Physicians Realty Trust Reaffirms Commitment to Sustainability with Fourth Annual ESG Report

June 9, 2023

☀️Trending News

Physicians Realty Trust ($NYSE:DOC) (PRT) is a publicly traded real estate investment trust that specializes in healthcare properties. On June 5, 2023, PRT issued their fourth annual ESG Report, reaffirming their commitment to sustainability and providing an overview of the progress they have made since they began focusing on ESG initiatives. This report marks the fourth consecutive year that PRT has released such a report, reflecting their dedication to making meaningful changes and constantly striving for improvement. The ESG Report focuses on various initiatives that PRT has completed in order to reduce its environmental footprint. These initiatives include increasing the efficiency of their buildings, expanding the use of renewable energy sources, and investing in green infrastructure projects.

Additionally, the report details PRT’s efforts to engage with their tenants and communities, as well as their commitment to diversity and inclusion in the workplace. Overall, the fourth annual ESG Report from Physicians Realty Trust confirms their dedication to sustainability and their progress towards achieving it. As PRT continues to focus on ESG initiatives and pledge to make meaningful changes, it is clear that they are setting a strong example for other real estate companies to follow.

Share Price

The stock opened and closed at $14.0 with no significant change from the prior closing price. The ESG report provided a comprehensive overview of the company’s progress in terms of environmental and social responsibility. It detailed PHYSICIANS REALTY TRUST’s wide-reaching initiatives to reduce their carbon footprint and increase investments in renewable energy. It also highlighted their focus on creating social impact through their involvement in local communities.

The release of the annual ESG report has been met with positive feedback from investors and shareholders alike. With this commitment, the company will continue to demonstrate their leadership in environmental sustainability and social responsibility. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for DOC. More…

| Total Revenues | Net Income | Net Margin |

| 530.59 | 101.48 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for DOC. More…

| Operations | Investing | Financing |

| 267.58 | -72.42 | -194.53 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for DOC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.06k | 2.04k | 12.12 |

Key Ratios Snapshot

Some of the financial key ratios for DOC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 23.5% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

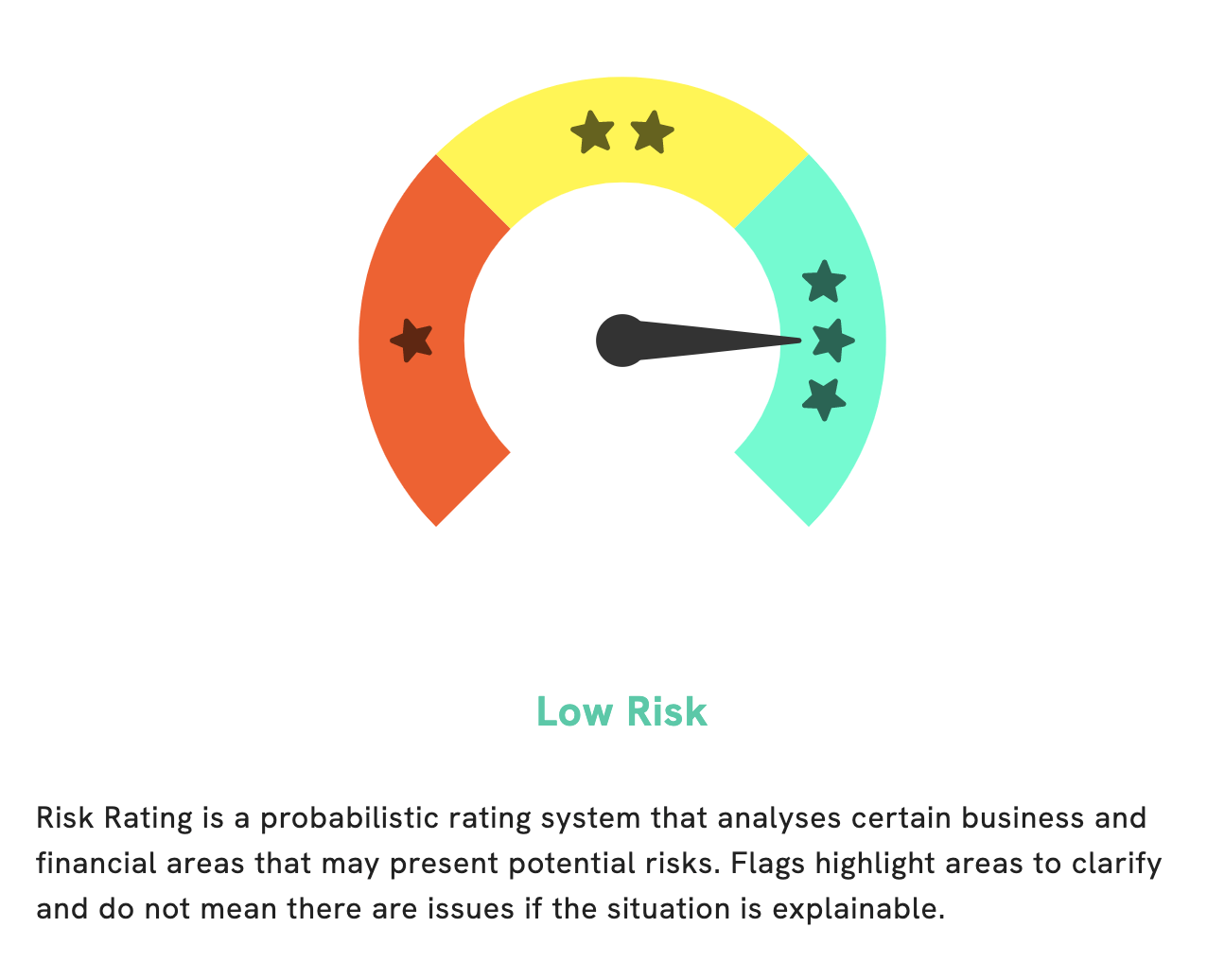

GoodWhale has conducted an analysis of PHYSICIANS REALTY TRUST’s financials to help you make a well-informed decision about investing in the company. Our Risk Rating for PHYSICIANS REALTY TRUST is low, which indicates that it is a low risk investment in terms of financial and business aspects. We have also detected one risk warning in the balance sheet that registered users can explore further. With GoodWhale’s support, you can be sure that you are making a sound decision when it comes to investing in PHYSICIANS REALTY TRUST. More…

Peers

The company competes with Healthcare Trust of America Inc, Global Medical REIT Inc, and Healthcare Realty Trust Inc.

– Healthcare Trust of America Inc ($NYSE:GMRE)

Global Medical REIT Inc is a publicly traded real estate investment trust focused on owning and leasing healthcare facilities. The company’s portfolio consists of medical office buildings, outpatient centers, senior housing, and other healthcare-related properties. As of 2022, the company’s market cap was 571.32M.

– Global Medical REIT Inc ($NYSE:HR)

Healthcare Realty Trust Incorporated is a real estate investment trust, which engages in the ownership, management, and development of healthcare properties. It operates through the following segments: Medical Office, On-Campus, In-fill, and Wellness. The company was founded by D. Edward Aldrich Jr. and John W. Heagy in January 1993 and is headquartered in Nashville, TN.

Summary

Physicians Realty Trust (PRT) is a healthcare real estate investment trust (REIT) that specializes in medical facilities. The company’s fourth annual ESG Report, released on June 5th, 2023, highlights PRT’s sustainability efforts and performance. The ESG Report also highlights positive trends in employee engagement, diversity and inclusion, and stakeholder engagement. As an investor, PRT’s progress in sustainability and ESG metrics could be indicative of the company’s long-term success and potential for generating returns.

Recent Posts