real estate investment trust that focuses on the healthcare sector. Sabra owns and leases properties across the United States and Canada. The company’s portfolio includes skilled nursing facilities, assisted living facilities, senior housing, hospitals, and other healthcare-related properties.

– Omega Healthcare Investors Inc ($NYSE:OHI)

Omega Healthcare Investors is a real estate investment trust that specializes in the ownership and leasing of long-term care facilities. As of December 31, 2020, the company owned 1,527 skilled nursing and assisted living facilities located in the United States, the United Kingdom, and India.

– LTC Properties Inc ($NYSE:LTC)

LTC Properties Inc is a real estate investment trust that primarily invests in senior housing and long-term care properties. As of December 31, 2020, the company owned a portfolio of 431 properties in 37 states. The company has a market cap of $1.54 billion as of March 2021.

Summary

Investing in Healthcare Realty Trust has recently become a more attractive option as the company has seen a 20.2% increase in its short interest. This has been accompanied by mostly positive news coverage. It is important to carefully analyze the company’s fundamentals before investing, such as its financial health and management team.

Additionally, investors should consider the industry it operates in, current economic conditions, and how the stock fits into their portfolio goals. Careful research and analysis of the stock could result in a successful investment.

Recent Posts