Director of National Health Investors Robert G. Adams Invests $56,600 in Company Shares

December 30, 2022

Trending News ☀️

National Health Investors ($NYSE:NHI) Inc. (NHI) is a real estate investment trust (REIT) that specializes in the ownership and financing of healthcare properties. The company’s portfolio comprises of investments in various types of healthcare-related real estate including skilled nursing, senior housing, medical office buildings, and hospitals. Considering an investment in National Health Investors Inc.? Adams’ purchase of NHI stock signals confidence in the company’s ability to continue to provide attractive returns for its investors. NHI has paid an increasing dividend each year since its inception and has a strong track record of success in managing its portfolio. Adams’ purchase of NHI shares also represents an opportunity to benefit from the company’s growth potential. NHI is focused on expanding its portfolio with strategic acquisitions and investments in quality healthcare properties that can generate steady income streams for the company.

In addition, NHI’s management team is experienced and knowledgeable when it comes to evaluating potential transactions and management of its portfolio. Overall, Adams’ purchase of NHI stock is a positive signal for the company’s future prospects and investors should consider this when making their own investment decisions. NHI has a strong track record of success and is well-positioned to continue to generate attractive returns for its shareholders.

Market Price

While the media sentiment surrounding the investment is mostly mixed, the stock opened at $54.9 and closed at $54.8, representing a 0.4% decrease from the previous closing price of $55.0. The company’s stock price has been on a steady decline for the past few months and it appears that Mr. Adams’ investment has not been able to reverse the trend. Despite this, National Health Investors Inc. remains committed to the long-term success of the company, and is confident that the stock will rebound in the near future. This investment is just one of many that National Health Investors Inc. has made to ensure its continued success.

The company has been actively investing in new products and services, as well as expanding its operations into new markets to help increase its profitability. It is clear that National Health Investors Inc. is focused on ensuring the long-term sustainability of the business and is not content to simply sit back and let the stock prices continue to decline. With Mr. Adams’ investment, it is likely that investors will once again take notice of National Health Investors Inc. and its potential for growth in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NHI. More…

| Total Revenues | Net Income | Net Margin |

| 277.19 | 71.02 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NHI. More…

| Operations | Investing | Financing |

| 192.34 | 269.06 | -479.88 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NHI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.51k | 1.18k | 30.11 |

Key Ratios Snapshot

Some of the financial key ratios for NHI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 48.0% |

