Medical Properties Trust: Short Squeeze Unlikely to Alter Outlook

May 16, 2023

Trending News ☀️

Medical Properties Trust ($NYSE:MPW) (MPT) is a real estate investment trust that specializes in providing capital to healthcare providers. It has been a popular target for short sellers, as they take bets against the stock. Recently, there has been speculation of a possible short squeeze on MPT, which occurs when a heavily shorted stock rises sharply, forcing short sellers to buy in order to cover their positions. While this could potentially trigger a short squeeze, it is unlikely to have any significant effect on MPT’s outlook. The company has a strong balance sheet and a portfolio of premier healthcare properties, and its fundamentals give it strong staying power regardless of short-term movements in the stock price.

This means that any potential short squeeze could have a fleeting effect on the stock, with no material change to MPT’s long-term prospects. Moreover, MPT is a large and established company with a diversified portfolio that is insulated from any single development or event. Therefore, it is unlikely that a possible short squeeze on Medical Properties Trust will have any lasting effect on the situation. The company’s long-term outlook appears to remain strong, and its fundamentals are not likely to be significantly altered by any short-term fluctuations in the stock price.

Market Price

Monday was a difficult day for Medical Properties Trust (MPT) shareholders. The real estate investment trust specializing in healthcare-related properties opened at $7.7 and closed at $7.4, down 3.3% from the previous closing price of $7.6. Despite this, it is unlikely that a short squeeze will alter their overall outlook. A short squeeze occurs when a heavily shorted stock is bought, driving up its price. In this case, investors have bet against Medical Properties Trust’s stock, but the current downward trend suggests it is unlikely that a short squeeze will occur.

This means investors will not be able to capitalize on any significant gains. The recent bearish sentiment around Medical Properties Trust stock is largely due to industry-wide challenges, as well as its own financial issues. The company has had to contend with pandemic-related challenges, as well as rising vacancies and lower tenant income. As a result, Medical Properties Trust’s outlook remains uncertain, and even a short squeeze is unlikely to alter that outlook in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MPW. More…

| Total Revenues | Net Income | Net Margin |

| 1.48k | 304.11 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MPW. More…

| Operations | Investing | Financing |

| 739.01 | 396.06 | -1.34k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MPW. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 19.65k | 11.21k | 14.38 |

Key Ratios Snapshot

Some of the financial key ratios for MPW are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 63.8% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

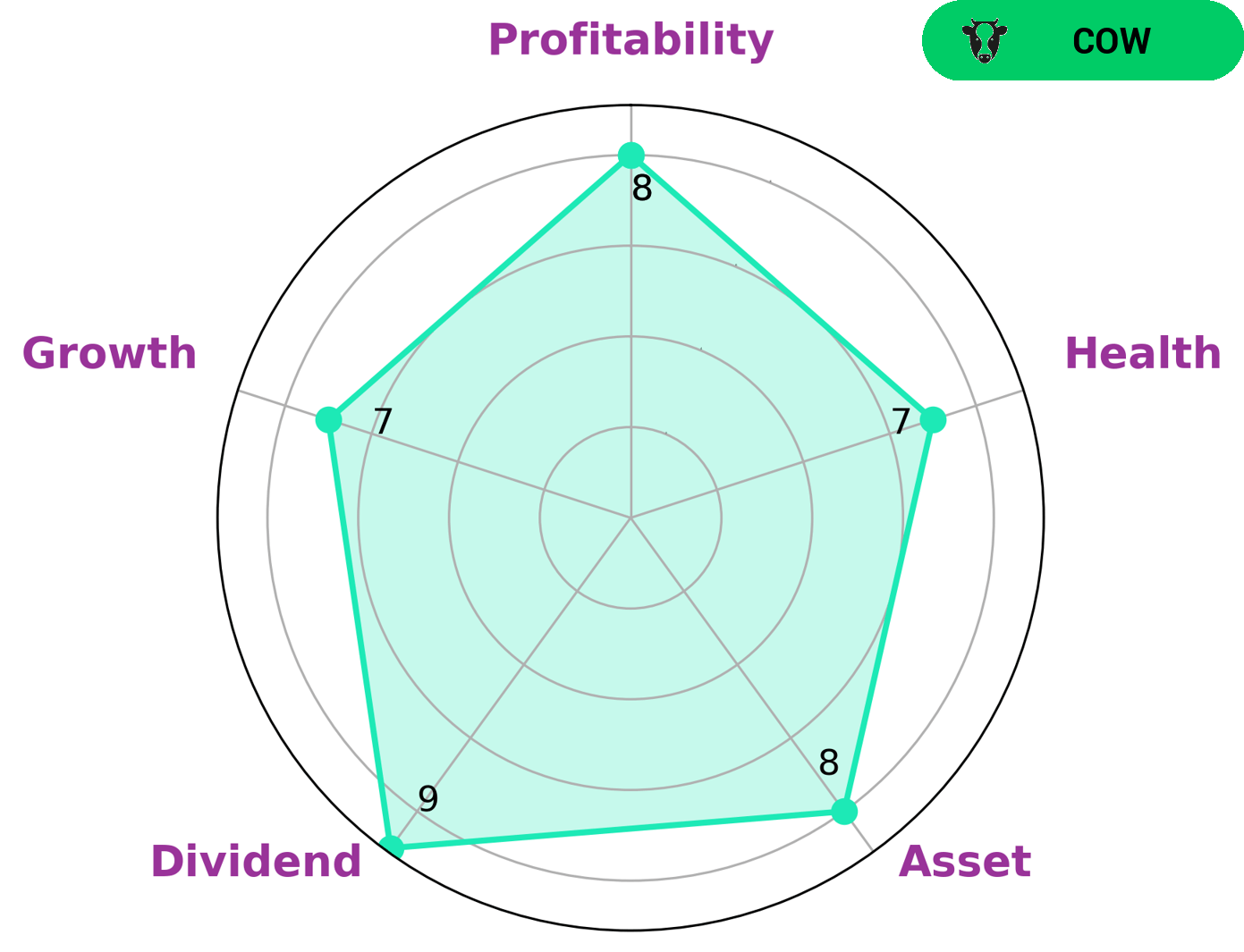

Having conducted an analysis on MEDICAL PROPERTIES TRUST’s wellbeing, GoodWhale found that the company is in good standing. Our Star Chart gave the company a high health score of 7/10, indicating that its cashflows and debt are well managed and it has the ability to pay off debt and fund future operations. GoodWhale also found that MEDICAL PROPERTIES TRUST was strong in asset, dividend, growth and profitability. We classified the company as a ‘cow’, which is a company that has been able to consistently pay out sustainable dividends over time. Given the positive ratings from GoodWhale, we believe that MEDICAL PROPERTIES TRUST would be a good choice for investors who are looking for a reliable dividend-paying company. Furthermore, given the company’s strong asset and profitability, it is likely to be attractive to investors looking for long-term capital appreciation. More…

Peers

The company operates in the United States, Germany, and the United Kingdom. The company was founded in 2003 and is headquartered in Birmingham, Alabama. Healthcare Trust of America, Inc. is a real estate investment trust that invests in healthcare-related real estate assets. The company owns and operates healthcare facilities across the United States. The company was founded in 2006 and is headquartered in Nashville, Tennessee. Vital Healthcare Property Trust is a real estate investment trust that invests in hospitals and other healthcare-related properties in New Zealand and Australia. The company was founded in 2002 and is headquartered in Auckland, New Zealand. Healthcare Trust Inc is a real estate investment trust that focuses on healthcare-related properties. The company operates in the United States and Canada. The company was founded in 2010 and is headquartered in Boston, Massachusetts.

– Healthcare Trust of America Inc ($NZSE:VHP)

Vital Healthcare Property Trust is a real estate investment trust that owns and operates healthcare facilities in New Zealand and Australia. The company has a market cap of 1.52 billion as of 2022. Vital Healthcare Property Trust’s portfolio consists of hospitals, medical centers, and aged care facilities.

– Vital Healthcare Property Trust ($OTCPK:HLTC)

As of 2022, Healthcare Trust Inc has a market cap of 694.19M. The company is a real estate investment trust that invests in healthcare properties, including hospitals, nursing homes, and medical office buildings.

Summary

Medical Properties Trust (MPT) is a real estate investment trust that focuses on the healthcare space. It has been underperforming the market recently, and the stock price moved down the same day. Despite recent news of a possible short squeeze, investors should proceed with caution. An analysis of MPT’s financials reveals that its current cash flows are not enough to cover its debt obligations.

Additionally, the company’s long-term debt has increased significantly in the last few years, leading to higher financial risk. Therefore, investors should examine MPT’s financials closely before investing in the stock.

Recent Posts