| FCF Margin | ROE | ROA |

| – | – | – |

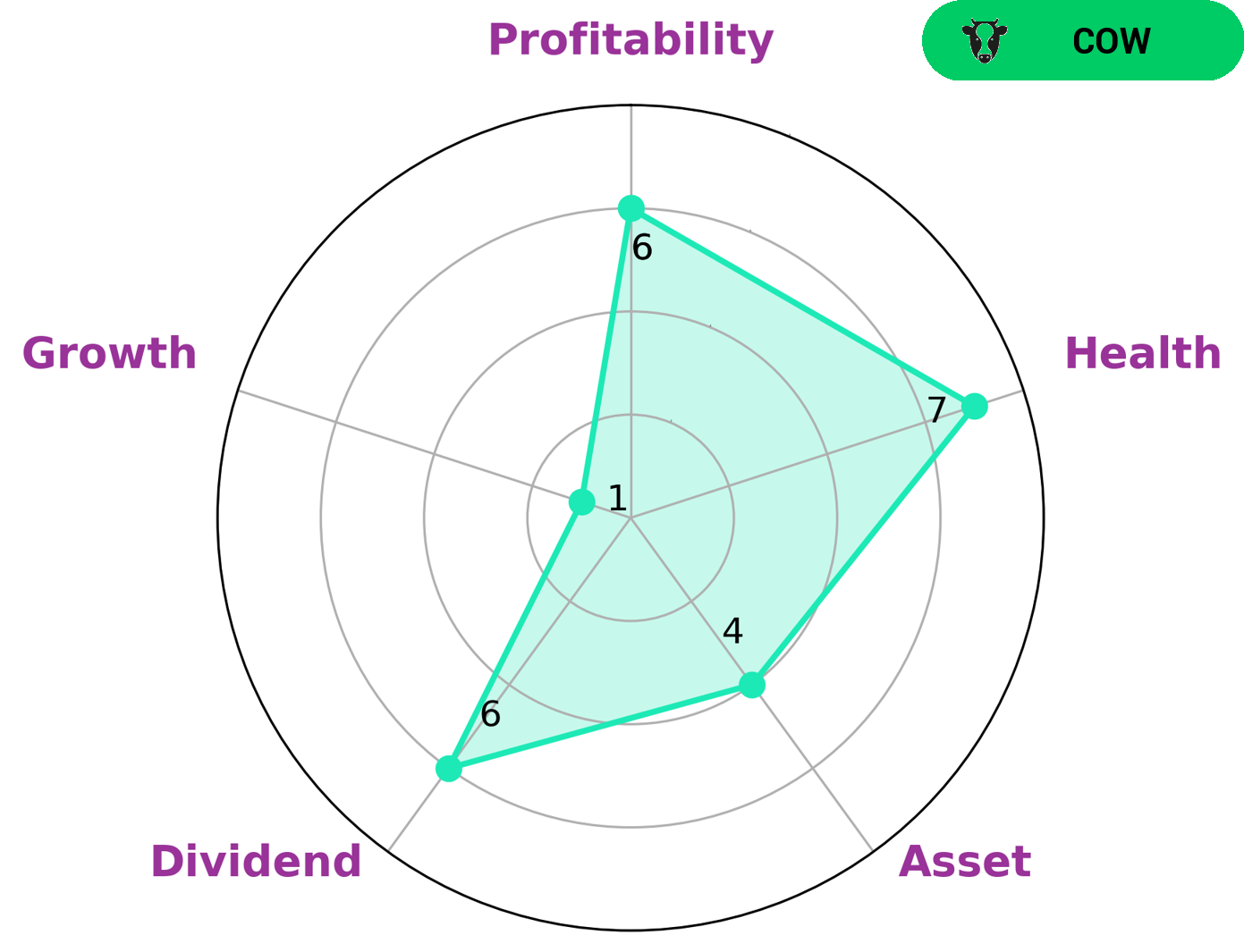

VI Analysis

Investing in a company’s fundamentals is key to understanding its long term potential. VI App simplifies this process by making an analysis of a company’s health score and other parameters. For example, NATIONAL HEALTH INVESTORS (NHI) has a high health score of 7/10, indicating its strong cashflows and low debt, which gives the confidence that it can ride out any crisis without the risk of bankruptcy. NHI is strong in asset, medium in dividend, profitability and weak in growth. This makes it a ‘cow’ type of company, one which has a track record of paying out consistent and sustainable dividends. Such companies are attractive to conservative investors who seek regular income without significant risk. They may also appeal to value investors who look for stocks with strong fundamentals in order to buy them at a discount. More aggressive investors may be drawn to NHI’s growth potential, as the company has low debt and a solid financial foundation which can be used to fuel future growth. Such investors may also be attracted by NHI’s dividend yield, which is likely to increase as the company grows. In summary, NHI is an attractive target for different types of investors. Its high health score and strong cashflows make it a safe bet for conservative investors, while its growth potential make it attractive to more aggressive investors. Its dividend yield also makes it a desirable stock for value investors. More…

VI Peers

The healthcare sector has seen a lot of consolidation in recent years as companies have been looking to increase their scale and efficiency. National Health Investors Inc (NHI) is one of the largest players in the healthcare real estate investment trust (REIT) space and competes with a number of other large companies, including Griffin-American Healthcare Reit III Inc, NorthStar Healthcare Income Inc, and Healthcare Trust of America Inc. NHI has been able to outperform its competitors in recent years by executing a strategy of diversifying its portfolio across a number of different healthcare subsectors. This has allowed NHI to weather the ups and downs of the healthcare sector better than its competitors and has resulted in better financial results for the company.

– Griffin-American Healthcare Reit III Inc ($OTCPK:GRAH)

Griffin-American Healthcare REIT III, Inc. is a real estate investment trust that focuses on owning and operating income-producing healthcare properties in the United States. As of December 31, 2020, the company’s portfolio consisted of 199 healthcare properties in 33 states. The company was founded in 2013 and is headquartered in Irvine, California.

– NorthStar Healthcare Income Inc ($OTCPK:NHHS)

NorthStar Healthcare Income Inc is a publicly traded real estate investment trust that focuses on investing in and owning net-leased healthcare properties across the United States. The company’s portfolio consists of skilled nursing, senior housing, hospitals, and other medical office buildings. NorthStar Healthcare Income Inc is headquartered in Dallas, Texas.

Summary

National Health Investors (NHI) is a real estate investment trust that specializes in healthcare-related investments. Despite this news, the market sentiment on the company has been mixed. Analysts predict that the company is likely to benefit from an aging population and an increase in healthcare spending in the U.S., but further investments are needed to make the most of these opportunities.

Analysts also cite potential challenges, such as rising competition and potential government regulations, as risks to consider. Overall, investors should conduct their own due diligence and research before making any decisions about investing in NHI.

Recent Posts